American Tower Corp (AMT) Reports Mixed Results for Q4 and Full Year 2023

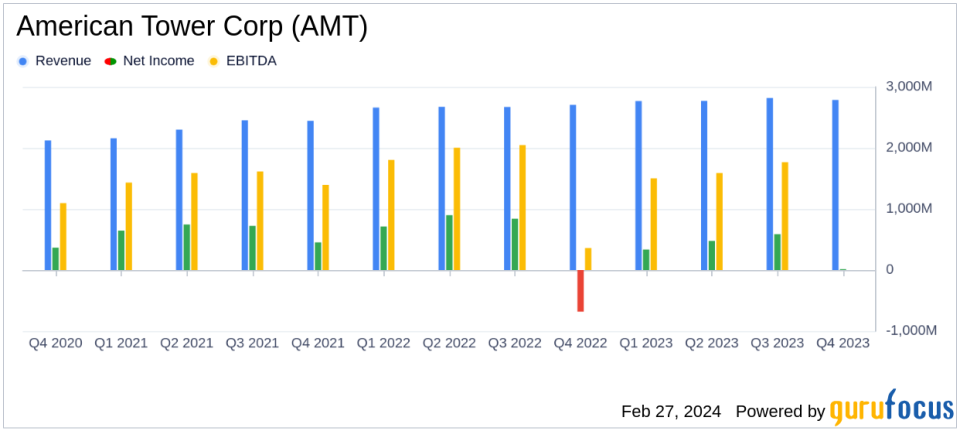

Total Revenue: Increased by 3.0% in Q4 and 4.0% for the full year.

Property Revenue: Grew by 4.6% in Q4 and 5.1% for the full year.

Net Income: Surged by 101.9% in Q4 but decreased by 19.4% for the full year.

Adjusted EBITDA: Rose by 3.2% in Q4 and 6.7% for the full year.

AFFO: Declined by 2.1% in Q4 but increased by 2.1% for the full year.

Free Cash Flow: Increased significantly by 17.7% in Q4 and 61.3% for the full year.

On February 27, 2024, American Tower Corp (NYSE:AMT) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The company, a leading independent owner, operator, and developer of multitenant communications real estate, reported a mixed set of results with revenue growth contrasted by a decrease in annual net income.

American Tower owns and operates over 220,000 cell towers across the globe, including a significant presence in the U.S., India, Latin America, Europe, and Africa. The company also manages 28 data centers in the U.S. after acquiring CoreSite. With a concentrated customer base, the top mobile carriers in each market generate most of the company's revenue. In the U.S., American Tower operates more than 40,000 towers, contributing to about half of the company's total revenue in 2022.

The fourth quarter of 2023 saw total revenue increase by 3.0% to $2,787 million, while property revenue grew by 4.6% to $2,766 million. However, net income showed a significant increase of 101.9% to $13 million in Q4, despite a full-year decrease of 19.4% to $1,367 million. Adjusted EBITDA for Q4 increased by 3.2% to $1,761 million, contributing to a 6.7% increase for the full year to $7,087 million.

Despite the positive growth in revenue and EBITDA, AFFO attributable to AMT common stockholders decreased by 2.1% to $1,070 million in Q4, although it increased by 2.1% to $4,612 million for the full year. The company's financial achievements, particularly the growth in free cash flow, which surged by 17.7% in Q4 and 61.3% for the full year, underscore the company's ability to generate cash and reinvest in its business or return capital to shareholders, which is crucial for REITs.

Key financial metrics from the income statement, balance sheet, and cash flow statement reveal the company's robust financial position, with a net leverage ratio of 5.2x and approximately $9.6 billion in total liquidity as of December 31, 2023. The company's disciplined capital allocation strategy is evident in its capital expenditures and acquisitions, which totaled approximately $531 million and $16 million, respectively, in Q4.

CEO Steven Vondran commented on the results, stating:

"We delivered another year of solid results at American Tower. In 2023, we combined record colocation and amendment growth in the US & Canada and a second consecutive year of record sales at CoreSite, with resilient performance in our international markets."

In conclusion, American Tower Corp's performance in 2023 reflects a company navigating a complex macroeconomic environment while capitalizing on the demand for its communications infrastructure assets. The company's focus on cost discipline, margin expansion, and cash flow growth, coupled with strategic balance sheet initiatives, positions it well for the future, especially with the anticipated demand from technology evolutions such as 5G and AI.

Explore the complete 8-K earnings release (here) from American Tower Corp for further details.

This article first appeared on GuruFocus.