American Eagle Outfitters Inc (AEO) Posts Record Q4 Revenue; Initiates Long-Term Growth Strategy

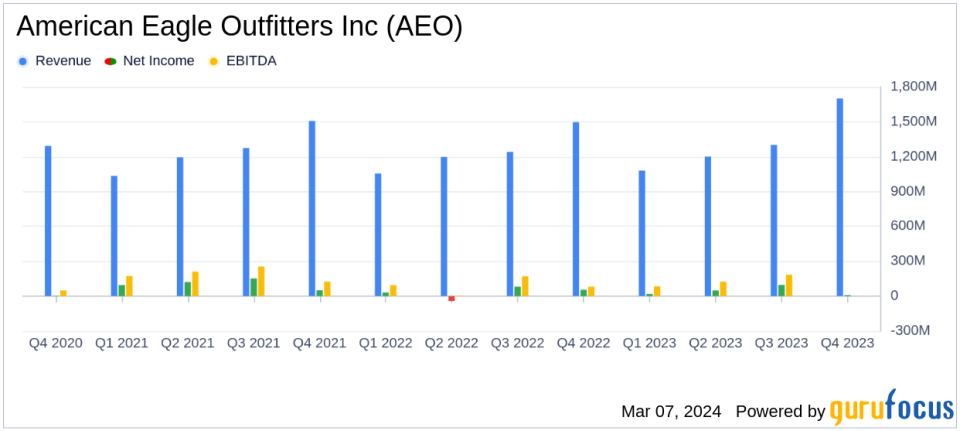

Record Revenue: AEO reported a record fourth quarter revenue of $1.7 billion, a 12% increase year-over-year.

Comp Sales Growth: Aerie and American Eagle brands saw comp sales rise by 13% and 6% respectively.

Adjusted Gross Profit: Adjusted gross profit soared by 23% to $626 million, with a gross margin rate improvement of 340 basis points.

Operating Income: Adjusted operating income reached $141 million, with a 200 basis point expansion in operating margin.

Earnings Per Share: Adjusted diluted earnings per share stood at $0.61, compared to GAAP diluted earnings per share of $0.03.

Inventory and Capital Expenditures: Inventory levels increased by 9%, while capital expenditures for Fiscal 2024 are projected to be between $200 to $250 million.

Fiscal 2024 Outlook: Management anticipates operating income in the range of $445 to $465 million, with revenue growth of 2 to 4%.

On March 7, 2024, American Eagle Outfitters Inc (NYSE:AEO) released its 8-K filing, announcing a record-setting fourth quarter that capped off a year of strategic growth and operational efficiency. The company, a leading apparel and accessory retailer operating under the American Eagle and Aerie brands, has shown resilience and adaptability in a competitive retail landscape.

Financial Highlights and Strategic Initiatives

AEO's fourth quarter was marked by a 12% increase in total net revenue, reaching $1.7 billion, with a notable contribution from the additional 53rd week in the fiscal calendar. The company's Aerie brand continued to outperform, achieving an all-time high fourth quarter revenue with a 13% increase in comparable sales. American Eagle also saw a 6% rise in comparable sales, signaling a positive trajectory for the brand.

Adjusted gross profit for the quarter stood at $626 million, a significant 23% rise from the previous year, driven by strong demand, reduced product and transportation costs, and effective markdown management. Adjusted operating income saw a substantial increase to $141 million, with the adjusted operating margin expanding to 8.4%.

Executive Chairman and CEO Jay Schottenstein expressed pride in the company's execution and the effectiveness of profit improvement initiatives. He highlighted the momentum AEO is carrying into 2024, bolstered by a healthy balance sheet and early indicators of success from the company's new long-term strategy, "Powering Profitable Growth." This strategy aims to achieve $5.7 to $6.0 billion in revenue and a 10% operating margin by the end of Fiscal 2026.

Challenges and Restructuring Efforts

Despite the strong performance, AEO faced challenges that required decisive action. The company recorded a $131 million impairment and restructuring charge, with $119 million being non-cash. This was primarily due to the refocusing of Quiet Platforms operations and the restructuring of international operations, which are expected to yield approximately $20 million in annualized savings starting in 2024.

Looking ahead, AEO's management expects operating income for Fiscal 2024 to range between $445 to $465 million, with a slight revenue increase of 2 to 4%. The first quarter is projected to see mid-single-digit revenue growth, influenced by the retail calendar shift.

Investor Considerations

For value investors, AEO's latest earnings report presents a company on the rise, with a clear strategy for sustained growth and profitability. The retailer's ability to navigate market challenges while delivering record revenues and expanding margins is a testament to its operational prowess and brand strength.

As American Eagle Outfitters Inc (NYSE:AEO) continues to execute on its strategic initiatives, investors should monitor the company's progress against its long-term targets, as well as its ability to maintain momentum in a dynamic retail environment.

For a deeper dive into AEO's financials and strategic outlook, investors are encouraged to review the full earnings release and accompanying financial statements.

Stay informed on the latest financial news and analysis by visiting GuruFocus.com for comprehensive coverage on American Eagle Outfitters Inc (NYSE:AEO) and other value investment opportunities.

Explore the complete 8-K earnings release (here) from American Eagle Outfitters Inc for further details.

This article first appeared on GuruFocus.