AMERISAFE (AMSF) to Post Q4 Earnings: Here's What to Expect

AMERISAFE, Inc. AMSF is set to report its fourth-quarter 2022 results on Feb 20, after the closing bell.

In the last reported quarter, the specialty insurance provider reported adjusted operating earnings per share of 73 cents, beating the Zacks Consensus Estimate by 25.9% due to higher premiums and net investment income. However, the positives were partially offset by an elevated expense level, lower fees, and other income. The market value of its bond portfolio took a hit in the last reported quarter.

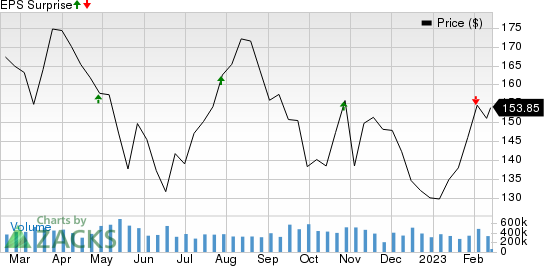

Earnings Surprise History

AMERISAFE’s earnings beat the consensus estimate in three of the prior four quarters and missed once. This is depicted in the graph below:

Let’s see how things have shaped up prior to the fourth-quarter earnings announcement.

AMERISAFE, Inc. Price and EPS Surprise

AMERISAFE, Inc. price-eps-surprise | AMERISAFE, Inc. Quote

Factors to Note

The Zacks Consensus Estimate for fourth-quarter fees and other income indicates 50% year-over-year growth. The increased interest rate environment is expected to have helped AMERISAFE generate higher returns from its investments. The consensus estimate for net investment income indicates an 8% year-over-year increase while our estimate suggests close to 3% growth.

Also, the net loss ratio is expected to have improved in the quarter under review. The consensus estimate for the metric is pegged at 60% for the fourth quarter while our estimate is pegged at 60.6%, both suggesting a significant improvement from 87.4% a year ago. This is likely to have aided AMERISAFE’s margins.

The Zacks Consensus Estimate for fourth-quarter earnings per share of 65 cents has witnessed no movement in the past week while our estimate is pegged at 62 cents. The estimated figures project massive improvement from the prior-year reported break-even earnings.

However, the Zacks Consensus Estimate for net premiums earned indicates a 1.1% year-over-year decline for the fourth quarter while our estimate predicts a 2.9% fall. This is expected to have affected revenues. The Zacks Consensus Estimate for AMERISAFE’s fourth-quarter revenues of $73.6 million indicates a 0.4% decrease from the year-ago reported figure of $73.9 million.

Moreover, the consensus mark for fourth-quarter expense ratio is pegged at 26.9%, predicting a rise from 24.7% a year ago, making an earnings beat uncertain.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for AMERISAFE this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP: The company has an Earnings ESP of 0.00%. The Most Accurate Estimate is currently pegged at 65 cents per share, in line with the Zacks Consensus Estimate.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: AMERISAFE currently carries a Zacks Rank #3.

Stocks to Consider

While an earnings beat looks uncertain for AMERISAFE, here are some companies in the broader Finance space that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around:

AssetMark Financial Holdings, Inc. AMK has an Earnings ESP of +2.30% and is a Zacks #2 Ranked player. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for AssetMark Financial’s bottom line for the to-be-reported quarter is pegged at 44 cents per share, implying a 33.3% improvement from the year-ago figure. AMK beat earnings estimates in three of the past four quarters and missed on the other occasion, with an average surprise of 6.1%.

Broadstone Net Lease, Inc. BNL has an Earnings ESP of +3.54% and a Zacks Rank of 2.

The Zacks Consensus Estimate for Broadstone Net Lease’s bottom line for the to-be-reported quarter is pegged at 38 cents per share, which suggests an 11.8% improvement from the year-ago figure. BNL witnessed one upward estimate revision against none in the opposite direction, in the past 30 days.

Monroe Capital Corporation MRCC has an Earnings ESP of +5.00% and a Zacks Rank of 2.

The Zacks Consensus Estimate for Monroe Capital’s bottom line for the to-be-reported quarter is pegged at 27 cents per share, indicating an 8% year-over-year rise. MRCC beat earnings estimates in one of the past four quarters and met on three other occasions, with an average surprise of 4%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AMERISAFE, Inc. (AMSF) : Free Stock Analysis Report

Monroe Capital Corporation (MRCC) : Free Stock Analysis Report

AssetMark Financial Holdings, Inc. (AMK) : Free Stock Analysis Report

Broadstone Net Lease, Inc. (BNL) : Free Stock Analysis Report