Amplitude (NASDAQ:AMPL) Reports Q4 In Line With Expectations But Stock Drops

Data analytics software provider Amplitude (NASDAQ:AMPL) reported results in line with analysts' expectations in Q4 FY2023, with revenue up 9.4% year on year to $71.4 million. The company expects next quarter's revenue to be around $72.4 million, slightly above analysts' estimates. It made a non-GAAP profit of $0.04 per share, improving from its loss of $0.03 per share in the same quarter last year.

Is now the time to buy Amplitude? Find out by accessing our full research report, it's free.

Amplitude (AMPL) Q4 FY2023 Highlights:

Revenue: $71.4 million vs analyst estimates of $71.51 million (small miss)

EPS (non-GAAP): $0.04 vs analyst estimates of $0.03 (28.9% beat)

Revenue Guidance for Q1 2024 is $72.4 million at the midpoint, above analyst estimates of $71.34 million

Management's revenue guidance for the upcoming financial year 2024 is $293 million at the midpoint, missing analyst estimates by 1.4% and implying 6.1% growth (vs 16.5% in FY2023)

Free Cash Flow of $1.48 million, down 80.2% from the previous quarter

Net Revenue Retention Rate: 101%, down from 105% in the previous quarter

Customers: 2,723, up from 2,471 in the previous quarter

Gross Margin (GAAP): 74.4%, up from 70.5% in the same quarter last year

Market Capitalization: $1.68 billion

“Amplitude closed 2023 strong. It was our biggest year ever for product innovation, and we ended Q4 with a record number of new enterprise logo wins," said Spenser Skates, CEO and co-founder of Amplitude.

Born out of a failed voice recognition startup by founder Spenser Skates, Amplitude (NASDAQ:AMPL) is data analytics software helping companies improve and optimize their digital products.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the silo-ed data.

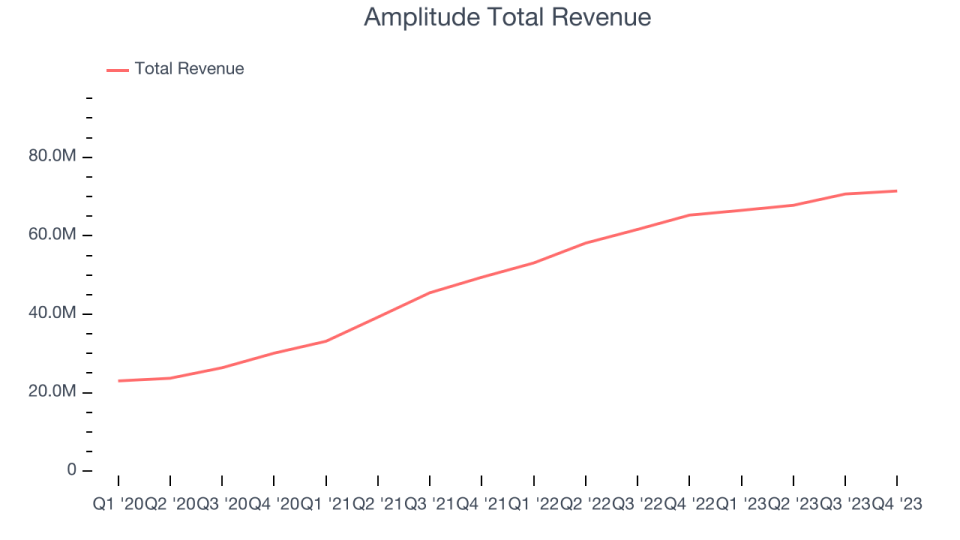

Sales Growth

As you can see below, Amplitude's revenue growth has been strong over the last two years, growing from $49.42 million in Q4 FY2021 to $71.4 million this quarter.

Amplitude's quarterly revenue was only up 9.4% year on year, which might disappoint some shareholders. Additionally, its growth did slow down compared to last quarter as the company's revenue increased by just $766,000 in Q4 compared to $2.87 million in Q3 2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that Amplitude is expecting revenue to grow 8.9% year on year to $72.4 million, slowing down from the 25.3% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $293 million at the midpoint, growing 6.1% year on year compared to the 16.1% increase in FY2023.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

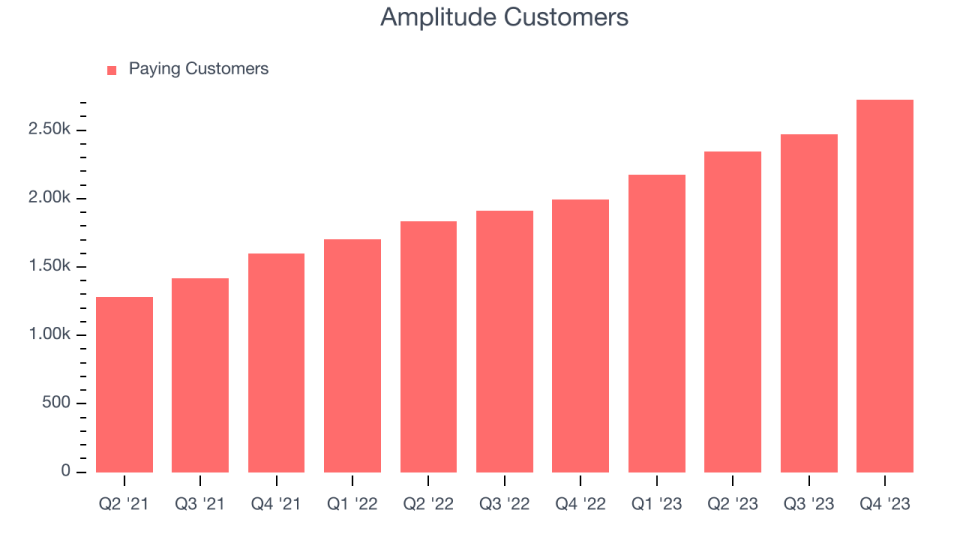

Customer Growth

Amplitude reported 2,723 customers at the end of the quarter, an increase of 252 from the previous quarter. That's quite a bit better customer growth than last quarter and quite a bit above the typical growth we've seen in past quarters, demonstrating that the business has strong sales momentum. We've no doubt shareholders will take this as an indication that Amplitude's go-to-market strategy is working very well.

Key Takeaways from Amplitude's Q4 Results

We were impressed by Amplitude's strong growth in customers this quarter. On the other hand, its full-year revenue guidance paints a different picture, as it was below expectations and suggests a slowdown in demand. Overall, this was a mixed quarter for Amplitude. The company is down 7.6% on the results and currently trades at $13 per share.

Amplitude may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.