Analysts Just Made A Dazzling Upgrade To Their Myovant Sciences Ltd. (NYSE:MYOV) Forecasts

Celebrations may be in order for Myovant Sciences Ltd. (NYSE:MYOV) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with analysts modelling a real improvement in business performance.

Following the upgrade, the current consensus from Myovant Sciences' seven analysts is for revenues of US$289m in 2022 which - if met - would reflect a sizeable increase on its sales over the past 12 months. Losses are predicted to fall substantially, shrinking 38% to US$1.66. Yet prior to the latest estimates, the analysts had been forecasting revenues of US$161m and losses of US$2.19 per share in 2022. We can see there's definitely been a change in sentiment in this update, with the analysts administering a sizeable upgrade to next year's revenue estimates, while at the same time reducing their loss estimates.

See our latest analysis for Myovant Sciences

There was no major change to the consensus price target of US$35.86, perhaps suggesting that the analysts remain concerned about ongoing losses despite the improved earnings and revenue outlook. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Myovant Sciences analyst has a price target of US$55.00 per share, while the most pessimistic values it at US$26.00. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

The Bottom Line

The most important thing here is that analysts reduced their loss per share estimates for next year, reflecting increased optimism around Myovant Sciences' prospects. Some investors might be disappointed to see that the price target is unchanged, but we feel that improving fundamentals are usually a positive - assuming these forecasts are met! So Myovant Sciences could be a good candidate for more research.

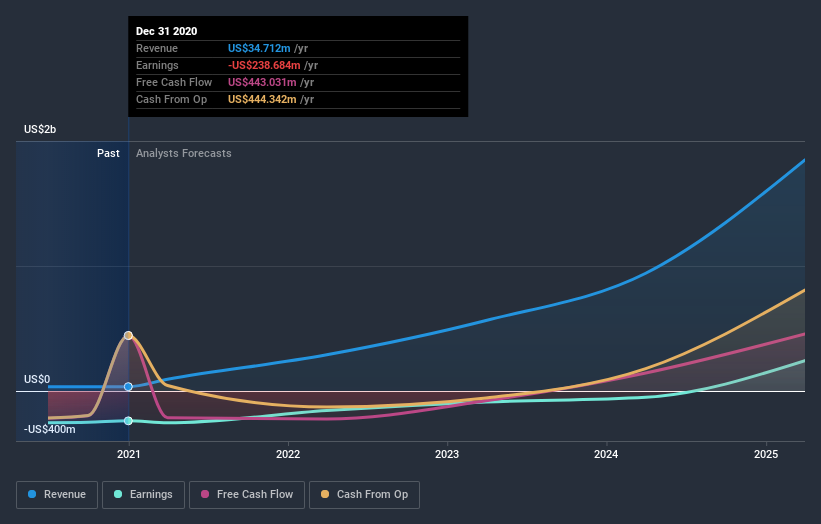

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Myovant Sciences going out to 2025, and you can see them free on our platform here..

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.