Ameris Bancorp (ABCB) Reports Full Year and Q4 2023 Financial Results

Net Income: $269.1 million for FY 2023, down from $346.5 million in FY 2022.

Adjusted Net Income: $276.3 million for FY 2023, compared to $329.4 million in FY 2022.

Diluted EPS: $3.89 for FY 2023, a decrease from $4.99 in FY 2022.

Net Interest Income: Increased to $838.8 million in FY 2023 from $804.9 million in FY 2022.

Net Interest Margin: Declined to 3.61% in FY 2023 from 3.76% in FY 2022.

Noninterest Income: Decreased by 14.6% to $242.8 million in FY 2023.

Loan Growth: Net loans increased by 2.1% to $20.27 billion at the end of FY 2023.

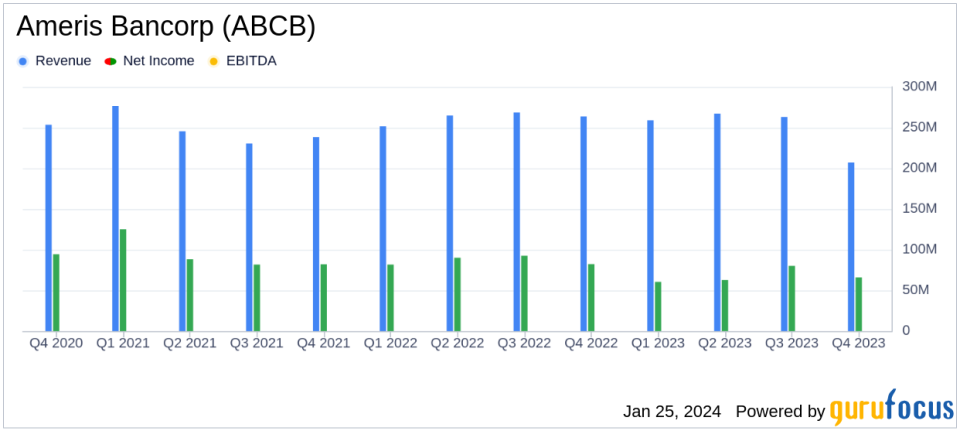

On January 25, 2024, Ameris Bancorp (NASDAQ:ABCB) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The bank holding company, which operates Ameris Bank and has branches across the Southeast, reported a decrease in net income for both the quarter and the full year when compared to the previous year. Despite the challenges, CEO Palmer Proctor highlighted the company's growth in tangible book value and a strengthened balance sheet.

Financial Performance

Ameris Bancorp's net income for the fourth quarter was $65.9 million, or $0.96 per diluted share, a decrease from $82.2 million, or $1.18 per diluted share, for the same period in 2022. Adjusted net income for the quarter was $73.6 million, or $1.07 per diluted share, compared to $81.1 million, or $1.17 per diluted share, in the prior year. The adjusted figures exclude certain non-recurring items such as merger and conversion charges and gains on sales of assets.

For the full year, net income was reported at $269.1 million, or $3.89 per diluted share, down from $346.5 million, or $4.99 per diluted share, in 2022. Adjusted net income for the year was $276.3 million, or $4.00 per diluted share, compared to $329.4 million, or $4.75 per diluted share, in the previous year.

Income Statement and Balance Sheet Highlights

The bank's net interest income on a tax-equivalent basis for 2023 increased to $838.8 million, up from $804.9 million in 2022. However, the net interest margin decreased to 3.61% for 2023 from 3.76% in 2022. The increase in net interest income is primarily attributable to the deployment of excess liquidity in the loan and securities portfolios during the year.

Noninterest income decreased by 14.6% to $242.8 million for the full year 2023, primarily due to decreased mortgage banking activity. Noninterest expense for the full year increased by 3.1% to $578.3 million, compared to $560.7 million in 2022.

On the balance sheet, total assets were $25.20 billion as of December 31, 2023, with loans, net of unearned income, increasing by 2.1% to $20.27 billion. Total deposits grew to $20.71 billion, representing 97.0% of total funding.

Credit Quality and Capital Adequacy

Credit quality remains strong, with the provision for credit losses at $23.0 million for the fourth quarter of 2023. Nonperforming assets as a percentage of total assets increased slightly to 0.69%. Shareholders equity totaled $3.43 billion at the end of 2023, an increase from the previous year, with tangible book value per share growing to $33.64.

Proctor expressed confidence in the company's positioning for 2024, emphasizing disciplined growth and strong financial results in the Southeastern markets.

For a more detailed analysis and to view the full financial tables, visit the 8-K filing on the SEC website.

For more information, contact Nicole S. Stokes, Chief Financial Officer, at (404) 240-1514.

Explore the complete 8-K earnings release (here) from Ameris Bancorp for further details.

This article first appeared on GuruFocus.