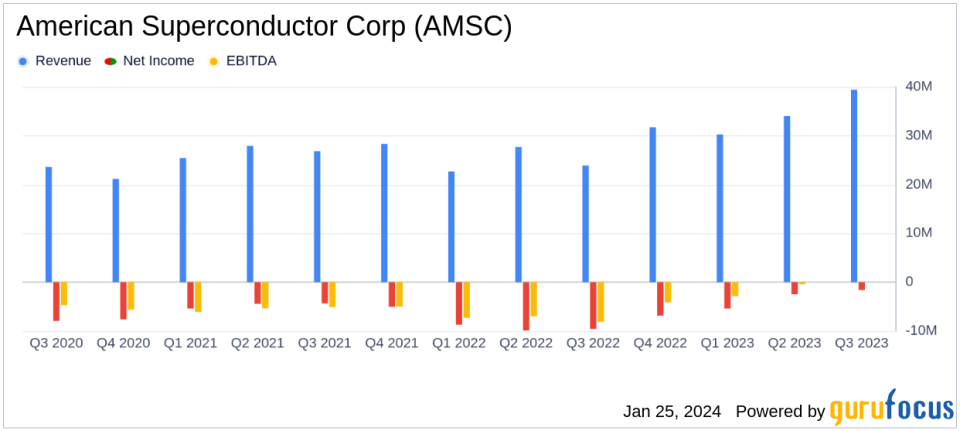

AMSC Surges with Over 60% Year-Over-Year Revenue Growth in Q3 Fiscal 2023

Revenue: Increased over 60% year-over-year to $39.4 million in Q3 fiscal 2023.

Net Loss: Decreased significantly to $1.6 million ($0.06 per share) from $9.6 million ($0.34 per share) in the same period last year.

Non-GAAP Net Income: Achieved $0.9 million ($0.03 per share), a notable improvement from a non-GAAP net loss of $7.7 million ($0.27 per share) in Q3 fiscal 2022.

Operating Cash Flow: Generated $1.3 million, reflecting improved operational efficiency.

Cash Position: Ended the quarter with $25.0 million in cash, cash equivalents, and restricted cash.

Backlog: Reported over $137 million in 12-month backlog, nearly 25% year-over-year growth.

Business Outlook: Expects Q4 revenues between $36.0 million to $40.0 million with a maximum net loss of $3.5 million, or $0.12 per share.

On January 24, 2024, American Superconductor Corp (NASDAQ:AMSC) released its 8-K filing, announcing a significant year-over-year revenue increase for the third quarter of fiscal year 2023. The company, which specializes in megawatt-scale power resiliency solutions and is known for orchestrating the rhythm and harmony of power on the grid, reported revenues of $39.4 million, a substantial increase from $23.9 million in the same period of fiscal 2022. This growth was primarily driven by increased shipments of new energy power systems and electrical control system shipments.

The reported net loss for the quarter was $1.6 million, or $0.06 per share, a marked improvement from a net loss of $9.6 million, or $0.34 per share, for the same period of fiscal 2022. Notably, AMSC achieved a non-GAAP net income of $0.9 million, or $0.03 per share, compared to a non-GAAP net loss of $7.7 million, or $0.27 per share, in the prior year's quarter. The company's cash position also strengthened, with cash, cash equivalents, and restricted cash totaling $25.0 million as of December 31, 2023.

Financial Performance and Challenges

AMSC's financial achievements this quarter are significant, particularly in the context of the Industrial Products industry. The company's ability to transition from a non-GAAP net loss to a non-GAAP net income is indicative of its successful cost management and operational efficiency. Moreover, generating positive operating cash flow in a challenging economic environment underscores the company's robust financial discipline and the efficacy of its strategic initiatives.

However, challenges remain, as the company expects a net loss in the fourth quarter of fiscal 2023, albeit lower than previous periods. The anticipated net loss is not expected to exceed $3.5 million, or $0.12 per share, with a non-GAAP net loss not exceeding $1.7 million, or $0.06 per share. These projections reflect the company's cautious optimism and its focus on maintaining financial stability.

Analysis of Financial Statements

From the income statement, the gross margin for Q3 fiscal 2023 was reported at $9.98 million, compared to a mere $517,000 in the same quarter of the previous year. This significant increase in gross margin is a testament to the company's improved cost structure and operational efficiency.

The balance sheet shows a healthy liquidity position, with current assets totaling $100.2 million. The company's total assets stood at $166.3 million, while total liabilities were at $86.8 million, indicating a solid financial foundation.

The cash flow statement reveals that AMSC has effectively managed its cash flows, with a modest net cash used in operating activities of $97,000 for the nine months ended December 31, 2023. This represents a substantial improvement over the $17.1 million used in the same period last year, demonstrating the company's enhanced cash flow management.

"We outperformed expectations during the third quarter of fiscal 2023 with year-over-year revenue growth of over 60%, reporting non-GAAP net income for a second consecutive quarter and $1.3 million in operating cash flow," said Daniel P. McGahn, Chairman, President and CEO, AMSC. "Given this backlog position, strong demand in our end markets, and shortening customer lead times, we believe we are very well positioned for the fourth fiscal quarter which will end March 2024."

In conclusion, American Superconductor Corp's Q3 fiscal 2023 results reflect a company that is successfully navigating the complexities of the Industrial Products sector, achieving growth and operational efficiency. Investors and stakeholders will be watching closely to see if the company can maintain this momentum in the coming quarters.

Explore the complete 8-K earnings release (here) from American Superconductor Corp for further details.

This article first appeared on GuruFocus.