Analog Semiconductors Stocks Q2 In Review: Vishay Intertechnology (NYSE:VSH) Vs Peers

Looking back on analog semiconductors stocks' Q2 earnings, we examine this quarter's best and worst performers, including Vishay Intertechnology (NYSE:VSH) and its peers.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a slower Q2; on average, revenues beat analyst consensus estimates by 1.9% while next quarter's revenue guidance was 5.17% under consensus. There has been a stampede out of expensive technology stocks as rising interest rates encourage investors to value profits over growth, and while some of the analog semiconductors stocks have fared somewhat better than others, they have not been spared, with share prices declining 9.63% since the previous earnings results, on average.

Vishay Intertechnology (NYSE:VSH)

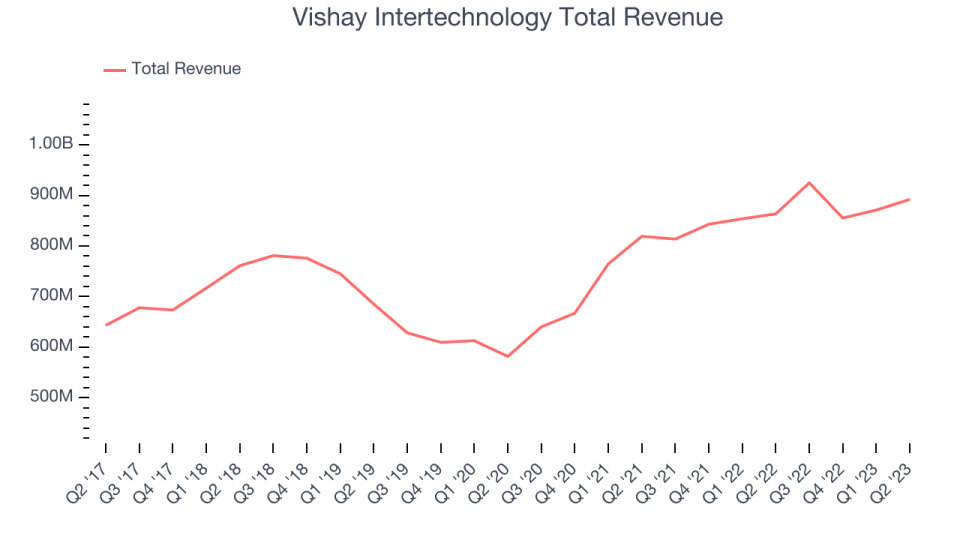

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE:VSH) manufactures simple chips and electronic components that are the building blocks for virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $892.1 million, up 3.31% year on year, beating analyst expectations by 1.17%. It was a slower quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its gross margin.

“For the second quarter Vishay posted solid results, with revenue increasing 2.4% over the first quarter and 3.3% over last year’s second quarter, reflecting sustained momentum in automotive end markets for Vishay products that support increased electronic content, ADAS features and EV production along with improved order flow for legacy automotive programs as supply chain bottlenecks have eased,” said Joel Smejkal, President and CEO.

The stock is down 9.49% since the results and currently trades at $24.22.

Read our full report on Vishay Intertechnology here, it's free.

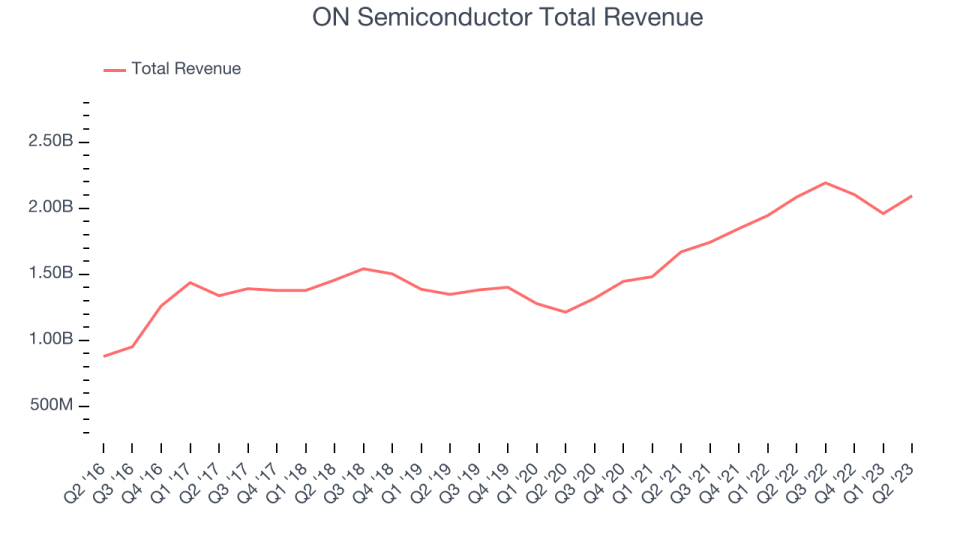

Best Q2: ON Semiconductor (NASDAQ:ON)

Spun out of Motorola in 1999 and built through a series of acquisitions, ON Semiconductor (NASDAQ:ON) is a global provider of analog chips with specialization in autos, industrial applications, and power management in cloud data centers.

ON Semiconductor reported revenues of $2.09 billion, flat year on year, beating analyst expectations by 3.66%. It was a strong quarter for the company, with an impressive beat of analysts' EPS estimates and optimistic revenue guidance for the next quarter.

The stock is down 12.9% since the results and currently trades at $91.47.

Is now the time to buy ON Semiconductor? Access our full analysis of the earnings results here, it's free.

Slowest Q2: Himax (NASDAQ:HIMX)

Taiwan-based Himax Technologies (NASDAQ:HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $235 million, down 24.8% year on year, missing analyst expectations by 2.71%. It was a weak quarter for the company, with a miss of analysts' revenue estimates and a decline in its operating margin.

Himax had the weakest performance against analyst estimates in the group. The stock is down 12.7% since the results and currently trades at $5.72.

Read our full analysis of Himax's results here.

Power Integrations (NASDAQ:POWI)

A leading supplier of parts for electronics such as home appliances, Power Integrations (NASDAQ:POWI) is a semiconductor designer and developer specializing in products used for high-voltage power conversion.

Power Integrations reported revenues of $123.2 million, down 33% year on year, in line with analyst expectations. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its operating margin.

The stock is down 15.4% since the results and currently trades at $76.13.

Read our full, actionable report on Power Integrations here, it's free.

Sensata Technologies (NYSE:ST)

Originally a temperature sensor control maker and a subsidiary of Texas Instruments for 60 years, Sensata Technology Holdings (NYSE: ST) is a leading supplier of analog sensors used in industrial and transportation applications, best known for its dominant position in the tire pressure monitoring systems in cars.

Sensata Technologies reported revenues of $1.06 billion, up 4.07% year on year, beating analyst expectations by 3.47%. It was a mixed quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in its gross margin.

The stock is down 18.9% since the results and currently trades at $37.69.

Read our full, actionable report on Sensata Technologies here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned