American Eagle's (AEO) Buyback Program Affirms Financial Health

American Eagle Outfitters AEO has taken another decisive move in its strategy to boost shareholders' value through the approval of its new share repurchase authorization. The program allows for the buyback of 30 million shares of its common stock through Feb 3, 2029. This ambitious plan aims to replace the previous authorization that expired on Feb 3, 2024. It showcases the company's aggressive approach to capital management.

In fiscal 2023, AEO demonstrated its financial prudence by repurchasing 1 million shares, per the reports.

The company is confident regarding its strong performance and optimistic future, which should help boost shareholders' value. This optimism was further evident from the 25% hike in AEO’s quarterly cash dividend, announced in December. Share repurchases and dividend announcements reinforce management's belief in AEO’s solid foundation and its dedication to rewarding shareholders.

The initiation of this share repurchase plan is a critical milestone for AEO, illustrating its financial stability and optimistic outlook. It highlights the company's commitment to continuous growth and enhancing value for its shareholders, backed by a confident view of its prospects.

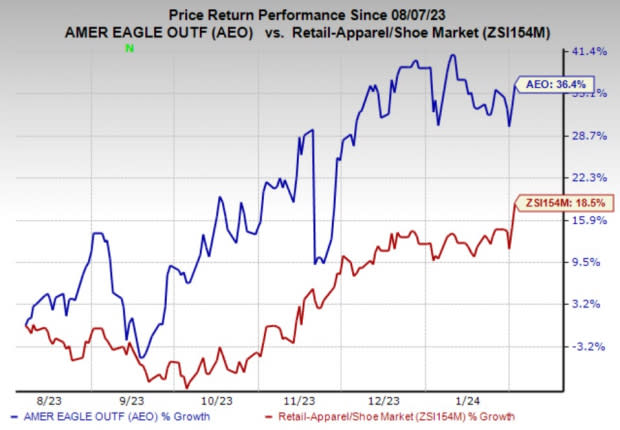

Image Source: Zacks Investment Research

Shares of this currently Zack’s Rank #1 (Strong Buy) company have risen 36.4%, outperforming the industry’s growth of 18.5% in the past six months. It has a trailing four-quarter average earnings surprise of 23%. The Zacks Consensus Estimate for AEO’s current fiscal-year sales and earnings indicates growth of 5% and 45.4%, respectively, from the year-ago period's levels.

Key Picks

The Gap Inc. GPS, a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products, currently holds Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Gap’s current financial-year earnings indicates growth of 385% from the year-ago reported figure.

Abercrombie & Fitch ANF operates as a specialty retailer of premium, high-quality casual apparel. It sports a Zacks Rank #1 at present.

The Zacks Consensus Estimate for Abercrombie’s current financial-year sales and earnings implies growth of 15% and 2,320%, respectively, from the year-ago reported figures.

Deckers Outdoor DECK is a leading designer, producer and brand manager of innovative, niche footwear and accessories developed for outdoor sports and other lifestyle-related activities. It currently holds a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for Deckers’ current financial-year sales and earnings indicates growth of 11.6% and 24%, respectively, from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Deckers Outdoor Corporation (DECK) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report