AMERISAFE (AMSF) Shares Fall 5.2% Despite Q2 Earnings Beat

AMERISAFE, Inc. AMSF shares lost 5.2% since it reported second-quarter 2023 results on Jul 27. The quarterly results were affected by declining rates in the insurance market, leading to a deteriorating top line. However, the negatives were partially offset by improving the net combined ratio and expenses.

AMSF reported second-quarter 2023 adjusted earnings per share (EPS) of 73 cents, which outpaced the Zacks Consensus Estimate by 5.8%. The bottom line improved 7.4% year over year.

Operating revenues deteriorated 4.4% year over year to $73.5 million. The top line missed the consensus mark by 2.4%.

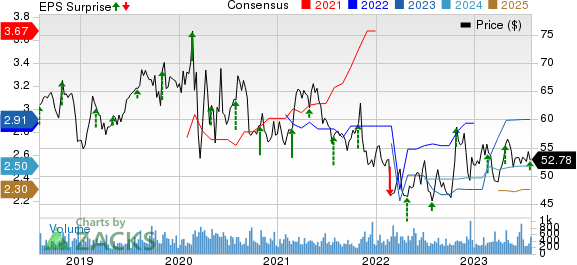

AMERISAFE, Inc. Price, Consensus and EPS Surprise

AMERISAFE, Inc. price-consensus-eps-surprise-chart | AMERISAFE, Inc. Quote

Q2 Performance

Net premiums earned by AMERISAFE amounted to $65.6 million, which decreased 6.7% year over year in the second quarter. Declining rates in the insurance market due to competitive pressures led to the deterioration of the top line. The figure missed our estimate by 1.1%.

Net investment income of $7.7 million increased 19.1% year over year due to growing yields on fixed-income and cash securities. The figure beat our estimate by 8.5%.

Fees and other income climbed 58.5% year over year to $0.2 million in the quarter under review, matching our estimate.

AMERISAFE’s pre-tax underwriting profit of $9.5 million improved 1.5% year over year.

Total expenses decreased 7.9% year over year to $56.1 million in the second quarter, attributable to lower loss and loss adjustment expenses incurred and policyholder dividends. The figure lagged our estimate by 1.1%.

The net combined ratio of 85.4% improved 130 basis points (bps) year over year. The figure was better than our estimate of 85.5%.

Financial Update (as of Jun 30, 2023)

AMERISAFE exited the second quarter with cash and cash equivalents of $33.9 million, which decreased from $61.5 million at 2022-end.

Total assets of $1,298.9 million increased from $1,269.3 million at 2022-end.

Shareholders' equity rose 7.3% from 2022-end to $340.6 million in the second quarter.

Book value per share tumbled 11% year over year to $17.76 in the second quarter.

Return on average equity improved 1230 bps year over year to 18.6% in the quarter under review.

Dividend Update

On Jul 25, 2023, its board of directors declared a quarterly cash dividend of 34 cents per share. The dividend will be paid out on Sep 22, 2023, to its shareholders of record as of Sep 8.

Zacks Rank

AMERISAFE currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Other Finance Sector Releases

Of the other Finance sector players that have reported second-quarter results so far, the bottom-line results of Synchrony Financial SYF, American Express Company AXP and Morgan Stanley MS beat the respective Zacks Consensus Estimate.

Synchrony Financial reported second-quarter 2023 adjusted EPS of $1.32, which beat the Zacks Consensus Estimate of $1.22. However, the bottom line plunged 17.5% year over year. Net interest income of SYF improved 8.4% year over year to $4,120 million, beating the consensus mark by 0.6%.

Other income of Synchrony Financial amounted to $61 million, which dropped 69.2% year over year in the second quarter. Total loan receivables grew 14.7% year over year to $94.8 billion. The purchase volume advanced 0.1% year over year to $47,276 million in the second quarter.

American Express reported second-quarter 2023 EPS of $2.89, beating the Zacks Consensus Estimate by 3.2%. The bottom line increased 12.5% year over year. For the quarter under review, AXP’s total revenues, net of interest expense, increased 12.4% year over year to $15,054 million.

However, the top line missed the consensus estimate by 2.3%. Network volumes jumped 8% year over year to $426.6 billion in the second quarter. Total interest income was $4,775 million in the second quarter, up 71% year over year. The International Card Services segment recorded a pre-tax income of $253 million, up 38% from a year ago.

Morgan Stanley’s second-quarter 2023 EPS of $1.24 surpassed the Zacks Consensus Estimate of $1.14. However, the bottom line reflects a decline of 11% from the year-ago quarter. Net revenues were $13.46 billion, up 2% from the prior-year quarter.

The top line beat the consensus estimate of $12.76 billion. While equity and fixed income underwriting fees increased 52% and 21%, respectively, from the prior-year quarter, advisory fees declined 24%. Therefore, total investment banking fees increased only marginally from the prior-year quarter. Fixed-income trading revenues of MS decreased 31%, and equity trading income declined 14% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Morgan Stanley (MS) : Free Stock Analysis Report

American Express Company (AXP) : Free Stock Analysis Report

AMERISAFE, Inc. (AMSF) : Free Stock Analysis Report

Synchrony Financial (SYF) : Free Stock Analysis Report