Analysts Just Slashed Their Sylvania Platinum Limited (LON:SLP) EPS Numbers

The latest analyst coverage could presage a bad day for Sylvania Platinum Limited (LON:SLP), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

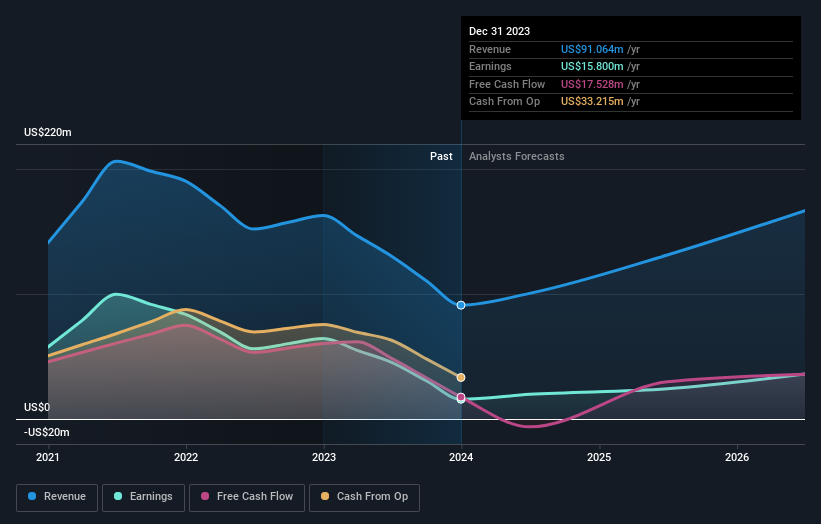

Following the downgrade, the current consensus from Sylvania Platinum's twin analysts is for revenues of US$100m in 2024 which - if met - would reflect a solid 10% increase on its sales over the past 12 months. Per-share earnings are expected to surge 66% to US$0.10. Prior to this update, the analysts had been forecasting revenues of US$112m and earnings per share (EPS) of US$0.12 in 2024. It looks like analyst sentiment has declined substantially, with a substantial drop in revenue estimates and a considerable drop in earnings per share numbers as well.

View our latest analysis for Sylvania Platinum

Analysts made no major changes to their price target of AU$1.85, suggesting the downgrades are not expected to have a long-term impact on Sylvania Platinum's valuation.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The period to the end of 2024 brings more of the same, according to the analysts, with revenue forecast to display 10% growth on an annualised basis. That is in line with its 10% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 1.0% per year. So although Sylvania Platinum is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. The lack of change in the price target is puzzling in light of the downgrade but, with a serious decline expected this year, we wouldn't be surprised if investors were a bit wary of Sylvania Platinum.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with Sylvania Platinum's financials, such as its declining profit margins. For more information, you can click here to discover this and the 1 other concern we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.