American Financial (AFG) Q2 Earnings Miss on Higher Expenses

American Financial Group, Inc. AFG reported second-quarter 2023 net operating earnings per share of $2.38, which missed the Zacks Consensus Estimate by 16.4%. The bottom line declined 16.4% year over year.

American Financial’s results reflected the impact of higher catastrophe losses and lower favorable prior year reserve development on underwriting profit in the Specialty Property and Casualty (P&C) insurance operations, partially offset by significantly improved net investment income.

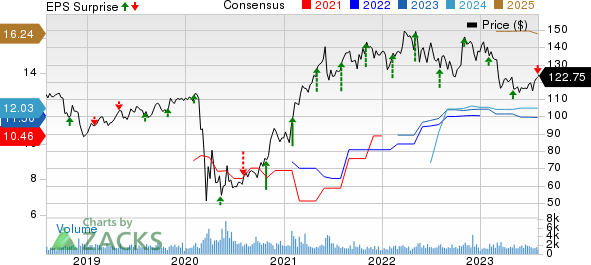

American Financial Group, Inc. Price, Consensus and EPS Surprise

American Financial Group, Inc. price-consensus-eps-surprise-chart | American Financial Group, Inc. Quote

Behind the Headlines

Total revenues of $1.7 billion increased 8.6% year over year in the quarter. The growth came on the back of higher P&C insurance net earned premiums and net investment income. The top line missed the Zacks Consensus Estimate by 6.7%.

Net investment income climbed 17.8% year over year to $198 million in the quarter under review. The figure was higher than our estimate of $170.7 million and beat the Zacks Consensus Estimate of $174 million.

Total cost and expenses increased 18.9% year over year to $1.5 billion due to higher P&C insurance losses and expenses, cost of managed investment entities and other expenses. The figure was lower than our estimate of $1.6 billion.

Segmental Update

The Specialty P&C Insurance segment generated $1.7 billion in net written premiums, which rose 10% year over year. The growth was reported within each of the Specialty P&C groups as a result of a combination of new business opportunities, increased exposures and a good renewal rate environment. Average renewal pricing across P&C Group, excluding workers’ compensation, increased approximately 5% for the quarter.

Net written premiums in Property & Transportation Group grew 6% year over year to $668 million in the quarter. The figure was higher than our estimate of $632.4 million.

Net written premiums at Specialty Casualty Group increased 7% year over year to $693 million. The figure was higher than our estimate of $654.7 million.

Further, net written premiums at Specialty Financial increased 36% year over year to $240 million. The figure was higher than our estimate of $183.8 million.

Net written premiums at Other divisions improved 8% year over year to $66 million. The figure was lower than our estimate of $69.5 million.

Specialty P&C Insurance segment’s underwriting profit decreased 37.5% year over year to $123 million in the quarter. The decrease was due to lower year-over-year underwriting profit following in each of the Specialty P&C Groups. The figure was lower than our estimate of $207.5 million.

The combined ratio deteriorated 610 basis points (bps) year over year to 91.9% at the segment.

Financial Update

American Financial exited the second quarter with total cash and investments of $14.5 billion, which declined 0.1% from the 2022-end level. The figure matched our estimate.

As of Jun 30, 2023, long-term debt totaled $1.4 billion, which decreased 1.5% from the level at 2022 end.

As of Jun 30, 2023, the company’s book value per share (excluding unrealized gains/losses on fixed maturities) was $52.90, down 1.5% from the 2022-end level.

Annualized return on equity (ROE) came in at 17.9% for the second quarter, expanding 360 bps year over year.

Prudent Capital Deployment

American Financial paid cash dividends of 63 cents per share during the second quarter. In addition, AFG bought back shares worth $43 million in the reported quarter.

2023 Guidance Revised

American Financial decreased core net operating earnings guidance to $10.15-$11.15 per share from the earlier guidance of $11-$12 per share. At the midpoint of the range, revised guidance would produce a core ROE of approximately 20%. This guidance reflects updated expectations for 2023 for underwriting results, partially offset by an increase in expected net investment income and continues to reflect an average crop year.

The insurer expects an overall calendar year combined ratio in the range of 89-91%, which revised upward from previous guidance of 87% to 89%.

AFG has increased guidance for net written premiums and now expects net written premiums to be 5-8% higher than $6.2 billion reported in 2022. This compares with previous guidance of growth in the range of 3% to 6% and will establish a record for net written premiums for the year.

American Financial expects a return of approximately 9% on alternative investments.

Zacks Rank

American Financial currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Property & Casualty Insurers

Selective Insurance Group, Inc. SIGI reported second-quarter 2023 operating income of 99 cents per share, which matched the Zacks Consensus Estimate. The bottom line declined 15% from the year-ago quarter. Total revenues of $1 billion increased 15.2% from the year-ago quarter’s figure, primarily due to higher premiums earned, net investment income and net premiums written. The top line outpaced the Zacks Consensus Estimate by 0.8%.

On a year-over-year basis, NPW increased 17% to $1 billion. The figure matched our estimate. After-tax net investment income increased 37% year over year to $77.8 million. After-tax net underwriting loss were $1.2 million against the year ago underwriting income of $29.8 million. Pre-tax catastrophe losses doubled year over year to $100 million. Non-catastrophe property loss and loss expenses of $138.6 million increased 13.4% year over year. The combined ratio deteriorated 470 bps on a year-over-year basis to 100.2. Total expenses increased 18.6% year over year to $966.4 million. The figure was higher than our estimate of $882.9 million.

NMI Holdings Inc. NMIH reported second-quarter 2023 operating net income per share of 95 cents, which beat the Zacks Consensus Estimate by 9.2%. The bottom line increased 10.4% year over year. NMI Holdings’ total operating revenues of $143 million increased 8.3% year over year on higher net premiums earned (up 4.2%) and net investment income (up 51.2%). Revenues beat the Zacks Consensus Estimate by 2.1%.

Primary insurance-in-force increased 13.5% to $191.3 billion. Annual persistency was 86%, up 1000 bps year over year. New insurance written was $11.5 billion, down 30.9% year over year. Underwriting and operating expenses totaled $27.4 million, down 10.7% year over year. Insurance claims and claim expenses were $2.9 million compared with a benefit of $3 million in the year-ago quarter. The loss ratio was 2.3 against (2.5) in the year-ago quarter. The adjusted expense ratio of 21.8 improved 360 bps year over year, while the adjusted combined ratio of 24.1 deteriorated 120 bps year over year.

Kinsale Capital Group KNSL delivered second-quarter 2023 net operating earnings of $2.88 per share, which outpaced the Zacks Consensus Estimate by 14.7%. The bottom line improved 50% year over year. Total revenues rose about 60.8% year over year to $295.7 million. Gross written premiums of $438.2 million rose 58.2% year over year. Our estimate was $343.2 million. Net written premiums climbed 41% year over year to $242.3 million in the quarter. Our estimate for net written premiums was pegged at a loss of $282.2 million. Net investment income more than doubled year over year to $24.2 million in the quarter and beat our estimate of $14.9 million. The Zacks Consensus Estimate was pegged at $20.7 million.

Total expenses increased 35.8% year over year to $205.6 million due to a rise in losses and loss adjustment expenses, underwriting, acquisition and insurance expenses, interest expense and other expenses. Our estimate was pinned at $197.9 million. Kinsale Capital’s underwriting income of $61.5 million soared 39.3% year over year. Our estimate was $50.8 million. The combined ratio improved 70 bps to 76.7 in the quarter under review. While the expense ratio improved 150 bps to 21 in the quarter, the loss ratio deteriorated 80 bps to 55.7.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

Selective Insurance Group, Inc. (SIGI) : Free Stock Analysis Report

NMI Holdings Inc (NMIH) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report