American Water's (AWK) Pennsylvania Arm to Buy Water Assets

American Water Works Company, Inc.’s AWK subsidiary, Pennsylvania American Water, announced that it signed a deal to acquire Appalachian Utilities, Inc. The deal is expected to close in late 2024, after necessary approvals, and add 1,450 customers.

Pennsylvania American Water is expanding its operations through systematic acquisitions.

Recently, the company entered into an agreement to buy Audubon Water Company for $8 million. The deal is expected to close in late 2024, after necessary approvals and add 2,900 customers.

Timely repairs and maintenance of aging water infrastructure are essential to providing high-quality 24x7 services to customers. As a part of the acquisition deal, Pennsylvania American Water plans to invest more than $6.5 million to upgrade the aging water infrastructure of Appalachian Utilities to provide high-quality water services to customers.

Pennsylvanian American Water has been upgrading and maintaining its water and wastewater infrastructure by methodically replacing old water mains and investing nearly $490 million in 2022 in infrastructural upgrades. Proper infrastructure maintenance allows it to serve its 2.3 million customers efficiently.

Water Industry Needs Investment & Consolidation

The aging water industry of the United States needs investment for proper upgrades and maintenance of water mains. Per the American Society of Civil Engineers, water main breaks occur every two minutes in the United States due to the aging of the existing water infrastructure, resulting in the wastage of millions of gallons of potable water.

Per the U.S. Environmental Protection Agency, an estimated $744 billion investment is necessary to maintain and expand drinking water and wastewater services to meet demand over the next 20 years.

Too many small water service providers work in the United States and the lack of financial strength of the small operators creates operational challenges in meeting the requirement for replacement and adding to the aging water and wastewater infrastructure. Large water utility companies continue to acquire small players to ensure the extension of high-quality services to customers and the investment required to upgrade old and acquired assets.

American Water Works, through its subsidiaries, is making systematic acquisitions and taking essential steps to upgrade the old infrastructure of its acquired assets. AWK has added 7,100 customers till Jun 30, 2023, by acquiring five companies. The company’s pending acquisitions (as of Jun 30, 2023), when completed, will add another 74,800 customers to its customer base. In addition, AWK has long-term investment plans to upgrade and expand its water infrastructure and efficiently serve customers.

Another water utility, Essential Utilities WTRG, is also making acquisitions to expand its operations. Since 2015, Essential Utilities has expanded utility operations by completing many water and wastewater acquisitions, adding 129,000 customers. The six acquisitions completed in 2023 added 11,025 customers. At present, there are four pending acquisition deals for a total purchase price of $335.8 million, which, when completed, will add 208,000 customers to its existing customer base.

Essential Utilities plans to invest $1.1 billion annually in the 2023-2025 period to further strengthen its water and natural gas operations.

Another utility, California Water Service Group CWT, is also expanding operations through inorganic routes. In June 2023, California Water’s unit, New Mexico Water, received approval from the New Mexico Public Regulation Commission to acquire the assets of Monterey Water Company and provide regulated water utility service to Monterey’s customers.

California Water Service is expected to invest $360 million and $365 million in 2023 and 2024, respectively, to upgrade its infrastructure and efficiently serve its expanding customer base.

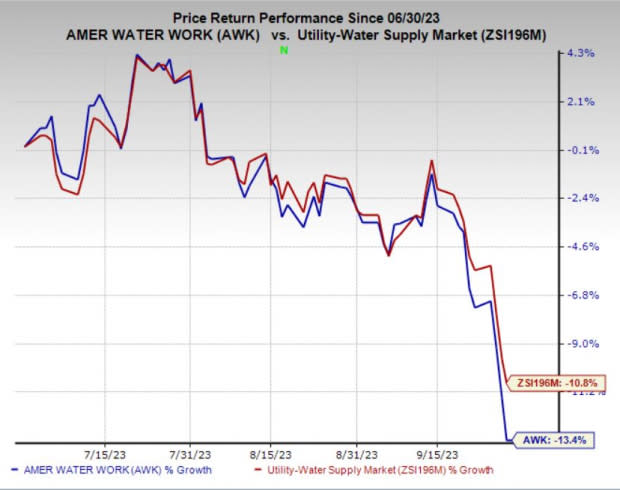

Price Performance

Over the past three months, shares of AWK have lost 13.4% compared with the industry’s 10.8% decline.

Image Source: Zacks Investment Research

Zacks Ranks & Another Stock to Consider

American Water currently has a Zacks Rank #2 (Buy).

Another top-ranked company from the same industry is American States Water AWR, currently carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AWR’s long-term (three- to five-year) earnings growth rate is pegged at 6.3%. The Zacks Consensus Estimate for 2023 earnings of $2.96 per share reflects an increase of 0.3% in sales over the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

California Water Service Group (CWT) : Free Stock Analysis Report

American States Water Company (AWR) : Free Stock Analysis Report

Essential Utilities Inc. (WTRG) : Free Stock Analysis Report