These Analysts Just Made A Significant Downgrade To Their Talos Energy Inc. (NYSE:TALO) EPS Forecasts

One thing we could say about the analysts on Talos Energy Inc. (NYSE:TALO) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon.

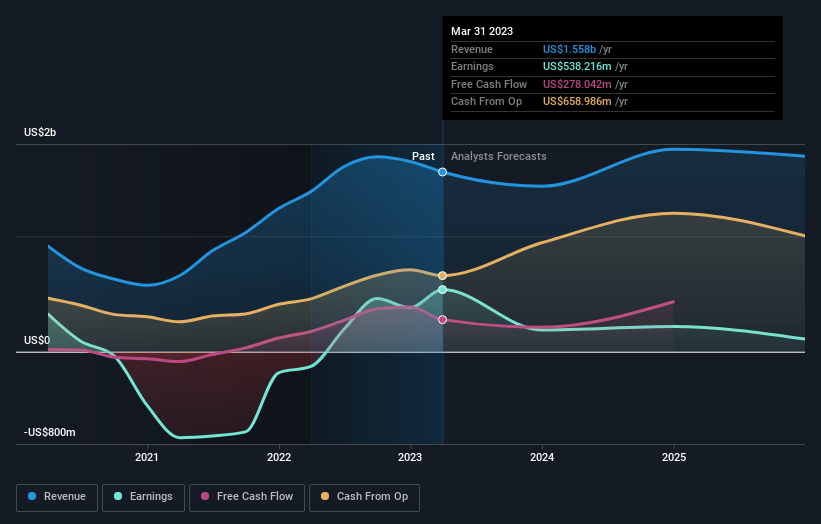

Following the latest downgrade, the current consensus, from the four analysts covering Talos Energy, is for revenues of US$1.5b in 2023, which would reflect a measurable 6.5% reduction in Talos Energy's sales over the past 12 months. Statutory earnings per share are supposed to dive 60% to US$1.71 in the same period. Prior to this update, the analysts had been forecasting revenues of US$1.7b and earnings per share (EPS) of US$2.00 in 2023. It looks like analyst sentiment has declined substantially, with a measurable cut to revenue estimates and a considerable drop in earnings per share numbers as well.

Check out our latest analysis for Talos Energy

It'll come as no surprise then, to learn that the analysts have cut their price target 12% to US$21.17. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Talos Energy analyst has a price target of US$24.00 per share, while the most pessimistic values it at US$16.00. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Talos Energy's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 8.6% by the end of 2023. This indicates a significant reduction from annual growth of 19% over the last five years. Yet aggregate analyst estimates for other companies in the industry suggest that industry revenues are forecast to decline 3.9% per year. The forecasts do look bearish for Talos Energy, since they're expecting it to shrink faster than the industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately they also cut their revenue estimates for this year, and they expect sales to lag the wider market. That said, earnings per share are more important for creating value for shareholders. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of Talos Energy.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with Talos Energy's financials, such as a weak balance sheet. For more information, you can click here to discover this and the 1 other flag we've identified.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here