Amplify Energy Corp (AMPY) Reports Q4 and Full-Year 2023 Results, Proved Reserves, and 2024 Outlook

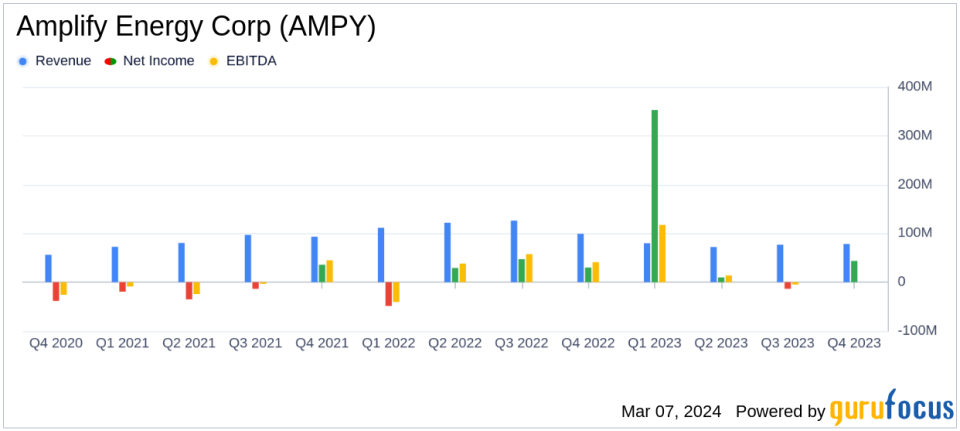

Net Income: Reported a net income of $43.6 million in Q4, a significant improvement from a net loss of $13.4 million in the previous quarter.

Adjusted EBITDA: Increased to $25.2 million in Q4, up from $19.5 million in Q3.

Free Cash Flow: Grew by 136% to $14.4 million in Q4.

Proved Reserves: Estimated at 98 MMBoe at year-end 2023, with a PV-10 value of approximately $757 million using SEC pricing.

Debt Reduction: Reduced debt outstanding by approximately $95 million and established a new credit facility.

Production: Average daily production increased slightly to 20.8 MBoepd in Q4.

2024 Guidance: Projects capital investments of $50 $60 million, focusing on high-return development opportunities.

On March 6, 2024, Amplify Energy Corp (NYSE:AMPY) released its 8-K filing, detailing its financial and operational performance for the fourth quarter and full year of 2023, as well as providing an update on year-end 2023 proved reserves and guidance for the full year of 2024.

Amplify Energy Corp is an independent oil and natural gas company focused on the acquisition, development, exploitation, and production of oil and natural gas properties in the United States. The company's assets are located in Oklahoma, the Rockies, Southern California offshore waters, East Texas/North Louisiana, and the Eagle Ford.

Financial and Operational Highlights

The company's performance in the fourth quarter showed a remarkable turnaround with a net income of $43.6 million, compared to a net loss in the previous quarter. This improvement was largely due to non-cash unrealized gains on commodity derivatives. Adjusted EBITDA also saw a healthy increase to $25.2 million, attributed to lower lease operating expenses and a slight uptick in oil production. Free cash flow stood at $14.4 million, marking a significant 136% increase from the prior quarter.

Amplify Energy Corp's year-end proved reserves were estimated at 98 MMBoe, with a substantial portion being proved developed reserves. The PV-10 value of these reserves was approximately $757 million, indicating the potential future cash inflows from these assets.

Operational Successes and Strategic Focus

President and CEO Martyn Willsher highlighted the operational successes, including the safe and effective return to production at the Beta field and the formation of Magnify Energy Services, a subsidiary aimed at managing operating costs and risks. The company's strategic focus for 2024 includes developing the Beta asset, reducing leverage, and cutting operating costs. The potential sale of assets in Bairoil is expected to further reduce debt and provide flexibility for evaluating return of capital alternatives.

"We believe 2024 has the potential to be a transformative year for the Company as we execute our strategic initiatives to develop the prolific Beta asset, further reduce leverage, and continue our focus on reducing operating costs," said Willsher.

Challenges and Future Outlook

Despite the positive results, Amplify Energy Corp faces the ongoing challenge of managing natural production declines and maintaining a competitive edge in a volatile market. The company's 2024 guidance reflects a proactive approach to these challenges, with a significant portion of capital allocated to high-return development opportunities and emission reduction projects.

The company's financial achievements, including the reduction of net debt to $94 million and a net debt to LTM Adjusted EBITDA ratio of 1.1x, underscore its commitment to financial discipline and operational efficiency. These achievements are particularly important in the oil and gas industry, where managing debt and maintaining strong cash flows are critical for sustainable growth.

Amplify Energy Corp's focus on reducing operating costs and improving operational efficiencies is expected to continue driving value for shareholders. With a solid plan for 2024 and strategic initiatives underway, the company is well-positioned to capitalize on development opportunities and enhance shareholder value.

For a more detailed analysis of Amplify Energy Corp's financial results and future outlook, investors are encouraged to review the full 8-K filing and attend the investor teleconference.

For more information on Amplify Energy Corp's financial performance and strategic plans, please visit the company's website or contact their investor relations team.

Explore the complete 8-K earnings release (here) from Amplify Energy Corp for further details.

This article first appeared on GuruFocus.