Amneal Pharmaceuticals Inc (AMRX) Reports Mixed 2023 Financial Results

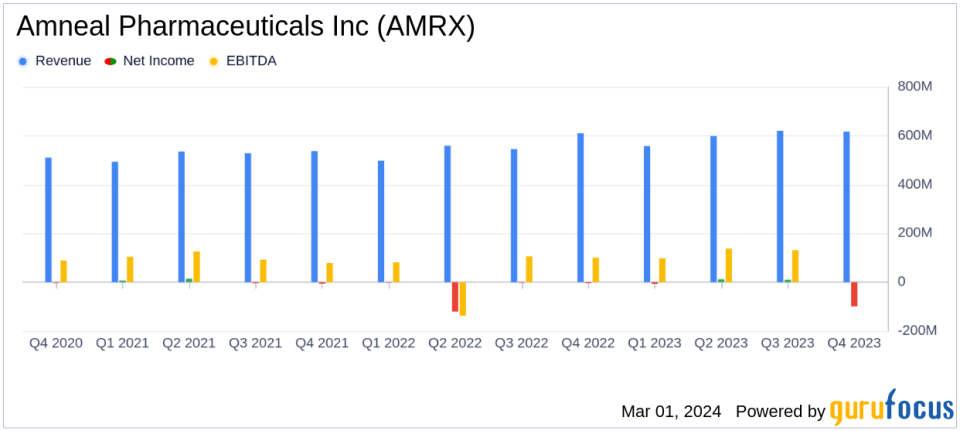

Net Revenue: Increased to $2.39 billion in FY 2023, up 8% from $2.21 billion in FY 2022.

GAAP Net Loss: Reported a net loss of $84 million for FY 2023, an improvement from a net loss of $130 million in FY 2022.

Adjusted EBITDA: Grew to $558 million in FY 2023, a $44 million increase from the previous year.

Adjusted Diluted EPS: Decreased to $0.64 in FY 2023, down from $0.68 in FY 2022.

2024 Financial Guidance: Expects net revenue between $2.55 billion and $2.65 billion and Adjusted EBITDA between $580 million and $620 million.

On March 1, 2024, Amneal Pharmaceuticals Inc (NASDAQ:AMRX) released its 8-K filing, detailing the financial outcomes for the fourth quarter and full year of 2023. The company, a generic pharmaceutical manufacturer with segments in Generic Products, Specialty Products, and AvKARE, reported a slight increase in net revenue for the fourth quarter, reaching $617 million, a 1% rise from the same period in the previous year. However, the company faced a GAAP net loss of $99 million in Q4 2023, primarily due to non-cash intangible asset impairment charges and costs associated with term loan refinancing.

Performance Highlights and Challenges

Amneal's full-year net revenue climbed to $2.39 billion, an 8% increase compared to $2.21 billion in 2022, driven by growth across all business segments. The AvKARE segment saw a significant 31% growth, while Generics and Specialty segments grew by 3% and 4%, respectively. Despite this, the company's GAAP net loss for the year improved to $84 million from a net loss of $130 million in the previous year. Adjusted EBITDA for the year was $558 million, reflecting strong revenue growth and continued operating expense leverage.

However, the company's performance was not without its challenges. The GAAP net loss was attributed to various factors, including non-cash intangible asset impairment charges and costs related to term loan refinancing. Additionally, the company's Adjusted EBITDA in Q4 2023 decreased by 8% due to investments in research and development and commercial efforts to drive future growth. The diluted loss per share for Q4 2023 was $0.40, a significant increase from a loss of $0.03 in the same quarter of the previous year.

Financial Achievements and Industry Significance

Amneal's financial achievements, particularly the growth in net revenue and Adjusted EBITDA, underscore the company's ability to expand and manage its diverse pharmaceutical portfolio effectively. These achievements are critical in the Drug Manufacturers industry, where consistent revenue growth and the ability to invest in R&D are essential for long-term sustainability and competitiveness.

Key Financial Metrics

Important metrics from the financial statements include:

Financial Metric | FY 2023 | FY 2022 |

|---|---|---|

Net Revenue | $2.39 billion | $2.21 billion |

GAAP Net Loss | $84 million | $130 million |

Adjusted EBITDA | $558 million | $514 million |

Adjusted Diluted EPS | $0.64 | $0.68 |

These metrics are important as they provide insights into the company's profitability, operational efficiency, and earnings potential. Adjusted EBITDA and Adjusted Diluted EPS are particularly useful for investors as they exclude one-time charges and non-cash expenses, offering a clearer view of the company's ongoing operational performance.

"Amneal had a very successful year in 2023 as we delivered strong execution and growth across our diversified pharmaceutical business. We are starting 2024 with substantial momentum and key catalysts, including complex high-value products, biosimilars and specialty, to further expand our reach," said Chirag and Chintu Patel, Co-Chief Executive Officers.

2024 Outlook and Analysis

Looking ahead, Amneal provided financial guidance for 2024, projecting net revenue between $2.55 billion and $2.65 billion and Adjusted EBITDA between $580 million and $620 million. This guidance reflects the company's confidence in its growth trajectory and its ability to navigate the challenges of the pharmaceutical industry.

While the GAAP net loss presents a concern, the company's overall growth in revenue and Adjusted EBITDA suggests a strong underlying business capable of overcoming temporary setbacks. The company's focus on expanding its product portfolio, particularly in complex generics and biosimilars, positions it well for future growth amidst a global aging population and significant unmet patient needs.

For a more detailed analysis and to stay updated on Amneal Pharmaceuticals Inc (NASDAQ:AMRX)'s financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Amneal Pharmaceuticals Inc for further details.

This article first appeared on GuruFocus.