American Financial (AFG) Q4 Earnings Beat, Revenues Up Y/Y

American Financial Group, Inc. AFG delivered fourth-quarter 2021 core net operating earnings per share of $4.12, which outpaced the Zacks Consensus Estimate by 38.3%. The bottom line doubled on a year-over-year basis.

American Financial’s quarterly performance was driven by a substantial uptick in underwriting profit across the Specialty Property and Casualty (P&C) insurance operations. Reduced costs and expenses, and solid performance of AFG’s alternative investment portfolio that resulted in increased P&C net investment income contributed to the upside.

Behind the Headlines

Total operating revenues amounted to $1.8 billion in the fourth quarter, which rose 2.6% year over year. The improvement can be attributed to growth in net earned premiums at its P&C insurance, net investment income and other income.

P&C insurance net earned premiums of $1.5 billion climbed 9.6% year over year. Net investment income surged 42.2% year over year to $209 million. On a year-over-year basis, other income of $43 million more than doubled in the quarter under review.

Total costs and expenses of American Financial fell 4.1% year over year to $1.3 billion due to reduced P&C insurance losses and expenses and lower other expenses.

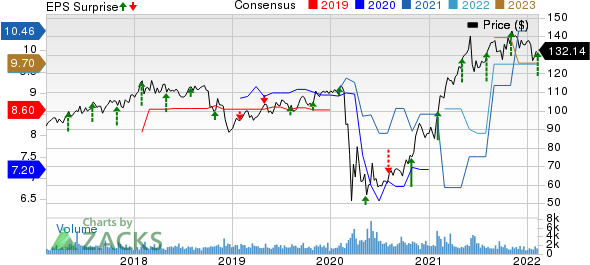

American Financial Group, Inc. Price, Consensus and EPS Surprise

American Financial Group, Inc. price-consensus-eps-surprise-chart | American Financial Group, Inc. Quote

Segment Results

Specialty P&C insurance operations generated $1.3 billion in net written premiums, which grew 4% year over year on the back of robust growth in each of its Specialty P&C groups. The turnaround of the economy, new business opportunities and a solid renewal rate environment contributed to the improvement.

Pretax core operating earnings of P&C Insurance Segment attained a record level of $485 million in the fourth quarter, which soared 77% year over year. The significant growth can be attributed to improved P&C underwriting profit and P&C net investment income.

The segment’s record underwriting profit of $281 million surged 57% year over year in the reported quarter on the back of better year-over-year underwriting profit across Specialty Casualty, and Property and Transportation Groups.

Consequently, Specialty Group’s aggregate combined ratio improved 550 basis points (bps) year over year to 80.7% on account of improvements of 530 bps in Property & Transportation, 600 bps in Specialty Casualty and 130 bps in Specialty Financial divisions.

Net written premiums in Specialty Casualty Group totaled $628 million, which advanced 11% year over year. The same at Specialty Financial and Other divisions rose 6% and 8%, respectively, year over year. Meanwhile, net written premiums at Property & Transportation Group fell 5% year over year.

Financial Update

American Financial exited the fourth quarter with cash and investments of $15.7 billion, which increased 16.7% from the 2020-end level.

As of Dec 31, 2021, long-term debt remained almost flat year over year at nearly $2 billion.

AFG’s book value per share (excluding unrealized gains/losses on fixed maturities) came in at $57.42. The figure decreased 9.7% from the figure at 2020 end.

The company had around $2.1 billion of excess capital as of Dec 31, 2021.

Dividend Update

American Financial declared cash dividends amounting to $6.56 per share in the fourth quarter. Included within the total cash dividends are a special dividend of $4.00 per share paid in November 2021 and another special dividend of $2.00 per share in December.

Full-Year Highlights

For 2021, AFG’s core net operating earnings per share of $11.59 surpassed the Zacks Consensus Estimate of $10.46 by 10.8%. The bottom line more than doubled from the 2020-end level.

Operating revenues for the year were $6.6 billion, which climbed 13.6% from the figure at 2020 end.

Core operating return on equity improved 940 bps year over year to 18.6%.

In 2021, American Financial bought back shares worth $319 million and distributed special dividends of $26.00 per share.

2022 Outlook Unveiled

AFG forecast core net operating earnings to be $9.75-$10.75 per share, which suggests a decline from the 2021 reported figure of $11.59.

Management anticipates net written premiums to witness growth in the range of 8% to 12%, which indicates an uptick from $5.6 billion reported in 2021.

The company projects a combined ratio in the range of 85% to 87% for 2022.

Discontinued Annuity Operations

On May 28, 2021, American Financial completed the divestiture of its Annuity business to Mass Mutual. AFG realized an after-tax non-core gain on the sale of $656 million in the first half of 2021. Consequently, from the first quarter of 2021 and through the date of sale, the results of the company’s Annuity operations are reported as discontinued operations.

Zacks Rank

American Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other Insurers

Of the insurance industry players that have reported fourth-quarter results so far, Prudential Financial, Inc. PRU, W.R. Berkley Corporation WRB and MetLife, Inc. MET beat the Zacks Consensus Estimate for earnings.

Prudential reported fourth-quarter 2021 adjusted operating income of $3.18 per share, which surpassed the Zacks Consensus Estimate by 33.1%. The bottom line improved 13.6% year over year. Total revenues of PRU amounted to $13.7 billion, which declined 5.8% year over year but beat the Zacks Consensus Estimate by 2.3%. Prudential’s total benefits and expenses amounted to $12.2 billion, which fell 7.4% year over year in the fourth quarter.

W.R. Berkley’s fourth-quarter 2021 operating income of $1.53 per share beat the Zacks Consensus Estimate of $1.21 by 26.5%. The bottom line improved 66.3% year over year. Operating revenues of WRB were $2.6 billion, up 19.4% year over year. The top line beat the consensus estimate by 9.2%. W.R. Berkley’s net premiums written were $2.3 billion, up 26.6% year over year.

MetLife reported fourth-quarter 2021 adjusted operating earnings of $2.39 per share, which surpassed the Zacks Consensus Estimate by 52.8%. The bottom line improved 6.9% over a year. MET’s adjusted operating revenues of $20 billion dipped 1.8% year over year but outpaced the Zacks Consensus Estimate by 19.8%. Adjusted net investment income of MetLife amounted to $5.2 billion, which improved 7% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MetLife, Inc. (MET) : Free Stock Analysis Report

Prudential Financial, Inc. (PRU) : Free Stock Analysis Report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research