Ameriprise (AMP) Q3 Earnings Beat, Revenues & Costs Rise Y/Y

Ameriprise Financial’s AMP third-quarter 2023 adjusted operating earnings (excluding unlocking) of $7.68 per share handily surpassed the Zacks Consensus Estimate of $7.58. The bottom line reflects a rise of 21% from the year-ago quarter.

Results were aided by revenue growth, along with higher assets under management (AUM) and assets under administration (AUA) balances. However, an increase in expenses was a negative.

After considering significant items, net income (GAAP basis) was $872 million or $8.14 per share, down from $1.06 billion or $9.41 per share in the prior-year quarter. Our estimate for the metric was $803.8 million.

Revenues Improve, Expenses Rise

On an operating basis, adjusted total net revenues were $3.91 billion, up 10% year over year. The top line missed the Zacks Consensus Estimate of $3.96 billion.

On a GAAP basis, net revenues were $3.93 billion, growing 13% year over year.

Adjusted operating expenses totaled $2.96 billion, which increased 18% year over year. We had projected the same to be $3.09 billion.

Total AUM and AUA increased 12% year over year to $1.23 trillion. The rise reflected strong client net inflows and market appreciation. Our estimate for the metric was $1.28 trillion.

Share Repurchase Update

In the reported quarter, Ameriprise repurchased 1.5 million shares for $520 million.

Our Take

Elevated expenses (mainly due to technology upgrades) will likely continue to hurt AMP’s bottom line. However, Ameriprise is well-positioned for impressive top-line growth on the back of its robust AUM balance and business-restructuring initiatives.

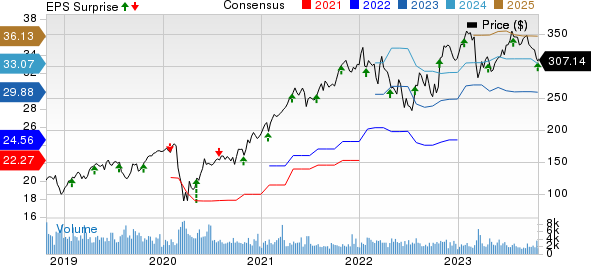

Ameriprise Financial, Inc. Price, Consensus and EPS Surprise

Ameriprise Financial, Inc. price-consensus-eps-surprise-chart | Ameriprise Financial, Inc. Quote

Ameriprise currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Asset Managers

BlackRock, Inc.’s BLK third-quarter 2023 adjusted earnings of $10.91 per share handily surpassed the Zacks Consensus Estimate of $8.52. Also, the figure reflects an increase of 14.2% from the year-ago quarter.

BLK’s results benefited from a rise in revenues and higher non-operating income. Further, the AUM balance witnessed improvement. However, higher expenses acted as a headwind for BLK.

Invesco’s IVZ third-quarter 2023 adjusted earnings of 35 cents per share lagged the Zacks Consensus Estimate of 36 cents. The bottom line, however, rose 2.9% from the prior-year quarter.

IVZ’s results were hurt by a rise in operating expenses and lower revenues. Nevertheless, an increase in the AUM balance on decent inflows aided the results to some extent.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Ameriprise Financial, Inc. (AMP) : Free Stock Analysis Report