American Public (APEI) Surges 195% in 6 Months: Here's How

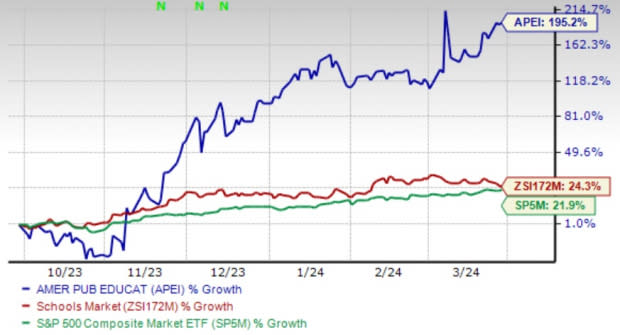

American Public Education, Inc. APEI has skyrocketed 195.2% in the past six months, outperforming the Zacks Schools industry’s 24.3% growth and the S&P 500 index’s 21.9% rally.

The uptrend was mainly backed by solid contributions from the American Public University System (“APUS”), Hondros College of Nursing (“HCN”) and Graduate School USA ("GSUSA"). Its focus on cost-saving initiatives and affordable tuition also bodes well.

APEI has seen an upward estimate revision for 2024 earnings to 62 cents per share from 55 cents over the past 30 days. The figure reflects a year-over-year increase of 121.2% and depicts analysts' optimism over the company’s prospects. It has a VGM Score of A, supported by a Growth Score of A and Value score of B, which solidifies its growth potential.

Image Source: Zacks Investment Research

Its earnings surpassed the Zacks Consensus Estimates in three of the trailing four quarters and missed once, with an average surprise of a whopping 125%.

Let’s check out the driving factors of this Zacks Rank #2 (Buy) company.

Strong Contribution From APUS, HCN & GSUSA

American Public has been registering an impressive enrollment growth at APUS and HCN. Net course registrations at APUS increased 4.9% year over year in 2023. Enrollment momentum continued for the 16th consecutive quarter at HCN, achieving growth of 16.9% year over year in 2023.

Despite higher costs, inflationary pressure and tepid RU enrollment, APUS and HCN’s revenues increased 6.4% and 20.9% year over year in 2023, respectively. GSUSA revenues also rose 25% from 2022 level. The upside was backed by successful marketing efforts and the execution of enrollment strategies. Also, the increase in net course registrations and tuition and fee increases implemented in April and July 2023 added to the positive.

Cost Containment Efforts

APEI has undertaken several initiatives to address increasing cost pressure. During the third quarter of 2023, it completed its previously announced operational improvements, including enhanced marketing efficiency and the right-sizing of the cost structure, both aligned with current levels of enrollment and revenues at Rasmussen. Also, it completed a reduction in force, terminating 74 employees and eliminating 57 open positions. This action is expected to yield approximately $15.5 million in annualized savings.

The headcount reductions align with ongoing efforts to restructure the organization, eliminate redundancies and optimize functions. The company’s EBITDA margin expanded 50 basis points (bps) year over year to 9.9% in 2023. This positive trend in margin growth is expected to continue in the first quarter and 2024, thanks to modest tuition increases combined with increased focus on marketing spend and other costs.

Affordability Moves

The company has undertaken several initiatives to improve enrollment trends and student persistence. It intends to drive students’ persistence rate by improving the quality of the student mix, releasing new tools for students and taking other initiatives that increase students’ engagement and classroom interactivity. APEI offers various competency-based education programs that permit students to control their pace and progress in a program.

The firm has also adopted a geographical marketing approach, which focuses on using cost-effective channels and aims to reach out to college-ready students who are more likely to succeed. It also aims to strengthen its digital marketing campaigns to leverage relationships with the military, public service and other high-value student populations.

Since its foundation, affordable tuition has been a priority of APUS. Its affordable tuition helps students take on comparably less debt. Tuition at APUS is currently among the lowest in the four-year for-profit sector.

This apart, APUS provides an APUS-funded tuition grant to undergraduate and master’s students to support its active-duty military students using TA. APUS’ low tuition and fees, in combination with APUS-funded tuition and book grants provided to all undergraduate students, active-duty military students and their spouses and dependents at the master’s level, lead to significant savings for students. Tuition and fees at Rasmussen University (“RU”) and HCN are also designed to be affordable and competitive with those of similar institutions offering the same level of flexibility, accessibility and student experience.

Focus on Nursing Programs

Currently, the U.S. healthcare sector is facing a severe talent shortage, impacting care quality and widening health disparities due to nursing departures and retirements during the pandemic. With 23 campuses, APEI's RU segment aims to bridge this gap by training new nurses. The firm is optimistic about its role in the healthcare ecosystem as it is dedicated to its mission for students, faculty and staff.

Other Key Picks

Some other top-ranked stocks in the same sector are:

Adtalem Global Education Inc. ATGE currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

ATGE has a trailing four-quarter earnings surprise of 16.9%, on average. The Zacks Consensus Estimate for ATGE’s fiscal 2024 sales and EPS indicates an increase of 6.4% and 10.2%, respectively, from the year-ago levels.

Ralph Lauren Corporation RL presently sports a Zacks Rank of 1. RL has a trailing four-quarter earnings surprise of 18.7%, on average.

The Zacks Consensus Estimate for RL’s fiscal 2025 sales and EPS suggests growth of 4.2% and 9.5%, respectively, from the year-ago levels.

Hyatt Hotels Corporation H currently carries a Zacks Rank of 2. Hyatt has a trailing four-quarter earnings surprise of 17.8%, on average.

The Zacks Consensus Estimate for H’s fiscal 2024 sales and EPS calls for growth of 3.5% and 27%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

American Public Education, Inc. (APEI) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Adtalem Global Education Inc. (ATGE) : Free Stock Analysis Report