American Software Inc (AMSWA) Reports Q3 Fiscal Year 2024 Earnings

Subscription Fees: Increased by 9% to $14.1 million in Q3 and 10% to $41.2 million year-to-date.

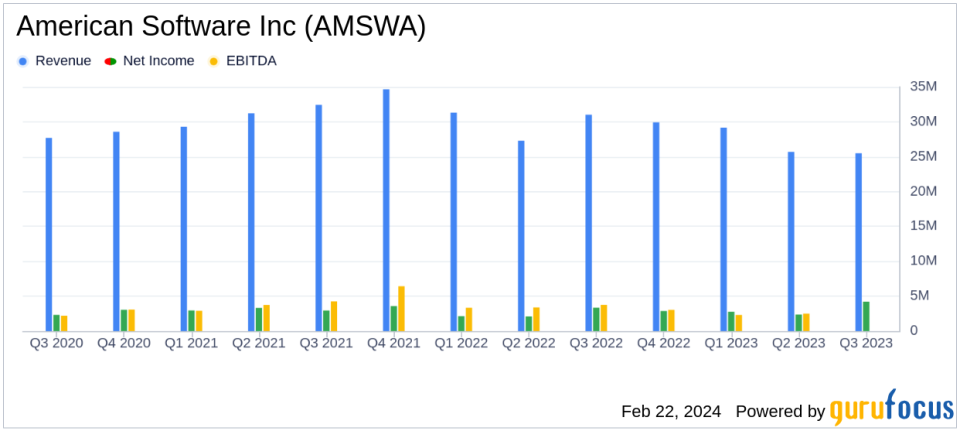

Total Revenues: Decreased by 7% to $25.5 million in Q3 and by 5% to $77.1 million year-to-date.

GAAP Net Earnings: From continuing operations rose to $4.2 million in Q3, a 31% increase year-over-year.

Adjusted EBITDA: From continuing operations was $4.0 million in Q3, representing 16% of revenue.

Recurring Revenue Streams: Accounted for 86% of total revenues in Q3, up from 79% in the same period last year.

On February 22, 2024, American Software Inc (NASDAQ:AMSWA) released its 8-K filing, detailing the financial results for the third quarter of fiscal year 2024. The company, known for its enterprise management and supply chain-related software and services, operates primarily through its Supply Chain Management (SCM) segment, which delivers collaborative supply chain solutions to optimize the production, distribution, and management of products.

Financial Performance and Challenges

AMSWA reported a 9% increase in subscription fees, which rose to $14.1 million for the quarter, reflecting a growing demand for the company's cloud-based solutions. However, total revenues saw a 7% decrease to $25.5 million, primarily due to a decline in services and maintenance fee revenue. The company's focus on cloud services sales is evident from the decrease in software license revenues, which dropped by 73% to $0.3 million for the quarter.

Despite the overall revenue dip, AMSWA's recurring revenue streams, which include Maintenance and Cloud Subscriptions, increased to 86% of total revenues, up from 79% in the prior year, indicating a shift towards more stable revenue sources. This shift is crucial for the software industry, where predictable and recurring revenue streams are highly valued for their long-term stability and predictability.

Financial Achievements and Importance

AMSWA's GAAP net earnings from continuing operations for the quarter were $4.2 million, or $0.12 per fully diluted share, a significant increase from $3.2 million, or $0.09 per fully diluted share, for the same period last year. Adjusted net earnings, which exclude non-cash stock-based compensation expense and amortization of acquisition-related intangibles, were $6.3 million, or $0.19 per fully diluted share, compared to $4.4 million, or $0.13 per fully diluted share, for the same period last year.

The company's Adjusted EBITDA margin was 16% of revenue from continuing operations in Q3, a key indicator of operational efficiency and profitability in the software industry. This metric is important as it shows the company's ability to convert revenue into actual profit while managing its expenses.

Key Financial Metrics

Important metrics from the financial statements include:

"Recurring revenue streams for Maintenance and Cloud Services were $65.2 million and $63.8 million or 85% and 78% of total revenues for the nine-month periods ended January 31, 2024, and 2023, respectively."

This high percentage of recurring revenue is a positive sign for the company's future revenue stability. Additionally, the company's strong cash and investments position of approximately $78.3 million provides financial flexibility and the ability to invest in growth opportunities.

Analysis of Company Performance

AMSWA's solid subscription fee growth is a testament to the strength of its cloud-based offerings. However, the decline in total revenues and the challenges in the services and maintenance segments suggest a need for strategic adjustments. The company's focus on recurring revenue streams and the strategic divestiture of non-core assets, such as The Proven Method, indicate a deliberate shift towards a more focused and efficient business model.

The company's financial outlook remains positive, with CEO Allan Dow expressing confidence in achieving the guidance for fiscal 2024. The increase in activity with both existing and prospective customers, particularly in adopting AI-first supply chain planning solutions, positions AMSWA for a strong finish to the fiscal year.

For a detailed analysis of American Software Inc's financial performance and future outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from American Software Inc for further details.

This article first appeared on GuruFocus.