The AMMO (NASDAQ:POWW) Share Price Has Soared 563%, Delighting Many Shareholders

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. When you find (and hold) a big winner, you can markedly improve your finances. For example, the AMMO, Inc. (NASDAQ:POWW) share price rocketed moonwards 563% in just one year. On top of that, the share price is up 239% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. It is also impressive that the stock is up 97% over three years, adding to the sense that it is a real winner.

We love happy stories like this one. The company should be really proud of that performance!

See our latest analysis for AMMO

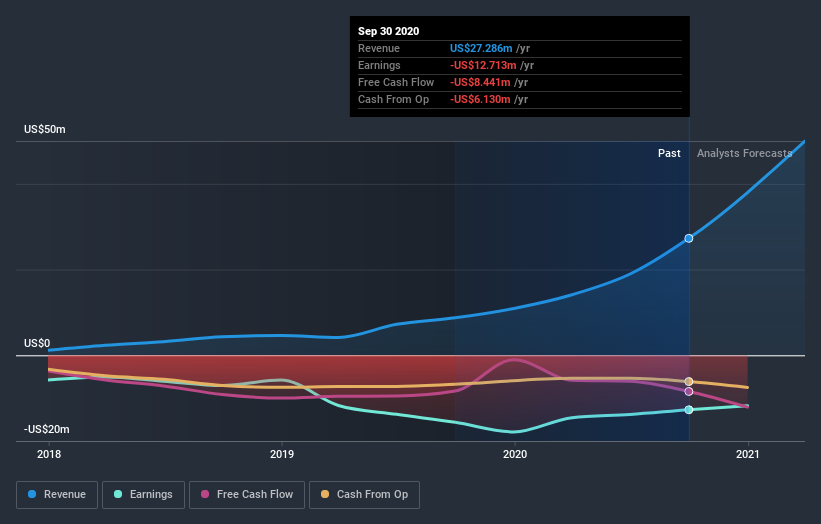

AMMO wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year AMMO saw its revenue grow by 211%. That's stonking growth even when compared to other loss-making stocks. But the share price seems headed to the moon, up 563% as previously highlighted. Even the most bullish shareholders might be thinking that the share price might drop back a bit, after a gain like that. So this looks like a great watchlist candidate for investors who look for high growth inflexion points.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think AMMO will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that AMMO shareholders have gained 563% (in total) over the last year. That's better than the annualized TSR of 25% over the last three years. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for AMMO you should be aware of, and 1 of them can't be ignored.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.