American National Bankshares Inc. Reports Decline in Q4 Earnings Amid Merger Expenses

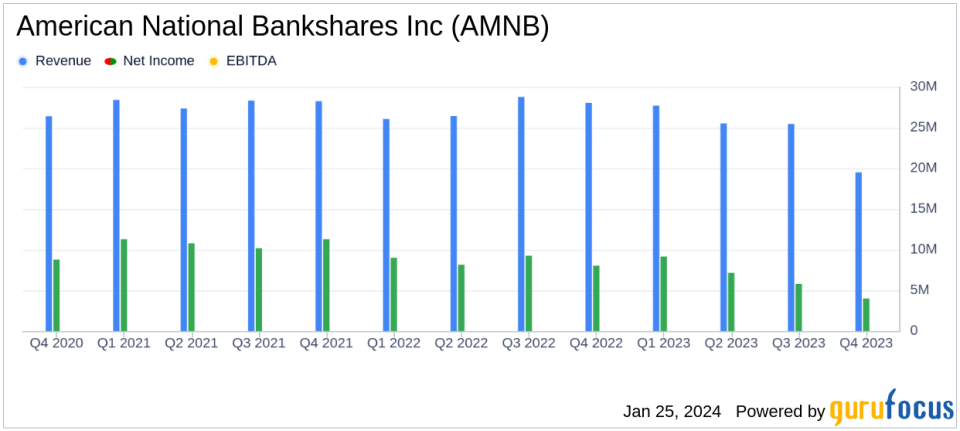

Net Income: Q4 earnings of $4.0 million, a decrease from $8.0 million in Q4 2022.

Earnings Per Share (EPS): Q4 EPS of $0.38, down from $0.76 in the same quarter last year.

Net Interest Income: Decreased by 5.4% to $19.5 million in Q4 2023 compared to the previous quarter.

Asset Quality: Nonperforming assets increased to $5.8 million as of December 31, 2023.

Balance Sheet: Total assets remained flat at $3.1 billion as of December 31, 2023.

On January 23, 2024, American National Bankshares Inc (NASDAQ:AMNB) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, a one-bank holding company that provides a comprehensive range of financial services, reported a decrease in earnings for the fourth quarter, with net income falling to $4.0 million, or $0.38 per diluted common share, compared to $8.0 million, or $0.76 per diluted common share, in the same quarter of the previous year. The year-end earnings also saw a decline, with $26.2 million in 2023 versus $34.4 million in 2022.

The reported earnings include merger-related expenses totaling $875 thousand for the quarter and $2.6 million for the year, in connection with the company's pending merger with Atlantic Union Bankshares Corporation. Despite these expenses, President and CEO Jeffrey V. Haley expressed satisfaction with the company's balance sheet growth and operating earnings performance, adjusting for merger-related expenses.

Financial Performance and Challenges

AMNB's net interest income for the fourth quarter decreased by 5.4% to $19.5 million compared to the third quarter of 2023, and by 19.5% from the same quarter in the previous year. The decrease was attributed to funding costs increasing more than earning asset yields. The net interest margin also contracted, reflecting the competitive interest rate environment.

Asset quality showed some signs of concern, with nonperforming assets increasing to $5.8 million, representing 0.19% of total assets. This is a notable increase from the previous quarter's $3.7 million and the previous year's $1.4 million. The company recorded a provision for credit losses of $437 thousand for the fourth quarter, indicating a cautious approach to potential credit losses.

Financial Achievements and Industry Importance

Despite the challenges, AMNB achieved a solid year of balance sheet growth. The company's loans held for investment increased by 4.7% year-over-year, and deposits saw a modest increase. These achievements are significant for AMNB and the banking industry, as they reflect the company's ability to grow its core business amidst a challenging economic landscape.

Income Statement and Balance Sheet Highlights

Key financial metrics from the income statement and balance sheet include:

"Net interest income for the fourth quarter of 2023 decreased by $1.1 million, or 5.4%, to $19.5 million compared to $20.7 million for the third quarter of 2023."

"Loans held for investment (net of deferred fees and costs) were $2.3 billion, an increase of $14.9 million, or 0.65%, from September 30, 2023."

"Deposits amounted to $2.6 billion at December 31, 2023, an increase of $35.3 million, or 1.37%, from September 30, 2023."

These figures are crucial as they provide insights into the company's revenue-generating ability and financial stability.

Analysis of AMNB's Performance

AMNB's performance in the fourth quarter reflects the impact of external factors such as merger-related expenses and a challenging interest rate environment. The increase in nonperforming assets and the provision for credit losses suggest a cautious outlook on asset quality. However, the company's balance sheet growth and the increase in loans and deposits demonstrate resilience and an ability to adapt to market conditions.

The bank's wealth management segment and its community banking operations continue to be key drivers of noninterest income, which increased by 1.3% from the previous quarter and by 33.9% from the same quarter in the previous year. This diversification of revenue streams is a positive sign for the company's overall health.

In conclusion, while American National Bankshares Inc faces challenges, including merger-related expenses and a competitive interest rate environment, the company's balance sheet growth and strategic focus on core operations position it for potential success in the future. Investors and stakeholders will be watching closely as the merger with Atlantic Union Bankshares Corporation progresses.

Explore the complete 8-K earnings release (here) from American National Bankshares Inc for further details.

This article first appeared on GuruFocus.