Amphastar Pharmaceuticals Inc Reports Robust Revenue Growth and Strong Full-Year Performance

Net Revenues: $178.1 million for Q4 2023, a 32% increase year-over-year.

GAAP Net Income: $36.2 million for Q4 2023, with a notable increase from the previous year.

Adjusted Non-GAAP Net Income: $46.9 million for Q4 2023, reflecting a more comprehensive view of profitability.

GAAP Diluted EPS: $0.68 for Q4 2023, showing earnings growth per share.

Product Revenues: Significant contributions from glucagon and Primatene MIST.

Operating Cash Flow: $183.5 million for the full year, indicating strong cash generation.

Pipeline Development: Multiple ANDAs and biosimilar products in development targeting markets worth billions.

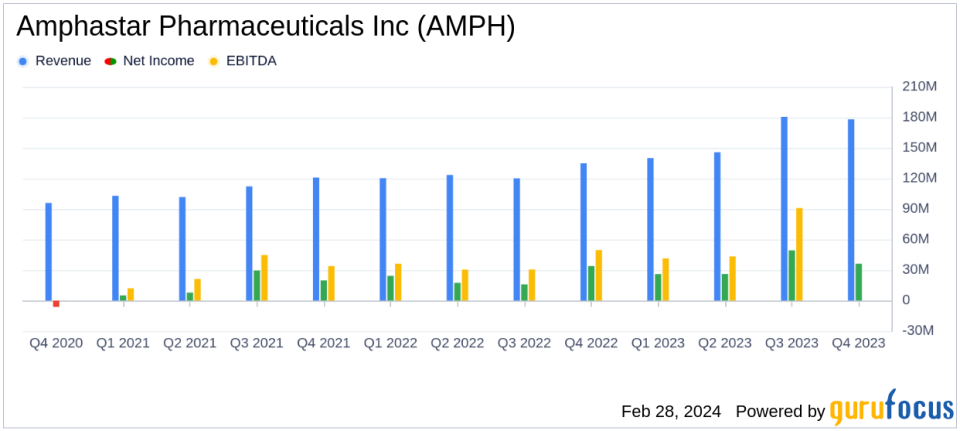

On February 28, 2024, Amphastar Pharmaceuticals Inc (NASDAQ:AMPH) released its 8-K filing, revealing a significant uptick in revenue and earnings for the fourth quarter and full year ended December 31, 2023. The company, known for its complex generic and proprietary injectable, inhalation, and intranasal products, as well as insulin API, reported a 32% increase in net revenues for the quarter, amounting to $178.1 million, and a 29% increase for the full year, totaling $644.4 million.

Financial Performance and Strategic Highlights

Amphastar's financial achievements are underscored by a robust 35% increase in gross profit for Q4, with a gross margin of 54% of net revenues. This performance is attributed to strong sales of glucagon and Primatene MIST, as well as the strategic acquisition of BAQSIMI, which has bolstered the company's diabetes portfolio. The acquisition is expected to further enhance revenue recognition as Amphastar transitions to direct distribution in various countries throughout 2024.

GAAP net income for the fourth quarter stood at $36.2 million, up from the previous year's $33.9 million, while adjusted non-GAAP net income reached $46.9 million, compared to $37.6 million in the prior year. This reflects a solid increase in profitability, with GAAP diluted EPS at $0.68 and adjusted non-GAAP diluted EPS at $0.88 for the quarter.

Operational and Development Milestones

Amphastar's operational cash flow for the year was a strong $183.5 million, indicating the company's ability to generate cash efficiently. The company's pipeline includes four ANDAs and one biosimilar insulin candidate, targeting products with a market size of over $3 billion, and three biosimilar products in development targeting products with a market size of over $10 billion.

Dr. Jack Zhang, Amphastars President and CEO, expressed optimism about the company's trajectory, stating:

"We enter 2024 with strong momentum. 2023 was an important year for the Company driven by the strong performance of glucagon and Primatene MIST alongside the acquisition of BAQSIMI, which strengthened our diabetes portfolio."

Challenges and Outlook

Despite the positive results, Amphastar faces challenges such as market competition and regulatory hurdles. The company's ability to maintain its growth trajectory will depend on the successful commercialization of its pipeline products and the integration of BAQSIMI into its portfolio.

Investors are encouraged to review the reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures provided in the earnings release, which offers a more detailed understanding of the company's financial performance.

For more detailed information on Amphastar Pharmaceuticals Inc's financial results, including the full income statement, balance sheet, and cash flow statement, please refer to the company's 8-K filing.

Value investors and potential GuruFocus.com members interested in following Amphastar Pharmaceuticals Inc's progress can find more resources and information at www.amphastar.com.

Explore the complete 8-K earnings release (here) from Amphastar Pharmaceuticals Inc for further details.

This article first appeared on GuruFocus.