American Water Works Co Inc (AWK) Reports Solid 2023 Earnings and Raises 2024 EPS Guidance

Earnings Per Share (EPS): Reported $4.90 for 2023, up from $4.51 in 2022.

Capital Investments: $2.7 billion invested in 2023, boosting rate base by 10.7% year-over-year.

2024 EPS Guidance: Increased to $5.20 - $5.30, benefiting from legacy note restructuring.

Revenue Growth: Authorized annualized revenues of approximately $273 million from rate cases.

Operating Expenses: Increased due to inflationary pressures and higher pension costs.

Dividend: Quarterly cash dividend of $0.7075 per share declared, payable on March 1, 2024.

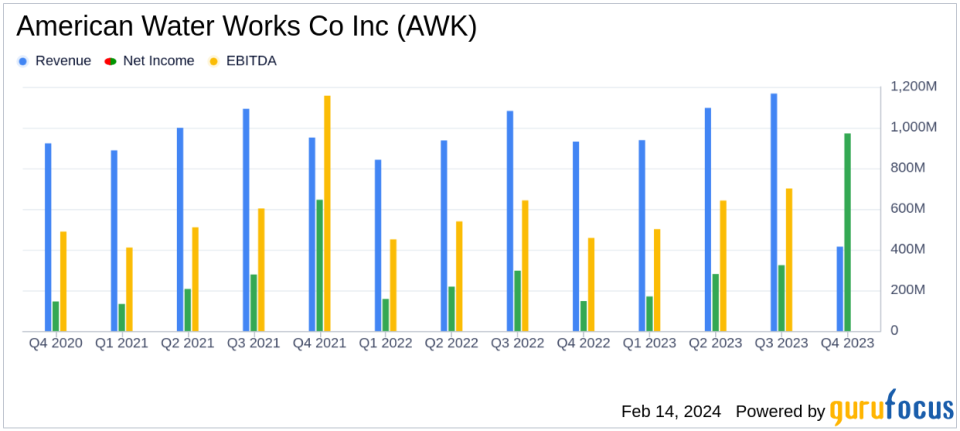

On February 14, 2024, American Water Works Co Inc (NYSE:AWK) released its 8-K filing, announcing a robust financial performance for the fiscal year 2023. The largest investor-owned U.S. water and wastewater utility, serving approximately 3.5 million customers in 16 states, reported a significant increase in earnings per share (EPS) for 2023, amounting to $4.90 compared to $4.51 in the previous year. This increase reflects the company's effective execution of its strategies, including a record $2.7 billion investment in regulated operations and the completion of 23 acquisitions across eight states.

Financial Performance and Challenges

The company's performance in 2023 was marked by the successful implementation of new rates in its Regulated Businesses, which drove revenue increases and offset the impact of rising operating costs. These costs, primarily production costs from inflationary pressures and higher pension costs, posed challenges that were somewhat mitigated by the net favorable impact of warmer, drier weather compared to normal. The company's long-term financial targets remain affirmed, with an increased EPS guidance for 2024 set at $5.20 to $5.30, up from the previously announced range of $5.10 to $5.20. This increase is attributed to the expected interest income from the restructuring of a legacy note related to the sale of the former Homeowner Services Group (HOS).

Regulated Business and Amended Legacy Note Receivable

For the Regulated Businesses, net income rose to $971 million in 2023 from $854 million in 2022, driven by authorized revenue increases from rate cases and infrastructure proceedings. Operating revenues saw a substantial increase, with $273 million authorized from general rate cases, all effective in 2023. Additionally, $117 million in annualized revenues from infrastructure surcharges was authorized, with $86 million effective in 2023 and the remainder in 2024. The company also reported an amendment to the terms of the secured seller note receivable from the HOS sale, which will result in increased interest income estimated at $0.10 per share per year through December 9, 2026.

Dividends and Future Outlook

American Water's Board of Directors declared a quarterly cash dividend of $0.7075 per share, underscoring the company's commitment to shareholder returns. The company remains confident in its long-term plan and its ability to navigate through the challenges posed by inflationary pressures and other economic factors. The affirmed long-term EPS and dividend growth rate targets of 7-9% reflect this confidence.

As the largest regulated water and wastewater utility in the U.S., American Water Works Co Inc (NYSE:AWK) continues to demonstrate its ability to invest strategically in its infrastructure and operations, leading to sustained growth and increased shareholder value. The company's focus on maintaining a healthy balance sheet and executing its long-term strategies positions it well for continued success in the regulated utilities industry.

For more detailed information on American Water Works Co Inc (NYSE:AWK)'s financial performance, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from American Water Works Co Inc for further details.

This article first appeared on GuruFocus.