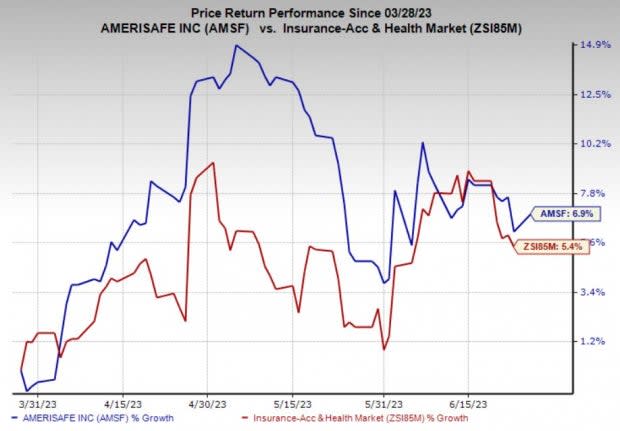

AMERISAFE (AMSF) Jumps 6.9% in 3 Months: More Growth Ahead?

AMERISAFE, Inc. AMSF shares have gained 6.9% in the past three months compared with the 5.4% rise of the industry it belongs to, thanks to improving operations, rising investment yields and net premiums written. AMSF’s efficient management and a favorable business scenario have created prudent investment opportunities.

Based in Deridder, LA, AMERISAFE is a specialty provider of workers’ compensation insurance. It has a market cap of $999.5 million.

Image Source: Zacks Investment Research

Can it Retain Momentum?

The answer is yes and before we get into the details, let us show you how its estimates for 2023 stand.

The Zacks Consensus Estimate for AMSF’s 2023 earnings is pegged at $2.91 per share, which has improved 7.4% in the past 60 days. It has witnessed three upward estimate revisions during this time against no movement in the opposite direction. The company beat earnings estimates in all the last four quarters, with an average of 24%.

Furthermore, the consensus estimate for 2023 revenues stands at $303.8 million, signaling a 1.5% year-over-year rise.

Now let’s delve into what’s driving this Zacks Rank #2 (Buy) stock.

Investors expect the high interest rate environment to continue boosting AMSF’s investment income. It recorded a net investment income of $7.4 million in the first quarter of 2023, which increased from $6.1 million a year ago due to growing yields on fixed-income and cash securities. Our estimate for the metric for 2023 indicates 10.5% year-over-year growth.

A disciplined risk selection approach is maintained by AMERISAFE, which has clients in hazardous industries. This helps the company fetch higher premiums while minimizing losses. Its loss & loss adjustment expenses as a portion of gross premiums written are on the decline, which will boost its profitability.

AMERISAFE’s return on equity of 16.9% is higher than the industry average of 15.2%. This reflects efficient utilization of shareholders’ money by the company. Its focus on deploying capital back to shareholders is also commendable. This February, the company hiked its quarterly dividend by 9.7%. Its dividend yield of 2.6% is higher than the industry average of 2.5%.

The company’s shareholder-friendly moves are supported by a strong balance sheet with no debt, which provides plenty of financial flexibility. AMERISAFE exited the first quarter with cash and cash equivalents of $41.2 million. Also, over the trailing 12-month period, free cash flow increased 25.2% to around $33 million.

Risks

Despite the upside potential, there are a few factors that investors should keep an eye on. For example, product concentration risks and declining operating revenues can affect the company. Nevertheless, we believe that a systematic and strategic plan of action will drive the company’s long-term growth.

Other Key Picks

Some other top-ranked stocks in the broader finance space are Unum Group UNM, Assurant, Inc. AIZ and Old Republic International Corporation ORI, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Chattanooga, TN-based Unum is a global financial protection benefit solutions provider. The Zacks Consensus Estimate for UNM’s current year earnings signals 20.6% year-over-year growth.

Based in Atlanta, GA, Assurant is a global risk management solutions provider. The Zacks Consensus Estimate for AIZ’s current year earnings indicates a 22.1% year-over-year increase.

Headquartered in Chicago, Old Republic International has insurance underwriting business and related services. The Zacks Consensus Estimate for ORI’s 2023 earnings has improved 9.1% over the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Unum Group (UNM) : Free Stock Analysis Report

AMERISAFE, Inc. (AMSF) : Free Stock Analysis Report

Old Republic International Corporation (ORI) : Free Stock Analysis Report