Ameriprise Financial Inc (AMP) Reports Strong Adjusted Operating Earnings Growth in Q4 2023

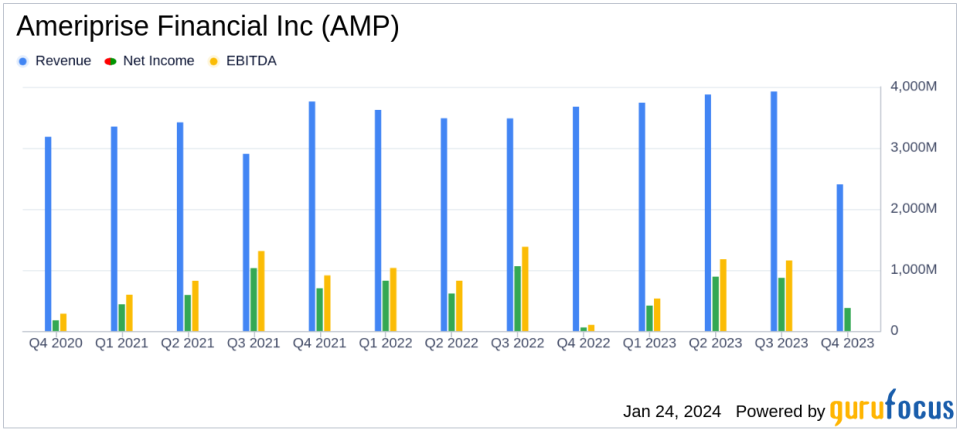

Adjusted Operating Earnings: Increased to $761 million in Q4, up 4% year-over-year.

Adjusted Operating EPS: Grew by 14% to $7.75, adjusted for specific expenses.

Assets Under Management and Administration: Reached $1.4 trillion, marking a 15% increase.

Free Cash Flow: Strong generation enabled $587 million return of capital to shareholders in Q4.

GAAP Net Income: Declined to $377 million in Q4, a 42% decrease from the previous year.

Return on Equity: GAAP ROE at 39.9%, with Adjusted Operating ROE at 48.5%.

On January 24, 2024, Ameriprise Financial Inc (NYSE:AMP) released its 8-K filing, disclosing its financial results for the fourth quarter of 2023. The company, a leading asset and wealth management firm in the U.S., reported a significant increase in adjusted operating earnings per diluted share (EPS), which grew by 14% to $7.75 when adjusted for specific expenses. This performance underscores the company's robust financial health and its ability to navigate market cycles effectively.

Ameriprise Financial has approximately $1.3 trillion in total assets under management and advisement, with a strong presence in the asset and wealth management sectors, contributing to around 80% of its revenue. The company has strategically reduced its insurance exposure, focusing more on its core wealth management services. The majority of Ameriprise Financial's pretax earnings are generated within the United States, reflecting its significant domestic market influence.

Financial Performance and Challenges

The company's adjusted operating net revenues saw an 8% increase, driven by organic growth and higher spread revenues. Ameriprise Financial's assets under management and administration swelled to $1.4 trillion, a testament to strong client net inflows and market appreciation. Despite a challenging environment, the company managed general and administrative expenses effectively, with only a 6% increase, or a mere 2% when excluding specific items.

However, GAAP net income per diluted share for Q4 was $3.57, a significant decrease from $5.83 a year ago, primarily due to market impacts on the valuation of derivatives and market risk benefits. This decline illustrates the volatility and risks inherent in the financial markets, which can affect the company's performance.

Financial Achievements

Ameriprise Financial's financial achievements are particularly noteworthy in the asset management industry, where managing expenses and maximizing returns are crucial. The company's pretax adjusted operating margin stood at 24.8%, or 26.4% excluding specific items, highlighting its efficiency and profitability. The adjusted operating return on equity was a robust 48.5%, reflecting the company's ability to generate earnings from its equity base.

Moreover, the company's strong free cash flow generation allowed for significant capital return to shareholders, with $587 million returned in the quarter and $2.5 billion for the full year. This level of shareholder return is indicative of Ameriprise Financial's financial strength and commitment to delivering value to its investors.

Key Financial Metrics

Key financial metrics from Ameriprise Financial's earnings report include:

"Fourth quarter adjusted operating earnings per diluted share was $7.20. Adjusted operating EPS grew 14 percent to $7.75 adjusted for $0.28 of expense related to a regulatory accrual, $0.14 from severance expense, and $0.13 from mark-to-market impacts on share-based compensation expense resulting from the company's share price appreciation in the quarter."

This adjusted EPS growth is a critical metric for Ameriprise Financial, as it reflects the company's operational efficiency and profitability. Additionally, the company's total client assets increased by 19% to $901 billion, and total client net flows surged by 83% to $22.7 billion, indicating strong market trust and client engagement.

Analysis of Company's Performance

Ameriprise Financial's performance in the fourth quarter of 2023 demonstrates its resilience and strategic focus. The company's ability to grow its adjusted operating earnings and EPS amidst market challenges is commendable. Its disciplined expense management and targeted growth investments have positioned it well for continued success in the future.

Chairman and Chief Executive Officer Jim Cracchiolo commented on the company's performance:

"Ameriprise delivered another strong quarter and record operating results in 2023. We're executing well, serving clients' needs and outperforming across market cycles. Our complementary businesses drove significant revenue and earnings growth, as well as strong free cash flow that we consistently invest in the business and return to shareholders at a differentiated rate. In 2024, we continue to be well-positioned, thanks to our compelling value propositions, growth investments and effective expense management."

As Ameriprise Financial continues to navigate the financial landscape, its focus on client service, operational efficiency, and shareholder value remains clear. The company's strategic decisions and financial results are likely to keep it at the forefront of the asset management industry.

For a detailed analysis of Ameriprise Financial Inc (NYSE:AMP)'s earnings and to stay updated on the company's future performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Ameriprise Financial Inc for further details.

This article first appeared on GuruFocus.