AMETEK's (AME) Strength in EIG Segment to Aid Q2 Earnings

AMETEK’s AME second-quarter 2023 results, set to be reported on Aug 1, are expected to reflect strength in the Electronic Instruments Group ("EIG").

EIG, which is an integral part of AMETEK, specializes in manufacturing instruments that are deployed for monitoring, examining, calibration and display purposes in aerospace, power and industrial instrumentation applications.

In first-quarter 2023, AMETEK generated sales of $1.12 billion from the segment (70% of total sales), reflecting growth of 13% from the year-ago quarter’s level.

AMETEK’s concerted efforts toward solid execution of growth strategies are likely to have continued aiding the performance of the underlined segment in the quarter to be reported.

For the second quarter, the Zacks Consensus Estimate of EIG sales is pegged at $1.13 billion, indicating a growth of 10% from the year-ago reported figure.

Click here to know how the company’s overall second-quarter results are expected to be.

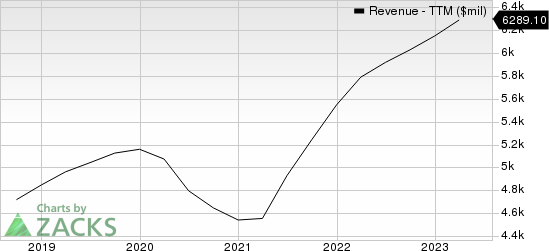

AMETEK, Inc. Revenue (TTM)

AMETEK, Inc. revenue-ttm | AMETEK, Inc. Quote

Factors to Consider

AMETEK’s robust portfolio of instruments for process and analytical measurement and analysis, which includes oxygen, moisture, combustion and liquid analyzers, emission monitors, spectrometers, mechanical and electronic pressure sensors and transmitters, is expected to have contributed well to EIG sales during the second quarter.

The company’s strengthening power business, which provides analytical instruments, might have benefited the underlined segment.

This apart, positive contributions from acquisitions are expected to have driven growth in the EIG segment.

The Magnetrol International and Crank Software buyouts are also anticipated to have contributed well to the EIG segment’s performance in the quarter under review.

The acquisitions of Motec, Forza, Telular, Gatan, Intellipower and Spectro Scientific are expected to have continued benefiting the segment.

Zacks Rank & Other Stocks to Consider

Currently, AMETEK has a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader technology sector are Salesforce CRM, AvidXchange AVDX and Akamai Technologies AKAM. Salesforce and AvidXchange sport a Zacks Rank #1 (Strong Buy), and Akamai Technologies carries a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Salesforce shares have gained 70.7% in the year-to-date period. The long-term earnings growth rate for CRM is projected at 19.25%.

AvidXchange shares have increased 21.1% in the year-to-date period. The long-term earnings growth rate for AVDX is projected at 22.90%.

Akamai shares have gained 9.5% in the year-to-date period. The long-term earnings growth rate for AKAM is projected at 10%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Akamai Technologies, Inc. (AKAM) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

AvidXchange Holdings, Inc. (AVDX) : Free Stock Analysis Report