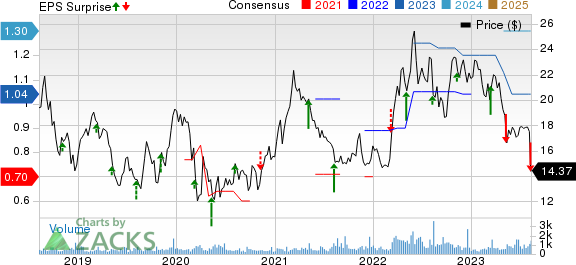

American Vanguard (AVD) Q2 Earnings & Sales Miss Estimates

American Vanguard Corporation AVD incurred a loss 4 cents per share in the second quarter of 2023 against earnings of 23 cents a year ago and the Zacks Consensus Estimate of earnings of 32 cents.

Revenues were $132.8 million for the reported quarter, down around 10% year over year. Revenues missed the Zacks Consensus Estimate of $166 million. In the second quarter of 2023, the global agriculture industry faced an unexpected decline in crop input procurement for crop inputs globally as higher interest rates led distribution to destock inventory, per American Vanguard.

American Vanguard Corporation Price, Consensus and EPS Surprise

American Vanguard Corporation price-consensus-eps-surprise-chart | American Vanguard Corporation Quote

Sales by Regions

Revenues from American Vanguard’s U.S. crop business for the reported quarter went down roughly 11% year over year to around $56.2 million.

Sales from the U.S. non-crop business fell roughly 20% year over year to around $16.9 million.

Revenues from international businesses fell 6% year over year to $59.7 million.

Financials

American Vanguard ended the quarter with cash and cash equivalents of roughly $14.6 million, down around 25.5% sequentially. Long-term debt was roughly $160.8 million, up around 66% sequentially.

Outlook

The company anticipates net sales in the range of $615-$625 million for 2023.

AVD expects gross margin to be around 32%. Net income is forecast to be in the range of $20-$24 million, while operating expenses are projected to be around 25% of net sales in 2023.

Price Performance

American Vanguard’s shares have lost 27.4% in a year against 5% rise of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

American Vanguard currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Carpenter Technology Corporation CRS and PPG Industries, Inc. PPG, both sporting a Zacks Rank #1 (Strong Buy), and TimkenSteel Corporation TMST, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for CRS’s current-year earnings is pegged at $3.43, indicating year-over-year growth of 200.9%. CRS beat the Zacks Consensus Estimate in all the last four quarters, with the average earnings surprise being 10%. The company’s shares have rallied 62.8% in the past year.

The consensus estimate for PPG’s current-year earnings has been revised 3.5% upward in the past 60 days. PPG beat the Zacks Consensus Estimate in three of the last four quarters. It delivered a trailing four-quarter earnings surprise of 7.3% on average. The company’s shares have risen roughly 4.4% in the past year.

The consensus estimate for TimkenSteel's current-year earnings has been revised 2.3% upward over the past 60 days. TimkenSteel’s earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 18.8%, on average. TMST shares have risen around 26.4% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

American Vanguard Corporation (AVD) : Free Stock Analysis Report

Timken Steel Corporation (TMST) : Free Stock Analysis Report