Analysts Say These 2 Stocks Are Their ‘Top Picks’ for the Rest of 2023

Anyone involved in the investing game will know it’s all about ‘stock picking.’ Choosing the right stock to put your money behind is vital to ensure strong returns on an investment. Therefore, when the Wall Street pros consider a name to be a ‘Top Pick,’ investors should take note.

Using the TipRanks platform, we’ve looked up details on two stocks that have recently gotten ‘Top Pick’ designation from some of the Street’s analysts.

So, let’s dive into the details and find out what makes them so. Using a combination of market data, company reports, and analyst commentary, we can get an idea of just what makes these stocks compelling picks for the rest of 2023, and why both are rated as Strong Buys by the analyst consensus.

EyePoint Pharmaceuticals (EYPT)

We’ll start in the biotech sector with EyePoint Pharmaceuticals, a small-cap biopharma company operating at both the clinical and commercial stages. The company is actively developing a new drug for the treatment of several eye conditions, has another product on the market, and has recently sold off a successful commercial product.

EyePoint has two drug delivery platforms, Durasert and Verisome, that allow for injectable, long-term, drug delivery. The first, Durasert, is used with the EYP-1901 drug candidate, a potential treatment for wet age-related macular degeneration (wAMD) and non-proliferative diabetic retinopathy (NPDR). The second platform, Verisome, is used with the commercial-stage product DEXYCU, a drug for the treatment of post-operative inflammation after eye surgeries. The platforms bring the advantage of dosing on a schedule of months, rather than days or hours.

A closer look at EyePoint’s pipeline reveals that the candidate EYP-1901 dominates the company’s research program. This drug is the subject of two leading clinical trials: the DAVIO trial, which focuses on the treatment of wAMD, and the PAVIA trial, which targets NPDR. In late March, EyePoint completed enrollment in the Phase 2 DAVIO trial, which was described as ‘oversubscribed.’ The release of topline data is expected by the end of 4Q23. In a recent press release dated June 5, EyePoint announced the completion of enrollment in the Phase 2 PAVIA trial of EYP-1901 for NPDR treatment. The trial aimed to enroll 60 patients, but ultimately enrolled 77. Topline data is expected to be released during 2Q24.

On the commercial side, the company’s current commercial-stage drug is DEXYCU, a one-time injectable treatment for inflammation that can occur after ocular surgeries. DEXYCU experienced a significant decline in product revenue during Q1, which was attributed to the conclusion of the pass-through reimbursement period on January 1 of this year. Nonetheless, the company is actively engaged in commercialization activities for the drug.

EyePoint also reported results for a second commercial product in 1Q23. This product, YUTIQ, accounted for the majority of the company’s revenue, contributing approximately $7.4 million out of a total of $7.7 million. YUTIQ’s revenue witnessed a year-over-year increase of 60%. Following the quarter, EyePoint announced in May that it had sold YUTIQ to Alimera Sciences for a total of $82.5 million in cash, along with royalties. The sale allowed EyePoint to retire its outstanding bank debt and extend its cash runway until 2025.

The main story here, however, is all about the research pipeline, in the view of Cantor analyst Jennifer Kim. She writes of EyePoint, “We’re calling attention to EYPT as one of our top picks [for] 2H23. We believe management’s continued execution and recent clinical & competitive developments deserve greater attention ahead of key upcoming readouts: 1) Phase 2 DAVIO 2 data in wet age-related macular degeneration (wAMD) in December ’23, and 2) Phase 2 PAVIA data in non-proliferative diabetic retinopathy (NPDR) in 2Q24. We continue to believe that the peak sales opportunity for EYP-1901 is under-appreciated, and believe the risk/reward is favorable heading into DAVIO 2 data.”

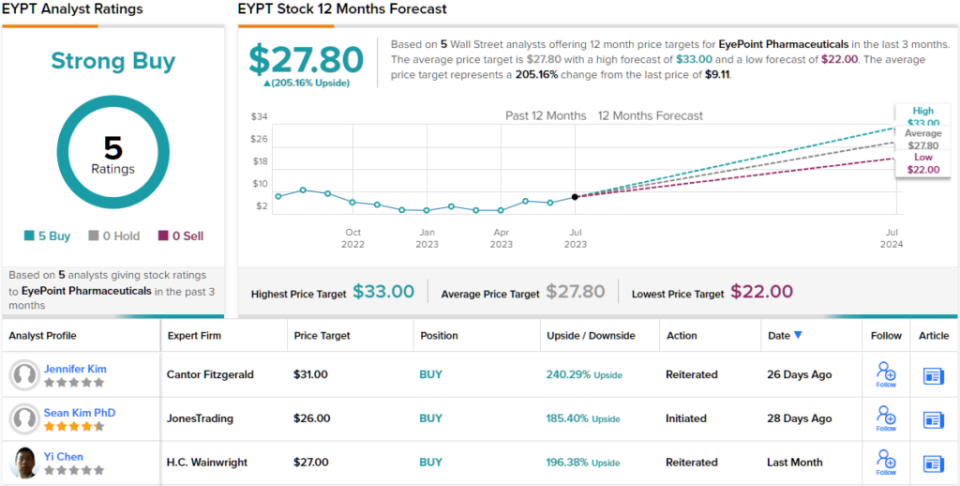

Putting her stance into a quantifiable mode, Kim rates EYPT shares an Overweight (i.e. Buy) and sets her price target at $31, implying a strong 240% upside for the next 12 months. (To watch Kim’s track record, click here)

Overall, the strong upside on this stock has made an impression the Street; all 5 of the recent analyst reviews are positive, for a Strong Buy consensus rating. The stock’s $9.11 trading price and $27.80 average price target combine to suggest a 205% one-year upside potential. (See EYPT stock forecast)

Cogent Biosciences (COGT)

Next up, we’ll look at Cogent Biosciences, a precision medicine company focused on the treatment of genetically-driven diseases. These can include autoimmune conditions and other rare diseases, and even a number of dangerous cancers. Typically, these conditions have high unmet medical needs. Cogent is working on solutions to improve the quality of life for patients, by targeting the genetic mutations behind the disease conditions.

The company’s focus on the genetic causes of disease is the key to its approach – Cogent seeks to move beyond just treating symptoms, and to effect a cure. To this end, the company’s drug pipeline features bezuclastinib, a precision medicine designed to specifically target exon 17 mutations when found in the KIT receptor tyrosine kinase. The KIT receptor KIT D816V can be locked in an ‘on’ state, causing systemic mastocytosis, or AdvSM. This is a disease condition in which mast cells accumulate in the internal organs. Mutations in exon 17 have also been implicated in GIST, gastrointestinal stromal tumors. Bezuclastinib is a potent inhibitor of KIT activity, and is highly selective in its activity. The drug candidate has shown, in early-stage trials, high potential in the treatment of exon 17-related conditions.

Cogent is currently conducting several clinical trials of bezuclastinib, with particular focus on the two most advanced trials. The first trial is the Phase 2 APEX trial for the treatment of AdvSM. Part 1 of the ongoing Phase 2 trial completed enrollment, and Part 2 has commenced enrollment in April with a target of 65 patients. The company anticipates releasing data from 30 patients in Part 1 of the APEX trial during the second half of 2023.

The second advanced clinical trial is the Phase 3 PEAK trial in the treatment of GIST. Data released in June showed a 55% disease control rate in heavily pre-treated GIST patients, and showed that bezuclastinib in combination with sunitinib was well-tolerated with an acceptable safety profile. The company is now actively enrolling patients in Part 2 of the PEAK trial, and further data is expected to be released in 2H23.

Piper Sandler analyst Christopher Raymond is impressed by bezuclastinib, particularly by the APEX and PEAK trials. In support of designating this stock as a ‘Top Pick,’ Raymond confidently states, “Our thesis on this name is that bezuclastinib’s unique mutational selectivity and safety profile position it well across the SM disease spectrum. With early AdvSM data that stacks up favorably to avapritinib, we are confident that updates later this year in both AdvSM and ISM will continue to support bezuclastinib’s best-in-class potential. In GIST, while the ASCO update was early, we think the thesis is playing out exactly as hoped, with indications of a meaningful clinical advance as a combination therapy with sunitinib in 2L GIST. We remain buyers of this name in front of a number of derisking data events this later year.”

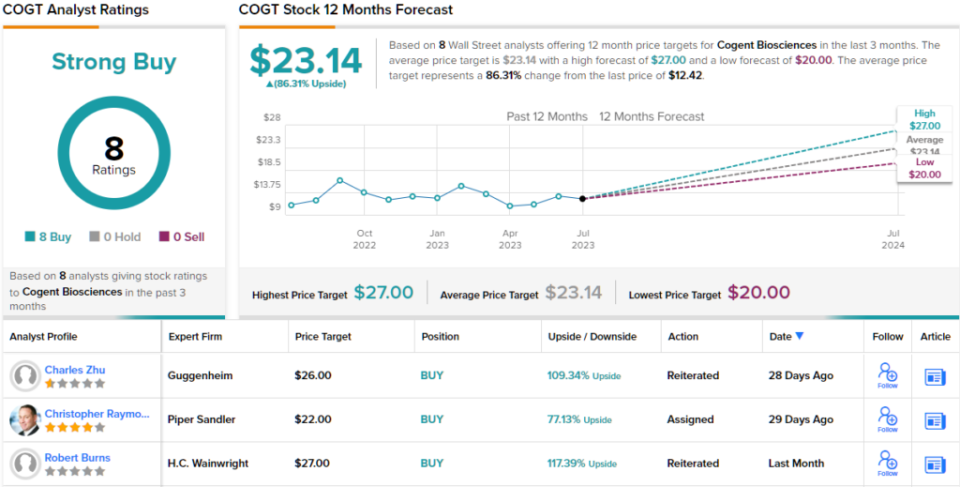

Unsurprisingly, Raymond rates Cogent an Overweight (i.e. Buy), while his $22 price target on the shares implies a 77% upside potential on the one-year horizon. (To watch Raymond’s track record, click here)

Overall, there are 8 recent analyst reviews on this stock and all are positive, for a unanimous Strong Buy consensus. The shares are selling for $12.42 and the average price target of $23.14 implies an 86% gain in the next 12 months. (See COGT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.