AMERISAFE Inc Reports Solid Year-End Financials with 20.4% ROE

Net Income: $62.1 million for the year, an 11.7% increase from the previous year.

Return on Equity (ROE): Strong performance with a 20.4% ROE for 2023.

Net Combined Ratio: Maintained at an efficient 85.9% for the year.

Gross Premiums Written: Increased by 8.4% in Q4 and 3.3% year-over-year.

Net Investment Income: Grew by 15.1% to $31.3 million in 2023.

Dividend Increase: Quarterly dividend raised by 8.8% to $0.37 per share.

Share Repurchase: $2.2 million worth of shares repurchased in Q4 2023.

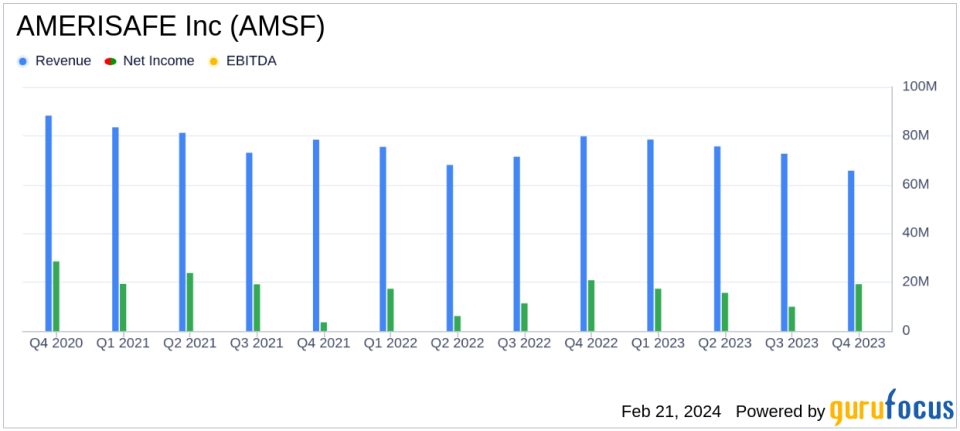

On February 21, 2024, AMERISAFE Inc (NASDAQ:AMSF), a specialty provider of workers' compensation insurance for high-hazard industries, released its 8-K filing, disclosing its financial results for the fourth quarter and the full year ended December 31, 2023. The company's performance highlights include a modest decrease in net premiums earned, a significant increase in net investment income, and a solid return on equity (ROE) of 20.4% for the year.

AMERISAFE's core business revolves around providing workers' compensation insurance to employers in hazardous industries such as construction, trucking, manufacturing, oil and gas, and agriculture. The company's revenue is primarily derived from insurance premiums.

Financial Performance and Challenges

For the year 2023, AMERISAFE reported a slight decrease in net premiums earned by 1.7% to $267.1 million, compared to $271.7 million in the previous year. However, the company's net investment income saw a notable increase of 15.1%, amounting to $31.3 million. This growth in investment income is crucial for an insurance company like AMERISAFE, as it supplements the income generated from underwriting activities, thereby enhancing profitability.

Despite the challenges of a competitive insurance market and economic fluctuations, AMERISAFE managed to achieve a net income of $62.1 million, an 11.7% increase from the previous year. This performance underscores the company's ability to maintain profitability and deliver value to shareholders, even in a challenging environment. However, the company did face a decrease in operating net income by 5.6% to $55.9 million, reflecting the competitive pressures and operational challenges in the industry.

Key Financial Metrics

The company's disciplined underwriting approach is reflected in its net combined ratio, which remained efficient at 85.9% for the year. The net combined ratio is a critical metric for insurance companies, indicating the profitability of their underwriting operations. A ratio below 100% signifies that the company is underwriting profitably.

AMERISAFE's financial strength is further evidenced by its return on average equity (ROAE), which stood at a robust 20.4% for the full year. This metric is important as it measures how effectively the company is using its equity to generate profits.

AMERISAFE's balance sheet remains strong, with a book value per share of $15.28, despite a 7.8% decrease from the previous year. The company's capital management strategy included the repurchase of 46,741 shares for a total of $2.2 million during the fourth quarter, demonstrating confidence in its stock value.

G. Janelle Frost, President and CEO of AMERISAFE, stated, "The Company's disciplined approach resulted in gross premium written growth of 8.4% and a combined ratio of 85.5% for the fourth quarter, and a 20.4% ROAE for the full year. Our capital strength and approach to the high-hazard workers compensation market position AMERISAFE for solid performance and ability to create long-term shareholder value into the future."

Investment and Capital Management Highlights

The company's investment results were also strong, with net realized gains on investments before tax increasing by 91.3% to $6.6 million for the year. Additionally, AMERISAFE reported net unrealized gains on equity securities, which contrasts sharply with the losses experienced in the previous year.

In terms of capital management, AMERISAFE continued its shareholder-friendly activities by increasing its regular quarterly dividend by 8.8% to $0.37 per share, reflecting its commitment to returning value to shareholders.

In conclusion, AMERISAFE's 2023 financial results demonstrate the company's resilience and strategic management in a challenging market. With a solid ROE, efficient combined ratio, and strong investment performance, AMERISAFE is well-positioned for future growth and profitability.

For more detailed information and to join the upcoming conference call discussing these results, investors and interested parties can refer to the official press release and supplemental information provided by AMERISAFE.

Explore the complete 8-K earnings release (here) from AMERISAFE Inc for further details.

This article first appeared on GuruFocus.