AMERISAFE (AMSF) to Post Q3 Earnings: What's in the Cards?

AMERISAFE, Inc. AMSF is slated to report its third-quarter 2023 results on Oct 25, after the closing bell. The company’s earnings beat estimates in the last reported quarter.

What Do the Estimates Say?

The Zacks Consensus Estimate for third-quarter earnings per share (EPS) of 64 cents indicates a 12.3% decrease from the year-ago quarter’s reported earnings of 73 cents. The consensus estimate has witnessed no movement in the past week.

The Zacks Consensus Estimate for third-quarter revenues is pegged at around $75 million, suggesting an increase of 0.2% from the year-ago quarter’s reported figure.

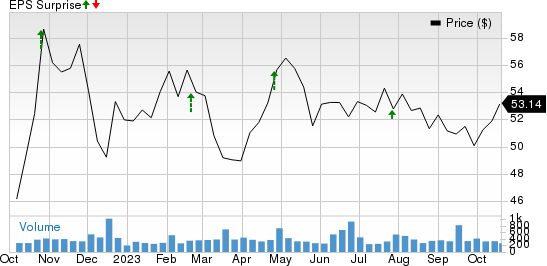

AMERISAFE’s earnings beat estimates in each of the trailing four quarters, the average being 21.7%. This is depicted in the graph below.

AMERISAFE, Inc. Price and EPS Surprise

AMERISAFE, Inc. price-eps-surprise | AMERISAFE, Inc. Quote

Before we get into what to expect for the to-be-reported quarter in detail, it is worth looking at AMSF’s previous-quarter performance.

Q2 Earnings Rewind

AMERISAFE reported second-quarter 2023 adjusted EPS of 73 cents, which outpaced the Zacks Consensus Estimate by 5.8%. The bottom line improved 7.4% year over year. The quarterly results were affected by declining rates in the insurance market, leading to a deteriorating top line. However, the negatives were partially offset by improving the net combined ratio and expenses.

Now let’s see how things have shaped up before the third-quarter earnings announcement.

Factors to Note

The top line of AMERISAFE is expected to have benefited from improving audit premiums, net investment income, fees and other income. While continued rate decreases and slowing of wage inflation might have pressured the net premiums earned in the third quarter, improving audit premiums would have come as a respite, partially offsetting the negatives.While the Zacks Consensus Estimate implies a 1.2% decline in net premiums earned, our estimate predicts a 2.1% decline in net earned premiums in the third quarter, year over year.

The company expects market dynamics to remain tough as competitive pressures and declining rates hurt the results. However, given its vast experience as a provider of workers’ compensation insurance in hazardous industries and a disciplined risk selection approach, it is expected to retain policyholders and attract new business.

Net investment income is expected to gain from higher income from higher yields on fixed maturity securities and cash and cash equivalents. The Zacks Consensus Estimate implies an 11.3% increase in net investment income, while our estimate suggests a 10% rise in the third-quarter figure, year over year. The Zacks Consensus Estimate for fees and other income implies growth of 30% year over year in the third quarter.

Nevertheless, it is probable that increased costs and expenses have impacted the profit margins in the third quarter, introducing uncertainty regarding the potential for surpassing earnings expectations. Our expectation for total underwriting and other operating costs stands at $20.3 million, implying an increase of 3.6% from the year-ago quarter.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for AMERISAFE this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP: The company has an Earnings ESP of 0.00%. The Most Accurate Estimate is currently pegged at 64 cents per share, in line with the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: AMERISAFE currently carries a Zacks Rank #3.

Stocks to Consider

While an earnings beat looks uncertain for AMERISAFE, here are some companies from the broader Finance space that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around:

Arch Capital Group Ltd. ACGL has an Earnings ESP of +1.37% and is a Zacks #2 Ranked player. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for ACGL’s bottom line for the to-be-reported quarter is pegged at $1.48 per share. The consensus estimate for ACGL’s revenues is pegged at $3.4 billion, suggesting a 30.3% increase from a year ago.

Brown & Brown, Inc. BRO has an Earnings ESP of +4.92% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Brown & Brown’s bottom line for the to-be-reported quarter is pegged at 61 cents per share, indicating 22% year-over-year growth. The estimate remained stable over the past week. BRO beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 4%.

The Hartford Financial Services Group, Inc. HIG has an Earnings ESP of +1.61% and a Zacks Rank of 2.

The Zacks Consensus Estimate for Hartford Financial’s bottom line for the to-be-reported quarter is pegged at $1.95 per share, suggesting a 35.4% year-over-year increase. HIG beat earnings estimates in three of the past four quarters and met once, with an average surprise of 9.4%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

AMERISAFE, Inc. (AMSF) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report