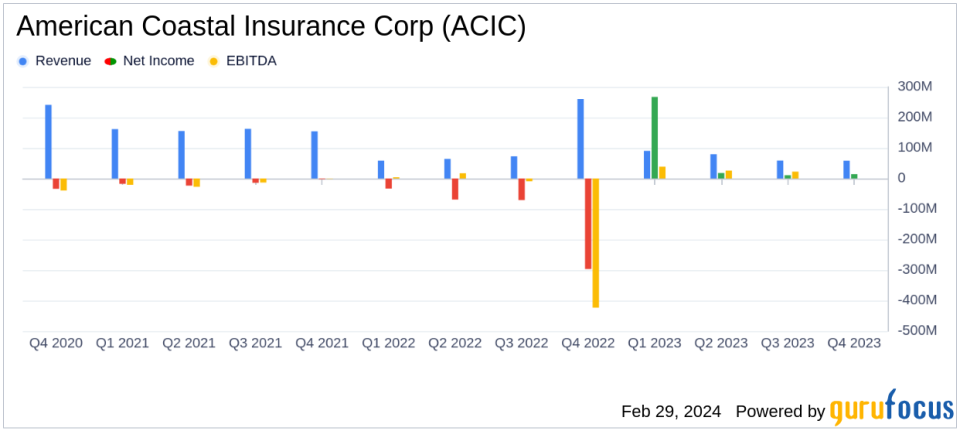

American Coastal Insurance Corp Reports Turnaround with Net Income of $309.9 Million for FY 2023

Net Income: Reported a consolidated net income of $309.9 million for the year ended December 31, 2023, a stark contrast to the net loss of $469.9 million in the previous year.

Gross Premiums Written: Increased by 17.1% year-over-year to $670.0 million.

Core Income: Core income for the year stood at $89.5 million compared to a core loss of $22.6 million in 2022.

Book Value Per Share: Improved significantly from $(4.21) at the end of 2022 to $3.61 at the end of 2023.

Underlying Combined Ratio: Improved to 65.0% for the year, down from 88.8% in 2022.

Investment Portfolio: Cash, restricted cash, and investment holdings increased to $369.0 million at the end of 2023.

On February 29, 2024, American Coastal Insurance Corp (NASDAQ:ACIC) released its 8-K filing, announcing a remarkable turnaround with a consolidated net income of $309.9 million for the fiscal year ended December 31, 2023. This performance marks a significant recovery from the net loss of $469.9 million reported in the previous year. The company, a property and casualty insurance holding company, attributes this improvement to several factors, including a decrease in loss and loss adjustment expenses, increased gross written premiums, and favorable prior year loss development.

Financial Performance and Challenges

ACIC's financial achievements in 2023 reflect a strategic shift towards becoming a specialty commercial lines underwriter, which has resulted in increased gross written premiums and a more favorable combined ratio. The company's gross premiums written for the year increased by 17.1% to $670.0 million, while the core income for the year stood at $89.5 million, a notable improvement from the core loss of $22.6 million in 2022. The underlying combined ratio, a key metric for insurance companies, improved to 65.0% for the year, down from 88.8% in the previous year, indicating a more efficient underwriting process and cost management.

Despite these achievements, ACIC faced challenges, particularly in its personal lines segment, which experienced a pre-tax loss of $5.2 million. However, this loss represents an improvement from the previous quarter, demonstrating the effectiveness of the company's underwriting and rating actions. The company's strategy to reduce expenses and improve underwriting performance in the commercial lines segment has yielded ongoing positive results.

We are pleased to deliver continued positive results to our shareholders. Our continuing operations reported core earnings of $17.7 million and $89.5 million for the 2023 fourth quarter and full year, respectively, leading to an annualized core return on equity of 100.6%, said Dan Peed, Chief Executive Officer of ACIC.

Key Financial Metrics

ACIC's book value per share increased significantly from $(4.21) at the end of 2022 to $3.61 at the end of 2023. This increase in book value is a critical indicator of the company's financial health and reflects the success of its operational strategies. The company's investment portfolio also saw growth, with cash, restricted cash, and investment holdings increasing to $369.0 million at the end of 2023.

The company's financial statements reveal a solid performance across key metrics. Net premiums earned increased by 4.7% year-over-year, and total revenues rose by 6.2%. The income from continuing operations, net of tax, was reported at $82.2 million for the year, a substantial recovery from the loss of $40.0 million in the previous year.

Analysis of Company's Performance

ACIC's performance in 2023 demonstrates a successful turnaround, with significant improvements in net income, core income, and book value per share. The company's focus on specialty commercial lines and effective cost management strategies have contributed to a more robust financial position. The positive results are also reflected in the company's return on equity, which was 81.0% for the fourth quarter of 2023 based on GAAP net income attributable to ACIC.

The company's strategic decisions, including the cessation of writing in Texas as of May 31, 2022, and the deconsolidation of activities related to UPC, have streamlined operations and reduced exposure to less profitable segments. ACIC's disciplined approach to underwriting and expense management is evident in the improved combined ratio and underlying combined ratio, which are key indicators of profitability in the insurance industry.

As ACIC continues to navigate the challenges of the insurance market, its financial results for 2023 provide a strong foundation for future growth and stability. Investors and potential members of GuruFocus.com can find detailed information on ACIC's financial performance and strategic initiatives in the full earnings report.

For more detailed financial information and to join the upcoming quarterly conference call, please visit the investor relations section of ACIC's website.

Explore the complete 8-K earnings release (here) from American Coastal Insurance Corp for further details.

This article first appeared on GuruFocus.