AMERISAFE (AMSF) Q3 Earnings Miss on Lower Premiums Earned

AMERISAFE, Inc. AMSF reported third-quarter 2023 adjusted earnings per share (EPS) of 61 cents, which missed the Zacks Consensus Estimate by 4.7%. The bottom line declined 16.4% year over year.

Operating revenues deteriorated 0.1% year over year to $74.8 million. The top line missed the consensus mark by 0.2%.

The weak third-quarter earnings were caused by lower net premiums earned and higher expenses. An increased combined ratio indicates lower profitability. However, the negatives were partially offset by increased net investment income.

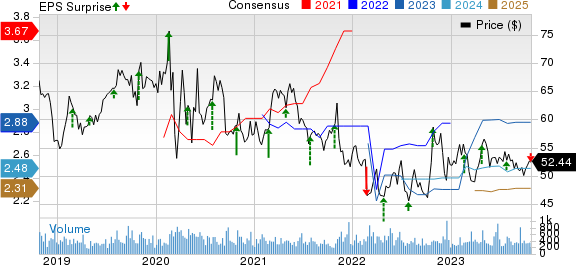

AMERISAFE, Inc. Price, Consensus and EPS Surprise

AMERISAFE, Inc. price-consensus-eps-surprise-chart | AMERISAFE, Inc. Quote

Q3 Performance

Net premiums earned by AMERISAFE amounted to $66.6 million, which decreased 1.7% year over year in the third quarter. The figure missed the Zacks Consensus Estimate by 0.7%.

Net investment income of $8.1 million increased 16.1% year over year due to growing yields on fixed-income and cash securities. The figure beat the consensus estimate by 4%.

Fees and other income declined 26% year over year and missed the consensus mark by 42.2%.

AMERISAFE’s pre-tax underwriting profit of $6.3 million plunged 35.9% year over year.

Total expenses increased 4.1% year over year to $60.3 million in the third quarter, attributable to higher underwriting and other operating costs and policyholder dividends.

The net combined ratio of 90.6% increased from 85.4% a year ago and was higher than our estimate of 89.5% due to an increased net underwriting expense ratio.

Financial Update (as of Sep 30, 2023)

AMERISAFE exited the third quarter with cash and cash equivalents of $59.2 million, which decreased from $61.5 million at 2022-end.

Total assets of $1,296.6 million increased from $1,269.3 million at 2022-end.

Shareholders' equity rose from $317.4 million at 2022-end to $335.9 million in the third quarter.

Book value per share tumbled 10.1% year over year to $17.51 in the third quarter.

Return on average equity decreased 20 bps year over year to 11.8% in the quarter under review.

Dividend Update

Its board of directors declared a quarterly cash dividend of 34 cents per share. The dividend will be paid out on Dec 15, 2023, to its shareholders of record as of Dec 1. It also declared a special dividend of $3.50 per share, payable on the same date as the regular dividend.

Zacks Rank & Key Picks

AMERISAFE currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Finance space are Trupanion, Inc. TRUP, Employers Holdings, Inc. EIG and Aflac Incorporated AFL, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Trupanion’s current year earnings has improved by a penny in the past 30 days. It beat earnings estimates twice in the past four quarters and missed on two occasions. Also, the consensus mark for TRUP’s revenues in 2023 suggests 20.1% year-over-year growth.

The consensus mark for Employers Holdings’ current year earnings indicates a 17.1% year-over-year increase. It beat earnings estimates in each of the past four quarters, with an average surprise of 26.5%. Furthermore, the consensus estimate for EIG’s revenues in 2023 suggests 20.5% year-over-year growth.

The Zacks Consensus Estimate for Aflac’s current year earnings indicates 13% year-over-year growth. In the past 30 days, AFL has witnessed three upward estimate revisions against none in the opposite direction. It beat earnings estimates in each of the past four quarters, with an average surprise of 7.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Aflac Incorporated (AFL) : Free Stock Analysis Report

AMERISAFE, Inc. (AMSF) : Free Stock Analysis Report

Employers Holdings Inc (EIG) : Free Stock Analysis Report

Trupanion, Inc. (TRUP) : Free Stock Analysis Report