Amplitude Inc (AMPL) Reports Growth in Annual Recurring Revenue and Free Cash Flow for FY 2023

Annual Recurring Revenue (ARR): Increased by 10% year-over-year to $281 million.

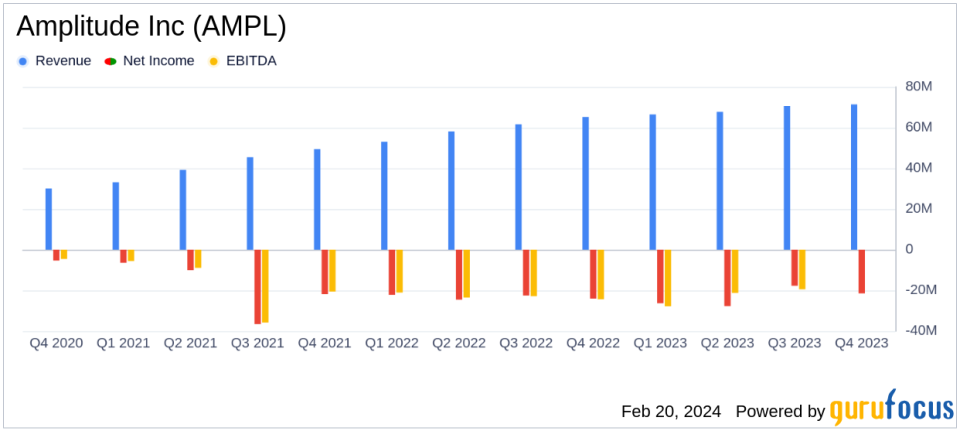

Revenue Growth: Fourth quarter revenue rose by 9% year-over-year to $71.4 million, contributing to a 16% increase in fiscal 2023 revenue to $276.3 million.

Profitability Metrics: Non-GAAP Income from Operations turned positive at $2.3 million in Q4, a significant improvement from a loss of $4.7 million in the same quarter last year.

Free Cash Flow: Marked a substantial year-over-year increase to $22.4 million for fiscal 2023, with a 13 percentage point rise in free cash flow margin.

Customer Growth: The number of paying customers grew by 37% year-over-year to 2,723.

On February 20, 2024, Amplitude Inc (NASDAQ:AMPL), a leading digital analytics platform, released its 8-K filing, detailing the financial results for the fourth quarter and fiscal year ended December 31, 2023. The company, which delivers its application as a subscription service using a software-as-a-service (SaaS) model, reported a 10% year-over-year increase in annual recurring revenue, reaching $281 million. This growth is indicative of the company's ability to maintain and expand its customer base, a critical factor for SaaS companies that rely on subscription models for revenue generation.

Amplitude Inc (NASDAQ:AMPL) saw its fourth quarter revenue climb to $71.4 million, a 9% increase compared to the same period in the previous year. The fiscal year 2023 revenue also saw a significant rise, up 16% year-over-year to $276.3 million. This revenue growth underscores the company's expanding market presence and the increasing value customers place on its digital analytics platform.

Financial Performance and Operational Highlights

The company's financial achievements for the fiscal year 2023 included a noteworthy improvement in free cash flow, which stood at $22.4 million, compared to a negative free cash flow in the previous year. This 13 percentage point increase in free cash flow margin is particularly important for Amplitude as it reflects the company's efficiency in converting revenue into cash, a vital aspect of financial health for growth-oriented software companies.

Amplitude's CEO, Spenser Skates, commented on the company's performance, stating,

Amplitude closed 2023 strong. It was our biggest year ever for product innovation, and we ended Q4 with a record number of new enterprise logo wins. We see continued validation that our strategic approach - a Digital Analytics Platform with product analytics at its core - is the right one to win in the long term."

The company also reported a GAAP Net Loss per share of $0.16 for the fourth quarter of 2023, an improvement from a loss of $0.21 per share in the same quarter of the previous year. The Non-GAAP Net Income per share was $0.04, compared to a loss of $0.03 per share in the fourth quarter of 2022, indicating progress towards profitability.

Amplitude's balance sheet remains robust with $248.5 million in cash and cash equivalents as of December 31, 2023, and a solid customer base that grew by 37% year-over-year. These factors, combined with the company's innovative product launches such as Session Replay and the hiring of a new Chief Product Officer, position Amplitude for continued growth in the digital analytics space.

Looking Forward

For the first quarter and full year 2024, Amplitude anticipates revenue to be in the range of $72.1 to $72.7 million and $291.5 to $294.5 million, respectively. The company also expects a non-GAAP Operating Income (Loss) between $(2.8) to $(2.2) million for the first quarter and between $(1.0) to $2.0 million for the full year 2024.

While Amplitude Inc (NASDAQ:AMPL) has demonstrated resilience in its fiscal year 2023 performance, the company's forward-looking statements suggest a cautious optimism for 2024. Investors and stakeholders will be watching closely to see if the company can maintain its momentum and continue to innovate in the competitive digital analytics market.

For a more detailed analysis of Amplitude Inc (NASDAQ:AMPL)'s financial results and future outlook, interested parties can access the webcast, earnings press release, and investor presentation on the events section of Amplitudes investor relations website at investors.amplitude.com.

Explore the complete 8-K earnings release (here) from Amplitude Inc for further details.

This article first appeared on GuruFocus.