American Woodmark Corp (AMWD) Reports Mixed Q3 Results Amid Market Challenges

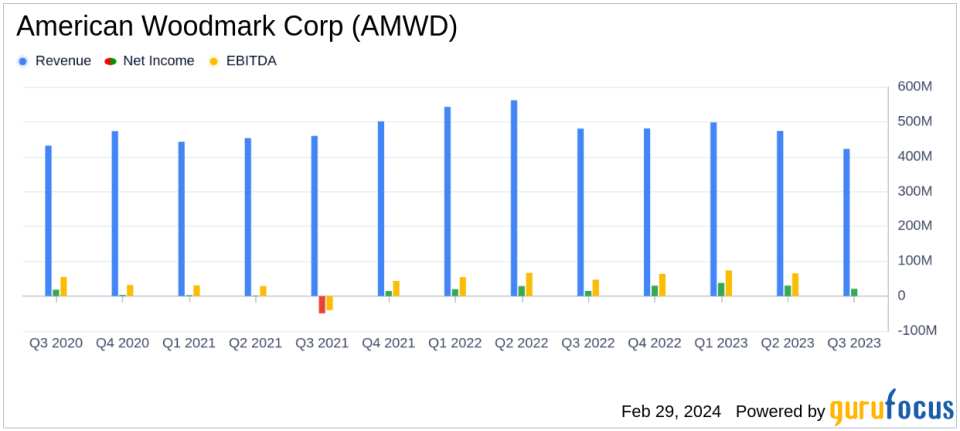

Net Sales: Decreased by 12.2% year-over-year to $422.1 million.

Net Income: Increased by 44.1% year-over-year to $21.2 million.

Adjusted EBITDA: Slightly decreased by 0.7% to $50.6 million.

GAAP EPS: Stood at $1.32, with an Adjusted EPS of $1.66.

Free Cash Flow: Amounted to $21.8 million for the quarter.

Share Repurchase: Repurchased 215,629 shares for $19.6 million.

Financial Outlook: Reaffirms low double-digit net sales decline year-over-year, with an increased Adjusted EBITDA outlook of $247 million to $253 million.

On February 29, 2024, American Woodmark Corp (NASDAQ:AMWD) released its 8-K filing, announcing financial results for the third quarter of fiscal year 2024. The company, known for manufacturing and distributing kitchen cabinets and vanities, faced a challenging market environment with a notable 12.2% decrease in net sales compared to the same period last year. However, net income saw a significant increase of 44.1% to $21.2 million, reflecting the company's ability to navigate through headwinds with effective cost management and operational improvements.

Performance Amidst Market Headwinds

Despite the decrease in net sales, American Woodmark Corp managed to improve its net income and maintain a relatively stable Adjusted EBITDA. The company's President and CEO, Scott Culbreth, attributed this performance to "improved operational performance" and a "stabilizing supply chain." The company's ability to match inflationary cost impacts with favorable product mix and pricing has been pivotal in offsetting the sales decline.

Financial Resilience and Shareholder Returns

The company's financial achievements, including a robust net income increase and a disciplined approach to cash flow management, are particularly important in the Furnishings, Fixtures & Appliances industry, where market volatility can significantly impact profitability. American Woodmark's free cash flow of $21.8 million for the quarter and share repurchase activity demonstrate a commitment to shareholder value amidst market challenges.

Key Financial Metrics

Important metrics from the financial statements include a Gross Profit of $80.9 million and Operating Income of $27.9 million for the quarter. The company's Balance Sheet shows a healthy cash position of $97.8 million, with a total asset base of $1.57 billion. These metrics are crucial for American Woodmark as they reflect the company's financial health and its ability to sustain operations and growth initiatives.

"As our teams have demonstrated throughout the fiscal year, we delivered strong financial performance in the third quarter of fiscal year 2024 despite the slowing demand environment," said Scott Culbreth, President and CEO of American Woodmark.

Analysis of Company's Performance

While American Woodmark's net sales decline reflects broader industry trends and a potentially cooling housing market, the company's increased net income and Adjusted EBITDA margins suggest effective cost control and operational efficiency. The company's share repurchase program also signals confidence in its long-term value proposition. However, investors should consider the potential impact of continued market challenges on future performance.

American Woodmark's outlook for the remainder of fiscal year 2024 remains cautious yet optimistic, with expectations for stronger Adjusted EBITDA performance. The company's strategic focus on operational excellence and cost management is likely to continue playing a key role in navigating a dynamic market landscape.

For a detailed understanding of American Woodmark Corp's financial results and strategic direction, investors and stakeholders are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from American Woodmark Corp for further details.

This article first appeared on GuruFocus.