American Woodmark (AMWD) Stock Up on Q2 Earnings, Sales Beat

American Woodmark Corporation’s AMWD shares jumped 2.21% in the after-hours trading session on Nov 30, as it reported impressive second-quarter fiscal 2024 results.

Both earnings and net sales surpassed their respective Zacks Consensus Estimate and increased on a year-over-year basis. Strong operational performance and platform change moves are boosting the company’s results in dynamic market conditions.

Quarter in Details

American Woodmark reported adjusted earnings of $2.36 per share, which beat the consensus estimate of $1.84 by 28.3%. The bottom line also increased 5.4% from $2.24 reported a year ago.

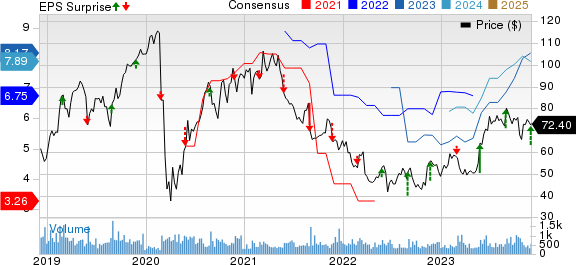

American Woodmark Corporation Price, Consensus and EPS Surprise

American Woodmark Corporation price-consensus-eps-surprise-chart | American Woodmark Corporation Quote

Net sales of $473.9 million beat the consensus mark of $455 million by 4.1%. However, the figure declined 15.6% from the prior-year quarter’s level of $561.5 million.

Adjusted EBITDA increased 7% year over year to $72.3 million. Adjusted EBITDA margin expanded 330 basis points (bps) to 15.3% from the year-ago quarter's figure.

Financials

As of Oct 31, the company had $96.4 million of cash and cash equivalents compared with $41.7 million at fiscal 2023-end. It also had $323.2 million of availability under its revolving credit facility. Long-term debt was $370.9 million compared with $369.4 million at fiscal 2023-end.

Cash from operations for the first half totaled $143.7 million compared with $55.4 million in the prior-year period. Free cash amounted to $109.9 million compared with $44.4 million in the year-ago period.

The company repurchased 394,220 shares for $30 million during the second quarter of fiscal 2024. On Nov 29, AMWD’s board of directors authorized a stock repurchase program of up to $125 million of its outstanding common shares, replacing the previous authorization.

Fiscal 2024 Guidance

The company expects net sales to decline in low double-digit year over year. Also, it now projects adjusted EBITDA in the range of $235-$250 million compared with the previous guidance of $225-$245 million. In fiscal 2023, the company reported net sales of $2.07 billion and adjusted EBITDA of $240.4 million.

Zacks Rank & Recent Consumer Discretionary Releases

AMWD currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Leggett & Platt, Inc. LEG reported tepid third-quarter 2023 results, wherein both earnings and sales missed their respective Zacks Consensus Estimate.

The top and bottom lines declined on a year-over-year basis. The downtrend was caused by persistent weak demand in the Bedding Products and Furniture and Flooring & Textile Products segments, partially offset by strong demand in the Specialized Products segment.

Strategic Education, Inc. or SEI STRA reported impressive results for third-quarter 2023. Its quarterly earnings and revenues topped the respective Zacks Consensus Estimate and increased year over year.

Growth across its three segments, led by continued enrollment growth in U.S. Higher Education, driven significantly by employer-affiliated enrollment, strong growth in Education Technology Services (earlier known as Alternative Learning) and improving performance in Australia/New Zealand, drove the result.

Adtalem Global Education Inc. ATGE reported impressive results for first-quarter fiscal 2024. Earnings and revenues surpassed their respective Zacks Consensus Estimate and increased year over year, given solid enrollment growth and strategic initiatives.

The company's accelerated performance across five operational pillars highlights its market-leading scale and healthcare focus. ATGE also raised its fiscal 2024 guidance. With 80,000 students and 300,000 alumni, it is well-equipped to address critical healthcare provider shortages.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Leggett & Platt, Incorporated (LEG) : Free Stock Analysis Report

American Woodmark Corporation (AMWD) : Free Stock Analysis Report

Adtalem Global Education Inc. (ATGE) : Free Stock Analysis Report