America’s big banks are staffing up—for blockchain

IBM this week announced a massive internal re-organization to cater to blockchain.

It is one of many recent signs that the peer-to-peer ledger technology, which first came along with the digital currency bitcoin, has serious future applications in big business. Or it is at least a sign that big companies are convinced they ought to examine it further. (What exactly is blockchain? Watch this primer video.)

The computing giant will create a new unit called Watson Financial Services to encompass Watson, cloud, and all blockchain-related offerings and strategy. Bridget van Kralingen, IBM’s senior VP of global banking services, will take on the role of building the unit, and take a new title, VP of industry platforms. To replace van Kralingen in global banking services, IBM has hired Mark Foster, a former Accenture executive.

IBM says that it has created new roles specifically devoted to blockchain, and will create more, but it declines to share how many.

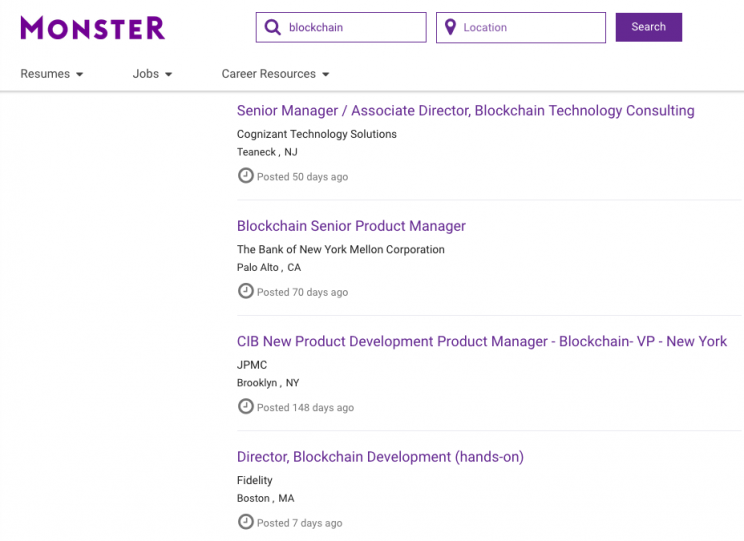

Search for “blockchain jobs” on job sites like Monster.com and Indeed and you’ll find more than 100 at some, posted by companies like IBM, Fidelity, BNY Mellon, JPMorgan, Bank of America, Capital One, American Express, Citigroup, Cognizant and Infosys.

There are, of course, many jobs listed at companies like Circle, a payments app that uses the bitcoin blockchain, and at Chain, which creates custom blockchains for clients like Visa, Citi and Nasdaq (see below video from May), but those are the companies you would expect. They are companies that exist squarely in the digital currency or blockchain space.

To see blockchain job openings at big banks, payment processors, or financial firms is the surprise. It suggests that blockchain tech is creating new jobs—hundreds of them, for now, not thousands.

As Computer World UK wrote in May, “Demand for distributed ledger expertise is on the rise.” (While many jobs require coding and technical proficiency, some of them are closer to traditional management positions.) And J. Christopher Giancarlo, commissioner of the US Commodity Futures Trading Commission (CFTC), wrote an op-ed in May encouraging companies to “Do no harm to the blockchain” because “American jobs depends on it.”

Getting rid of friction—and maybe humans—in banking

To be sure, blockchain will likely eliminate jobs in the long run, too, if it fulfills its promise as an efficiency-improver for big financial giants. Giancarlo had to acknowledge such in his own op-ed about the job benefits of blockchain: “Still, the blockchain revolution will not come without adverse consequences, including a likely drop in the human capital that supports the recordkeeping and transaction processing of today’s financial markets.” A report from Citi this year predicted that blockchain and other automation in retail banking could eventually eliminate 30% of jobs at banks in the US and Europe.

“That’s absolutely right,” says Jerry Cuomo, IBM’s VP of blockchain, who will report to Van Kralingen in the new unit. “At some level, the efficiency you get from blockchain is to create more of a B2B service without the friction. And many financial services companies are the friction in the system, by design.”

But companies exploring blockchain are still in the experimenting stage, where they need to bring new people on, rather than cut people because blockchain tech has made them non-essential.

“I think the year started with blockchain tourism running rampant—in a good way,” says Cuomo. “And the tourism business is rapidly turning into hands-on engagement. I think this is where blockchain as a service really aided that desire to enable developers to rapidly experiment with applications, and business folks to witness the transformative power. Users and institutions have gone from, ‘What is this thing? I want to know more about it,’ to, ‘Okay, I’m in.’”

IBM has rolled out a bevy of new blockchain services over the last year, including its own IBM Blockchain that runs on Bluemix, IBM’s cloud infrastructure, and this month a new secure blockchain platform for developers to access Hyperledger, a large-scale blockchain project with many different companies on board. And IBM is working on separate blockchains for specific business needs of IBM clients, such as, to name one example, dispute management.

In official press releases, the company is already calling itself “the leader in blockchain.”

Blockchain as a service (BaaS)

But IBM is hardly the only big corporation jumping in. Intel, JPMorgan, and Accenture are all “premier level” members of the Hyperledger project, along with IBM. And Cisco, BNY Mellon, and Wells Fargo are among the general level of members.

Microsoft took a different tack, launching its own Project Bletchley over its Azure cloud platform in June. PC Magazine writes that IBM and Microsoft are the two giants “defining” the new blockchain as a service (BaaS) market, and called their efforts “dueling initiatives.”

For what it’s worth, based on a check of three job web sites, IBM is hiring many more blockchain-related positions than Microsoft at the moment.

Tension between bank chains and bitcoin blockchain

Meanwhile, a core tension still exists between the bitcoin community, where blockchain technology first came around, and those in banking and finance that want to create their own private blockchain applications. The difference is one of not just practice but theory: Bitcoin and digital currency believers feel that the very point of blockchain is to be open, “permissionless,” anonymized, accessible to anyone. Those in the banking world are alarmed by such a lack of restriction, and instead are working on safer, “permissioned” blockchains, where participants must be verified and known.

It’s also about speed, says Ludwin of Chain. Because of the limited, processing power of the bitcoin blockchain, big companies like Visa, Citi, and Nasdaq “don’t build on bitcoin, and probably won’t if the goal is to keep bitcoin decentralized.”

Cuomo of IBM has his own explanation: regulatory concerns. “We’re still very much [focused] on the permissioned blockchain, which could either be public or private, but you need a membership card to get in,” he says. “That seems to be resonating with any client or user group that falls under any kind of regulation. If the data you use falls under regulatory rule, where you need to know your customer who is accessing your data, Ethereum and bitcoin-based blockchains aren’t going to help you with that. That would be a very large group to say no to, and we’re saying yes to them.”

But Cuomo gives a caveat: no one quite knows where all of this is heading for sure. “I don’t believe there will be one blockchain to rule them all,” he says. “I believe there will be many. This is all going to take time. And I think we will get there.”

—

Daniel Roberts is a writer at Yahoo Finance, covering sports business and technology. Follow him on Twitter at @readDanwrite.

Read more:

Why Ethereum is the hottest new thing in digital currency

The latest Bitcoin price hike is not all about Brexit

British bitcoin market sent incredible signals ahead of Brexit

Here’s why 21 Inc. is the most exciting bitcoin company right now