AMETEK (AME) Q2 Earnings Show Electronics Instruments Strength

AMETEK’s AME latest quarterly results benefited from both its segments, especially the Electronic Instruments Group (EIG). The robust portfolio of advanced analytical, test and measurement instruments for the process, aerospace, medical, research, power and industrial markets continued to drive organic growth within the segment. Positive contributions from strategic acquisitions have also been benefiting EIG for quite some time now.

Strength in EIG: Key Catalyst

In second-quarter 2023, the EIG segment generated sales of $1.135 billion (68.9% of total sales), reflecting growth of 10% year over year. The figure exhibited very strong organic growth of 8%. The reported figure also came ahead of the Zacks Consensus Estimate of $1.131 billion.

A strong demand environment across various end markets drove top-line growth within the segment. Solid momentum across aerospace and defense and ultra-precision technology businesses contributed well.

Growing sales of the company’s instrumentation, systems and sensors for applications in the aerospace market remained a positive. Strength in process and analytical instrumentation, which offers process analyzers, emission monitors, spectrometers, temperature sensors, transmitters and elemental and surface analysis instruments, remained a tailwind.

This apart, acquisitions like Navitar, Alphasense, Magnetrol, RTDS, Abaco Systems, Crank Software and NSI-MI continued to contribute well to EIG sales.

Notably, the segment generated operating margins of 27.1%, which expanded 130 basis points on a year-over-year basis. This was driven by solid execution of the operational drive.

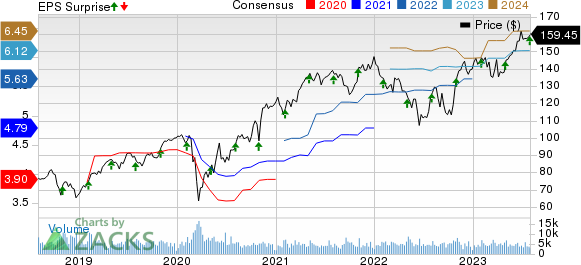

AMETEK, Inc. Price, Consensus and EPS Surprise

AMETEK, Inc. price-consensus-eps-surprise-chart | AMETEK, Inc. Quote

Q2 Result Highlights

In the second quarter, AMETEK reported revenues of $1.65 billion, up 9% year over year, which is within the management’s guidance of mid- to high-single digits sales growth. The figure topped the Zacks Consensus Estimate of $1.64 billion and exhibited organic growth of 5%.

The company’s adjusted earnings of $1.57 per share surpassed the Zacks Consensus Estimate by 3.3% and grew 14% on a year-over-year basis. The bottom line also came above the management’s guided range of $1.49-$1.51.

Zacks Rank & Other Stocks to Consider

AMETEK currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of AME have gained 14.5% on a year-to-date basis.

Some other top-ranked stocks in the broader technology sector are Salesforce CRM, AvidXchange AVDX and Akamai Technologies AKAM, each carrying a Zacks Rank #2.

Salesforce shares have gained 70.7% in the year-to-date period. The long-term earnings growth rate for CRM is currently projected at 19.25%.

AvidXchange shares have increased 21.1% in the year-to-date period. The long-term earnings growth rate for AVDX is currently projected at 22.90%.

Akamai shares have gained 9.5% in the year-to-date period. The long-term earnings growth rate for AKAM is currently projected at 10%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

AvidXchange Holdings, Inc. (AVDX) : Free Stock Analysis Report