Amwell Reports Fourth Quarter and Full Year 2023 Results: A Path to Profitability in Sight

Total Revenue: $259.0 million for FY 2023, with Q4 revenue at $70.7 million.

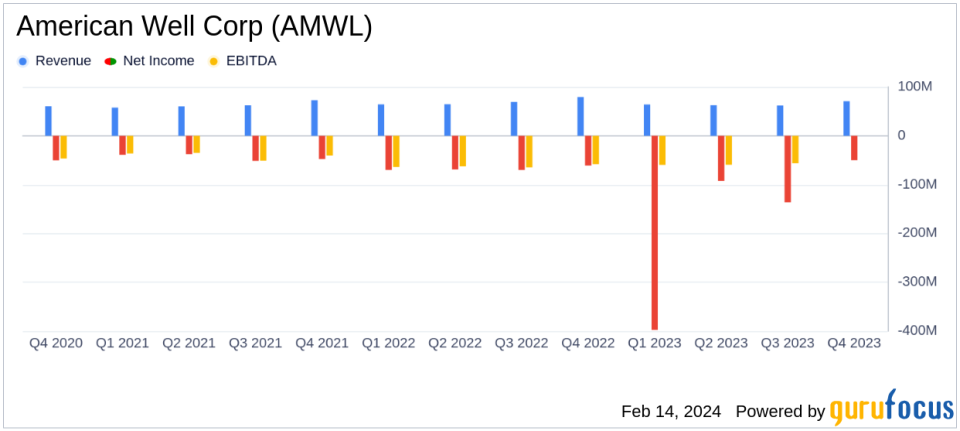

Net Loss: Reduced quarterly net loss to ($50.0) million in Q4 from ($137.1) million in Q3; annual net loss of ($679.2) million, including significant goodwill impairment charges.

Gross Margin: Reported at 37% for the full year.

Adjusted EBITDA: Improved to ($36.9) million in Q4 from ($38.5) million in Q3; FY 2023 adjusted EBITDA at ($165.4) million.

Visits: Total visits reached 6.3 million for the year, with over half on the new Converge platform.

Financial Outlook: 2024 revenue guidance set at $259 to $269 million with adjusted EBITDA between ($160) million to ($155) million.

On February 14, 2024, American Well Corp (NYSE:AMWL) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The telehealth company, which provides a comprehensive digital care delivery platform, has reported a year of strategic client acquisitions and technological advancements, despite facing a net loss.

Financial Performance and Challenges

AMWL's total revenue for the year stood at $259.0 million, with the fourth quarter contributing $70.7 million. Subscription revenue was a significant component, amounting to $112.4 million for the year. The company's gross margin improved slightly to 37%, reflecting cost management efforts. However, AMWL reported a substantial net loss of ($679.2) million for the year, which includes non-cash goodwill impairment charges of $436.5 million. Without these charges, the net loss would have been considerably lower, indicating underlying operational improvements.

The adjusted EBITDA for the fourth quarter was ($36.9) million, a slight improvement from ($38.5) million in the third quarter. This metric is crucial as it provides insight into the company's operational efficiency and ability to generate cash flow from its core business operations. The reduction in net loss and the improvement in adjusted EBITDA are important steps towards AMWL's path to profitability.

Strategic Developments and Future Outlook

AMWL's CEO, Ido Schoenberg, MD, highlighted the successful migration of more than half of the company's volume onto its new platform, Converge, and the accumulation of ROI proof points. The company's focus on efficiency and the transformation of its commercial organization are set to reaccelerate business momentum. With these achievements, AMWL begins 2024 with a strong conviction in its path to profitability.

The company provided financial guidance for 2024, expecting revenue in the range of $259 to $269 million and adjusted EBITDA between ($160) million to ($155) million. This guidance includes incremental investment in Research and Development, particularly for the deployment supporting the Defense Health Agencys Digital First initiative. AMWL also communicated its objective to attain adjusted EBITDA breakeven by 2026, offering a promising outlook for investors.

"Fiscal 2023 marked the close of an important year for Amwell as we advanced our goals in the market for enabling digital healthcare," said Ido Schoenberg, MD, chairman and CEO of Amwell. "With the achievements of 2023, we begin 2024 with high conviction regarding our path to profitability."

Balance Sheet and Cash Flow Highlights

As of December 31, 2023, AMWL reported cash and short-term securities of approximately $372.0 million. The balance sheet reflects the company's ability to fund its operations and strategic initiatives. The cash flow statements indicate that AMWL used ($148.3) million in operating activities during the year, which is an area for potential improvement as the company progresses towards profitability.

In summary, American Well Corp (NYSE:AMWL) has demonstrated resilience in a challenging fiscal year, making strategic advancements and setting a clear financial path forward. Investors and stakeholders can look forward to potential growth and profitability as the company continues to innovate in the telehealth space.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and consider the implications of AMWL's financial results on their investment decisions.

Explore the complete 8-K earnings release (here) from American Well Corp for further details.

This article first appeared on GuruFocus.