Is American Homes 4 Rent (NYSE:AMH) Excessively Paying Its CEO?

In 2012 David Singelyn was appointed CEO of American Homes 4 Rent (NYSE:AMH). First, this article will compare CEO compensation with compensation at similar sized companies. After that, we will consider the growth in the business. Third, we’ll reflect on the total return to shareholders over three years, as a second measure of business performance. This process should give us an idea about how appropriately the CEO is paid.

See our latest analysis for American Homes 4 Rent

How Does David Singelyn’s Compensation Compare With Similar Sized Companies?

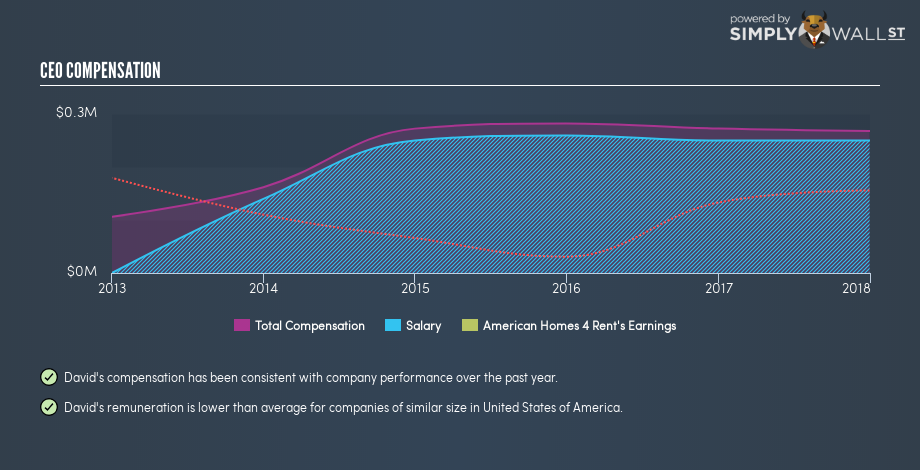

At the time of writing our data says that American Homes 4 Rent has a market cap of US$6.9b, and is paying total annual CEO compensation of US$268k. (This number is for the twelve months until 2017). While we always look at total compensation first, we note that the salary component is less, at US$250k. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of US$4.0b to US$12b. The median total CEO compensation was US$7.0m.

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. Though positive, it’s important we delve into the performance of the actual business.

You can see a visual representation of the CEO compensation at American Homes 4 Rent, below.

Is American Homes 4 Rent Growing?

Over the last three years American Homes 4 Rent has grown its earnings per share (EPS) by an average of 72% per year. In the last year, its revenue is up 11%.

This demonstrates that the company has been improving recently. A good result. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business.

Shareholders might be interested in this free visualization of analyst forecasts. .

Has American Homes 4 Rent Been A Good Investment?

With a total shareholder return of 29% over three years, American Homes 4 Rent shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary…

It appears that American Homes 4 Rent remunerates its CEO below most similar sized companies. Since the business is growing, many would argue this suggests the pay is modest. While some might be keen on seeing higher returns, our short analysis has not produced any evidence to suggest David Singelyn is overcompensated.

It’s good to see reasonable payment of the CEO, even while the business improves. It would be an additional positive if insiders are buying shares. If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at American Homes 4 Rent.

Or you could feast your eyes on this interactive graph depicting past earnings, cash flow and revenue.

To help readers see past the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price-sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned. For errors that warrant correction please contact the editor at editorial-team@simplywallst.com.