American Homes 4 Rent (AMH) Reports Solid Growth Amidst Market Challenges

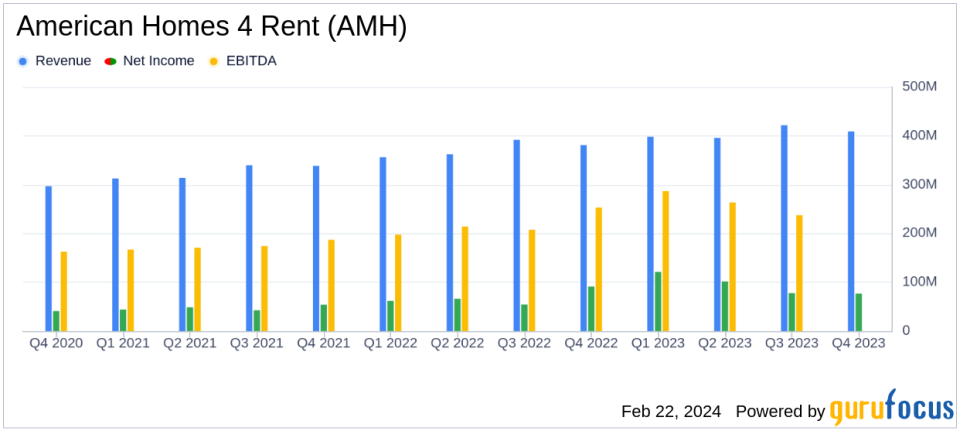

Revenue Growth: Rents and other single-family property revenues rose by 7.3% year-over-year to $408.7 million in Q4 2023.

Net Income: Net income attributable to common shareholders was $76.6 million in Q4 2023, a decrease from $87.5 million in Q4 2022.

Core FFO and Adjusted FFO: Core FFO per share increased by 8.8% to $0.43, and Adjusted FFO per share increased by 9.3% to $0.39 in Q4 2023.

Dividend Increase: The company raised its common share dividend by 18% to $0.26 for Q1 2024.

Portfolio Expansion: Delivered 503 newly constructed homes in Q4 2023 and increased the wholly-owned portfolio to 59,332 homes.

Green Bond Issuance: Issued $600 million in green bonds, a first in the single-family rental sector, to support sustainable growth.

2024 Guidance: Projected Core FFO growth of 2.4% - 6.0% and Same-Home Core NOI growth of 3.00% - 5.00% for the full year 2024.

On February 22, 2024, American Homes 4 Rent (NYSE:AMH), a leading large-scale integrated owner, operator, and developer of single-family rental homes, announced its financial and operating results for the fourth quarter and full year ended December 31, 2023. The company released its 8-K filing, detailing a year of resilient growth despite market challenges.

Company Overview

American Homes 4 Rent (NYSE:AMH) is a real estate investment trust (REIT) that focuses on acquiring, operating, and leasing single-family homes as rental properties across the United States. With a significant presence in urban markets in the Southern and Midwestern regions, the company's portfolio is primarily composed of single-family properties. AMH's business model is centered on generating rental revenue through short-term or annual leases, with key markets including Dallas, Texas; Indianapolis, Indiana; Atlanta, Georgia; and Charlotte, North Carolina.

Financial Performance and Challenges

For the fourth quarter of 2023, AMH reported a 7.3% increase in rents and other single-family property revenues, amounting to $408.7 million. However, net income attributable to common shareholders decreased to $76.6 million, or $0.21 per diluted share, compared to $87.5 million, or $0.25 per diluted share, in the same quarter of the previous year. This decline was primarily due to lower net gains on property sales, partially offset by higher rental rates.

Despite these challenges, the company's financial achievements are noteworthy. Core FFO attributable to common share and unit holders increased by 8.8% year-over-year to $0.43 per FFO share and unit, and Adjusted FFO saw a 9.3% increase to $0.39 per FFO share and unit for the fourth quarter. These metrics are critical for REITs as they provide a clearer picture of operating performance and cash flows from operations.

Income Statement and Balance Sheet Highlights

AMH's income statement reflects solid revenue growth driven by higher rental rates. The balance sheet shows a robust portfolio expansion with the delivery of 503 newly constructed homes, contributing to a total of 59,332 homes in the wholly-owned portfolio. The company's liquidity position remains strong, with cash and cash equivalents of $59.4 million and a strategic issuance of green bonds raising $600 million.

Commentary from the CEO

"Our strong fourth quarter results capped off another year of resilient and durable growth at AMH with Core FFO per share growing by nearly 8% in 2023," stated David Singelyn, AMH's Chief Executive Officer. "As we look ahead to 2024, sustained long-term fundamentals, superior operational execution supported by strategic initiatives, and consistent production out of the development program will continue to position us for both resiliency and long-term value creation."

Analysis of Performance

AMH's performance in 2023 demonstrates the company's ability to navigate a challenging market environment effectively. The increase in Core FFO and Adjusted FFO, along with the expansion of its property portfolio, indicates a strong operational execution. The issuance of green bonds also underscores the company's commitment to sustainable growth. Looking forward, AMH's guidance for 2024 suggests continued confidence in its business model and market position.

For more detailed information and to stay updated on American Homes 4 Rent's financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from American Homes 4 Rent for further details.

This article first appeared on GuruFocus.