AMN Healthcare Services Inc Reports Challenging 2023 Amid Industry Reset

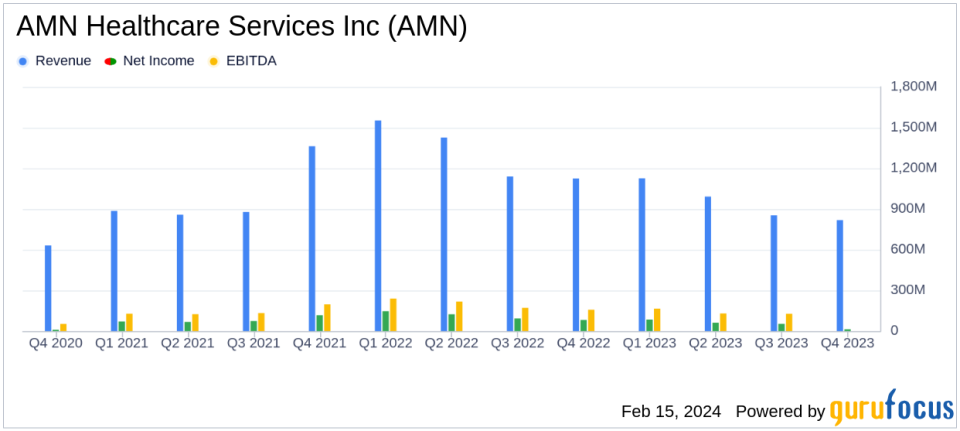

Revenue: $818.3 million in Q4 2023, a 27% decrease from Q4 2022.

Net Income: $12.5 million in Q4 2023, an 85% decrease from the same period last year.

Diluted EPS: $0.33 in Q4 2023, down from $1.88 in Q4 2022.

Adjusted EBITDA: $104.0 million in Q4 2023, a 40% decrease year-over-year.

Full Year Revenue: $3,789.3 million in 2023, a 28% decrease from 2022.

Full Year Net Income: $210.7 million in 2023, a 53% decrease from the previous year.

Adjusted Diluted EPS: $8.21 for the full year 2023, down from $11.90 in 2022.

On February 15, 2024, AMN Healthcare Services Inc (NYSE:AMN) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, a leading healthcare staffing provider in the United States, faced significant headwinds as it navigated what its President and CEO, Cary Grace, described as "the largest cyclical reset of staffing demand in industry history."

AMN Healthcare Services, known for offering a wide range of healthcare staffing services, including temporary nursing, physician placement, and technology-backed workplace solutions, reported a substantial decline in both quarterly and annual revenue and net income. The company's temporary nursing division, which generates two-thirds of its business, saw a particularly sharp decrease in demand.

Financial Performance and Challenges

The fourth quarter of 2023 saw revenues of $818 million, a 27% decrease from the same period in the previous year. Net income plummeted by 85% to $12.5 million, and diluted EPS dropped to $0.33, down from $1.88 in the prior year's quarter. Adjusted diluted EPS was $1.32, a 47% decrease from the year-ago quarter. The full year 2023 results were similarly affected, with revenue down 28% to $3.789 billion and net income down 53% to $210.7 million.

These declines reflect the broader challenges faced by the healthcare staffing industry, including a shift in demand for temporary staffing services. The company's ability to adapt to these changes is crucial for its long-term success and stability.

Segment Performance

The Nurse and Allied Solutions segment experienced a 35% year-over-year revenue decrease, while the Physician and Leadership Solutions segment remained flat compared to the previous year. The Technology and Workforce Solutions segment saw a 16% decline in revenue year over year.

AMN's gross margin also contracted, primarily due to lower margins in the Nurse and Allied Solutions and a decrease in Vendor Management Systems (VMS) revenue. Selling, general, and administrative (SG&A) expenses were reduced year over year, reflecting the company's efforts to manage costs amid lower revenue.

Strategic Initiatives and Outlook

Despite the downturn, AMN Healthcare Services continued to invest in growth opportunities and technology innovations, spending over $100 million in capital expenditures. The company is focusing on consolidating its businesses under the "One AMN" branding and platform initiative, aiming to create a unified, client-centric sales and service organization.

For the first quarter of 2024, AMN expects consolidated revenue to be between $810 and $830 million, with gross margin projected at 31.0% to 31.5%. The company anticipates an operating margin of 4.2% to 4.9% and an adjusted EBITDA margin of 11.2% to 11.7%.

AMN Healthcare Services Inc's performance in 2023 underscores the volatility of the healthcare staffing market and the importance of strategic agility in navigating industry cycles. As the company continues to innovate and adapt, investors and stakeholders will be watching closely to see how these efforts translate into financial results in the coming quarters.

For a more detailed analysis of AMN Healthcare Services Inc's financial results, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from AMN Healthcare Services Inc for further details.

This article first appeared on GuruFocus.