The American Finance Trust (NASDAQ:AFIN) Share Price Is Down 16% So Some Shareholders Are Getting Worried

It's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Unfortunately the American Finance Trust, Inc. (NASDAQ:AFIN) share price slid 16% over twelve months. That contrasts poorly with the market return of -1.1%. American Finance Trust may have better days ahead, of course; we've only looked at a one year period. The share price has dropped 36% in three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

See our latest analysis for American Finance Trust

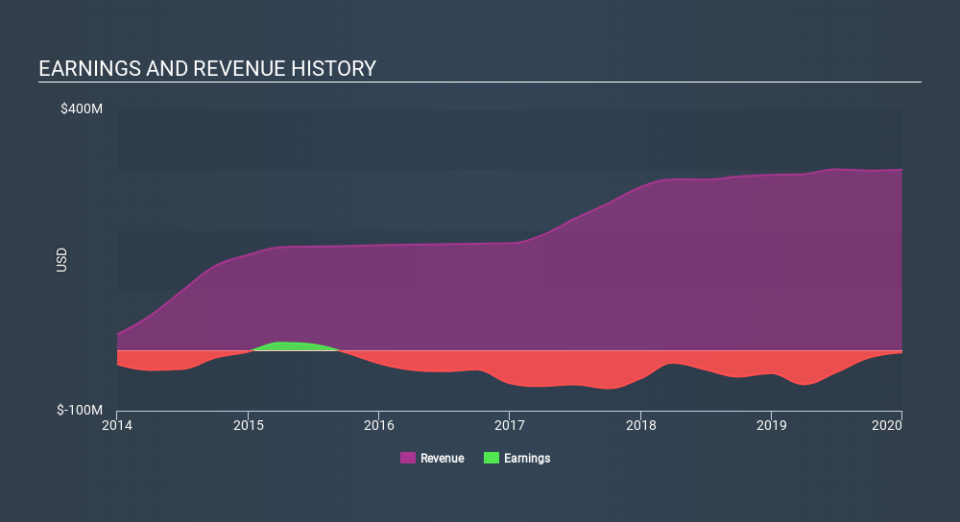

Given that American Finance Trust didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last twelve months, American Finance Trust increased its revenue by 2.9%. While that may seem decent it isn't great considering the company is still making a loss. Given this lacklustre revenue growth, the share price drop of 16% seems pretty appropriate. In a hot market it's easy to forget growth is the life-blood of a loss making company. So remember, if you buy a profitless company then you risk being a profitless investor.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling American Finance Trust stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of American Finance Trust, it has a TSR of -7.7% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We doubt American Finance Trust shareholders are happy with the loss of 7.7% over twelve months (even including dividends) . That falls short of the market, which lost 1.1%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. Notably, the loss over the last year isn't as bad as the 36% drop in the last three months. So it seems like some holders have been dumping the stock of late - and that's not bullish. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for American Finance Trust you should know about.

American Finance Trust is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.