AMN Healthcare (AMN) Q4 Earnings and Revenues Beat Estimates

AMN Healthcare Services, Inc. AMN delivered adjusted earnings per share (EPS) of $1.32 in the fourth quarter of 2023, which declined 46.8% year over year. However, the figure surpassed the Zacks Consensus Estimate by 4.8%.

GAAP EPS for the quarter was 33 cents, reflecting an 82.4% plunge from the year-ago figure.

Full-year adjusted EPS was $8.21, down 31% compared with that at the end of the comparable 2022 period. The figure surpassed the Zacks Consensus Estimate by 0.9%.

Revenues in Detail

AMN Healthcare registered revenues of $818.3 million in the fourth quarter, down 27.3% year over year. However, the figure surpassed the Zacks Consensus Estimate by 1.9%.

Full-year revenues were $3.79 billion, reflecting a 27.7% decline from the comparable 2022 period. The figure, however, topped the Zacks Consensus Estimate by 0.5%.

Segment Details

AMN Healthcare conducts its business via three reportable segments — Nurse and Allied Solutions, Physician and Leadership Solutions and Technology and Workforce Solutions.

In the fourth quarter of 2023, the Nurse and Allied Solutions segment’s revenues totaled $537.6 million, down 34.8% year over year. Travel nurse staffing revenues were down 40% year over year, whereas Allied revenues declined 16% year over year. This figure compares to our Nurse and Allied Solutions segment’s fourth-quarter projection of $538.7 million.

The Physician and Leadership Solutions segment’s revenues totaled $168.2 million, up 0.3% year over year on the back of a 7% uptick in organic locum tenens revenues, which amounted to $123 million (including $13 million from MSDR). Interim leadership revenues were down 35% year over year. Physician and leadership search businesses saw revenue decline by 20% year over year. This figure compares to our Physician and Leadership Solutions segment’s fourth-quarter projection of $145.4 million.

The Technology and Workforce Solutions segment’s revenues totaled $112.5 million, down 15.6% year over year. Language interpretation services business revenues came in at $68 million in the quarter (up 18% year over year), while the vendor management systems business saw a 45% year-over-year revenue decline to reach $31 million. This figure compares to our Technology and Workforce Solutions segment’s fourth-quarter projection of $109.4 million.

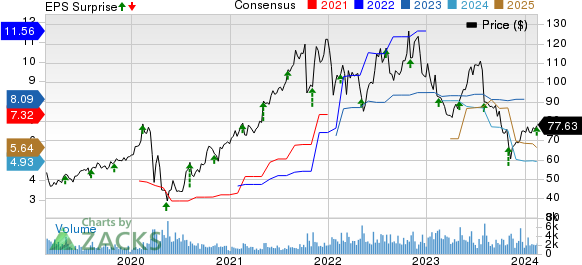

AMN Healthcare Services Inc Price, Consensus and EPS Surprise

AMN Healthcare Services Inc price-consensus-eps-surprise-chart | AMN Healthcare Services Inc Quote

Margin Trend

In the quarter under review, AMN Healthcare’s gross profit fell 30.5% to $260.9 million. The gross margin contracted 145 basis points (bps) to 31.9%.

We had projected 32.4% of gross margin for the fourth quarter.

Selling, general & administrative expenses fell 15.4% to $185.5 million.

Adjusted operating profit totaled $75.5 million, reflecting a 51.6% decline from the prior-year quarter. The adjusted operating margin in the fourth quarter contracted 464 bps to 9.2%.

Financial Position

AMN Healthcare exited 2023 with cash and cash equivalents of $32.9 million compared with $64.5 million at the end of 2022. Total debt at the end of 2023 was $1,310 million compared with $850 million at the end of 2022.

Cumulative net cash provided by operating activities at the end of 2023 was $372.2 million compared with $653.7 million a year ago.

Guidance

AMN Healthcare has provided its financial outlook for the first quarter of 2024.

For the first quarter, the company expects revenues in the range of $810 million-$830 million, reflecting a decline of 26-28% compared with the prior-year figure. The Zacks Consensus Estimate stands at $831.9 million.

With respect to the Nurse and Allied Solutions segment, the company expects revenues to decline 36-38% from the prior-year figure. The Technology and Workforce Solutions segment’s revenues are expected to decline 18-20% from the prior-year figure.

The company projects first-quarter revenues at the Physician and Leadership Solutions segment to increase 11-14% from the prior-year figure.

Our Take

AMN Healthcare exited the fourth quarter of 2023 with better-than-expected results. The uptick in the Physician and Leadership Solutions segment’s revenues, organic locum tenens revenues and Language interpretation services revenues was impressive.

Management confirmed that during the reported quarter, AMN Healthcare continued the tech momentum with Market Insights and Analytics for ShiftWise Flex vendor management and the first mobile apps for ShiftWise Flex and Smart Square scheduling, and AI-empowered self-service in AMN Passport for healthcare professionals. Management also believes that the company’s integrated go-to-market platform and experience are adding momentum to its sales pipeline while also bringing candidate traffic and applicants that exceeded its expectations in the fourth quarter. AMN Healthcare also signed its largest Managed Services Program client win since 2019 and strengthened its capabilities in locum tenens with the acquisition of MSDR during the quarter. These look promising for the stock.

However, AMN Healthcare’s dismal top-line and bottom-line performances were disappointing. The decline in the majority of its segmental revenues during the reported quarter was worrying. The contraction of both margins raises our apprehension about the stock. AMN Healthcare expects to register a decline in its overall top line and the majority of its segments in the first quarter of 2024, which is concerning.

Zacks Rank and Key Picks

AMN Healthcare currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Cencora, Inc. COR, Elevance Health, Inc. ELV and Cardinal Health, Inc. CAH.

Cencora, carrying a Zacks Rank of 2 (Buy), reported first-quarter fiscal 2024 adjusted EPS of $3.28, beating the Zacks Consensus Estimate by 14.7%. Revenues of $72.25 billion outpaced the consensus mark by 5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cencora has a long-term estimated growth rate of 8.6%. COR’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 6.7%.

Elevance Health reported fourth-quarter 2023 adjusted EPS of $5.62, beating the Zacks Consensus Estimate by 1.3%. Revenues of $42.45 billion outpaced the consensus mark by 1.5%. It currently carries a Zacks Rank #2.

Elevance Health has a long-term estimated growth rate of 12%. ELV’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 3.1%.

Cardinal Health reported second-quarter fiscal 2024 adjusted EPS of $1.82, beating the Zacks Consensus Estimate by 16.7%. Revenues of $57.45 billion surpassed the Zacks Consensus Estimate by 1.1%. It currently carries a Zacks Rank #2.

Cardinal Health has a long-term estimated growth rate of 15.2%. CAH’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 15.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report