America's Car-Mart Inc (CRMT) Faces Revenue Decline Amid Market Challenges

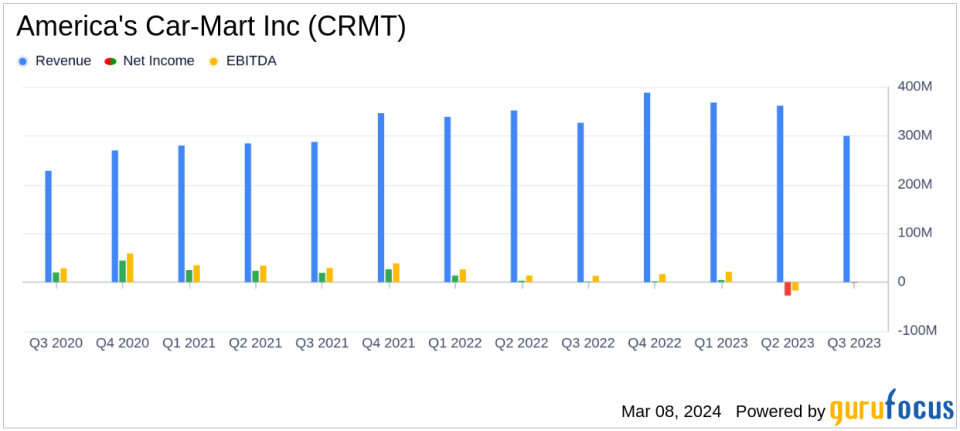

Revenue: Reported a 7.9% decrease to $299.6 million in Q3 FY24.

Net Income: Experienced a loss of $8.5 million, with a loss per share of $1.34.

Gross Profit: Gross profit per unit sold increased by 10.5% year-over-year.

Net Charge-Offs: Net charge-offs as a percentage of average finance receivables increased to 6.8%.

Strategic Partnership: Entered into a strategic partnership with Cox Automotive in February.

Loan Origination System: Completed implementation of updated loan origination system.

Stock Performance: Share price may be affected by the reported loss and revenue decline.

On March 8, 2024, America's Car-Mart Inc (NASDAQ:CRMT) released its 8-K filing, detailing the financial results for the third quarter ended January 31, 2024. The company, a prominent automotive retailer in the United States, focuses on the Integrated Auto Sales and Finance segment of the used car market, operating through its subsidiaries and providing financing for most of its customers.

Financial Performance and Challenges

America's Car-Mart Inc (NASDAQ:CRMT) reported a decrease in Q3 revenue by 7.9% to $299.6 million, compared to the same period last year. This decline was primarily due to a decrease in retail units sold, despite a 16.0% year-over-year increase in interest income and a 7.5% rise in the average retail sales price. The company sold 11,664 units, a significant drop of 19.6% from the prior year's quarter. The reduction in total credit application volume and fewer selling days, compounded by adverse weather conditions, contributed to the decline in sales volume.

Despite the revenue challenges, gross profit per unit sold improved by 10.5% year-over-year, attributed to better operational execution and pricing discipline. However, the company faced headwinds in gross profit related to lower wholesale market prices and an increased volume of wholesale vehicles due to higher credit losses in the previous quarter.

Strategic Moves and Financial Metrics

Amidst the challenging macro environment, America's Car-Mart Inc (NASDAQ:CRMT) has been proactive in implementing several initiatives to improve sales and profitability. The company entered into a strategic partnership with Cox Automotive, aiming to drive better outcomes in vehicle acquisition, reconditioning, transportation, and remarketing. Additionally, the company completed the implementation of an updated loan origination system, which is expected to attract higher down-payments, shorter terms, and a stronger consumer profile.

Key financial metrics such as net charge-offs and allowance for credit losses showed mixed results. Net charge-offs as a percentage of average finance receivables increased to 6.8%, while the allowance for credit losses was slightly adjusted down to 25.74%. The company also reported a loss per share of $1.34, compared to diluted earnings per share of $0.23 in the same quarter of the previous year.

"We continue to navigate a challenging macro environment facing our customers and remain focused on their success. While sales volumes fell short of our expectations during the quarter, they are not reflective of the efforts put forth by the team. I am encouraged by our continued progress during the quarter in gross profit, credit losses, and initial results generated by our loan origination system. We have implemented several initiatives to improve sales during the fourth quarter. Our priority is to be agile with our cost structure and investments to deliver long-term profitability and shareholder value," said Doug Campbell, President and CEO.

Analysis of Company's Performance

The company's strategic partnership and updated loan origination system are steps towards addressing the current challenges and improving future performance. The increase in gross profit per unit indicates a potential for profitability despite the decrease in units sold. However, the rise in net charge-offs and the reported net loss highlight the ongoing pressures in the used car market and the need for effective cost management and operational efficiency.

Value investors may find the company's efforts to improve sales and control costs appealing, as these initiatives could lead to improved financial performance in the long term. However, the current decline in revenue and net income may raise concerns about the company's short-term prospects.

For a more detailed analysis of America's Car-Mart Inc (NASDAQ:CRMT)'s financial results and to stay updated on the company's progress, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from America's Car-Mart Inc for further details.

This article first appeared on GuruFocus.