Is American Software Inc (AMSWA) Significantly Undervalued?

With a daily gain of 8.67%, a 3-month loss of -4.82%, and an Earnings Per Share (EPS) of 0.3, American Software Inc (NASDAQ:AMSWA) presents an intriguing case for value investors. Is this stock significantly undervalued? Let's delve into a comprehensive valuation analysis to uncover the answer.

Company Overview

American Software Inc develops enterprise management and supply chain-related software and services. Its software and services bring business value to companies by supporting their operations over cloud-based Internet-architected solutions. The company's operating segments include Supply Chain Management (SCM), Information Technology Consulting (IT Consulting), and Others. The SCM segment, which generates the maximum revenue, provides collaborative supply chain solutions to streamline and optimize the production, distribution, and management of products between trading partners.

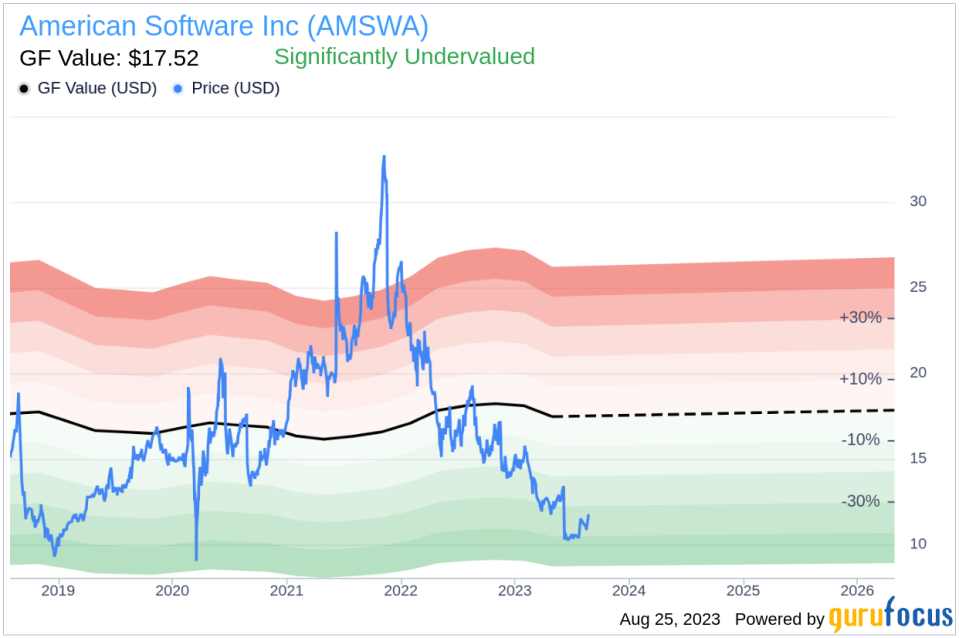

At its current price of $11.66 per share, American Software (NASDAQ:AMSWA) has a market cap of $398.40 million. However, the GF Value, an estimation of fair value, is pegged at $17.52. This discrepancy suggests that the stock might be significantly undervalued.

Understanding the GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It is computed based on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates.

If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher. For American Software, the stock price is significantly below the GF Value Line, suggesting that it is undervalued.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

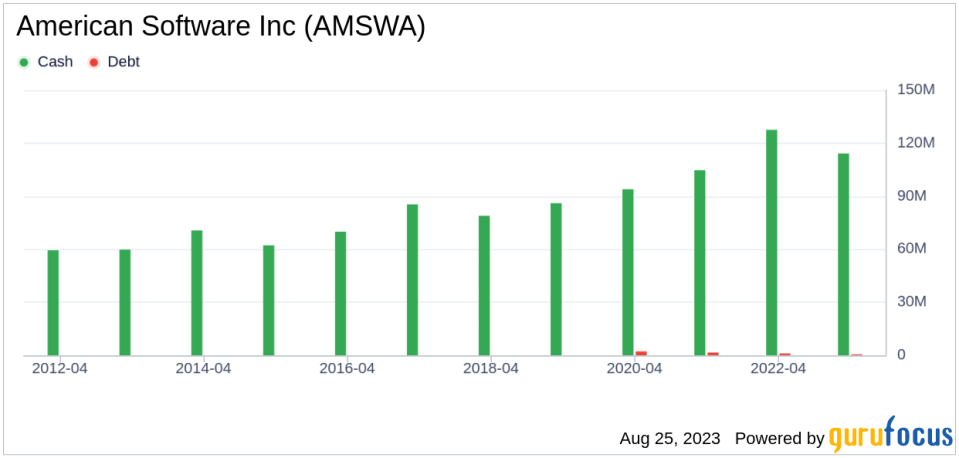

Before investing, it's crucial to assess the financial strength of a company. American Software boasts a cash-to-debt ratio of 239.81, better than 84.15% of the companies in the Software industry. This strong financial position indicates a lower risk of permanent loss.

Profitability and Growth

Investing in profitable companies carries less risk. American Software has been profitable for 10 years over the past 10 years, with an operating margin of 8.53%, better than 67.49% of the companies in the Software industry. However, the 3-year average annual revenue growth of American Software is 0.7%, ranking worse than 68.65% of the companies in the Software industry.

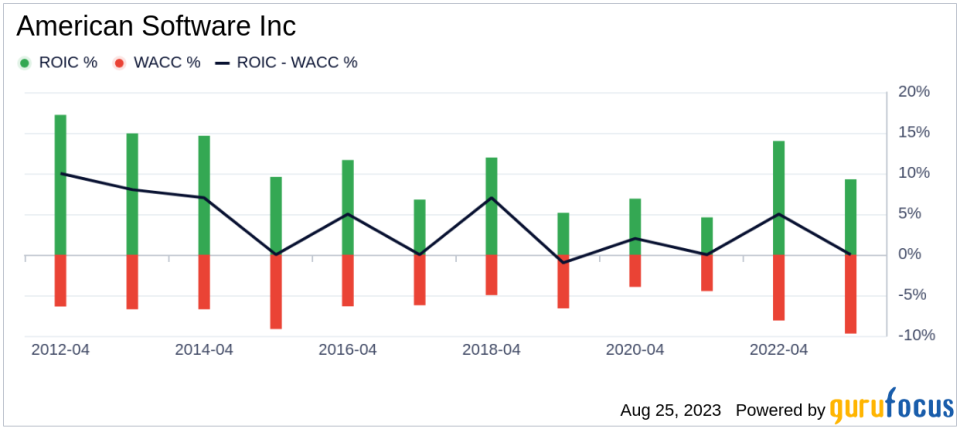

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) can also provide insights into its profitability. When the ROIC is higher than the WACC, the company is creating value for shareholders. For American Software, the ROIC is 9.43, and the WACC is 9.51.

Conclusion

Overall, American Software Inc (NASDAQ:AMSWA) stock appears to be significantly undervalued. The company's financial condition is strong, and its profitability is fair, although its growth ranks lower than 67.95% of the companies in the Software industry. To learn more about American Software stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.