Analysts Are Raising Expectations for These 3 Auto Stocks

Targeting areas of the market that are seeing positive earnings estimate revisions is an excellent way for investors to insert themselves in favorable trends.

That’s precisely what the Zacks Autos sector has witnessed as of late, helping push it into the #3 spot out of all 16 Zacks sectors.

Three stocks from the realm – Copart CPRT, Genuine Parts GPC, and Gentex GNTX – could all be watchlist considerations for those looking to tap into the improved outlooks. Let’s take a closer look at each.

Gentex

Gentex supplies automatic-dimming rear-view mirrors and electronics to the automotive industry, fire protection products to the fire protection market, and dimmable aircraft windows for aviation markets. The stock is a Zacks Rank #2 (Buy), with earnings expectations increasing across nearly all timeframes.

The company’s growth profile is hard to ignore, with earnings expected to climb 22% in its current fiscal year (FY23) and a further 25% in FY24. Revenue growth is also apparent, expected to grow 14% in FY23 and 10% in FY24.

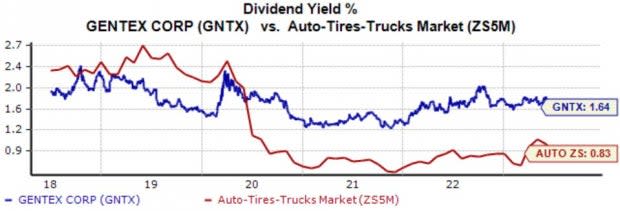

Image Source: Zacks Investment Research

Shares also provide a source of income, yielding 1.6% annually paired with a sustainable payout ratio residing at 34% of the company’s earnings. GNTX has also increasingly rewarded its shareholders, carrying a 2% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Genuine Parts

Genuine Parts, a Zacks Rank #2 (Buy), distributes automotive and industrial replacement parts and materials. The company is a consistent earnings performer, exceeding earnings and revenue expectations in nine consecutive quarters.

Just in its latest release, the company delivered a 6% EPS beat paired with a modest revenue surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

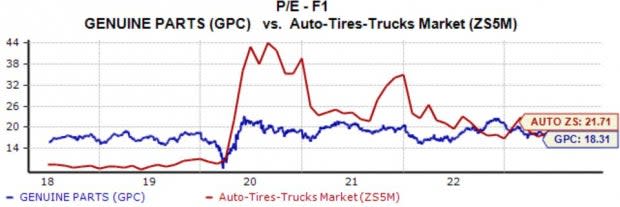

Image Source: Zacks Investment Research

In addition, shares aren’t stretched from a valuation perspective, with the current 18.3X forward earnings multiple sitting in line with the five-year median and well below highs of 22.9X in 2022.

The stock carries a Style Score of “A” for Value.

Image Source: Zacks Investment Research

Copart

Copart, a Zacks Rank #1 (Strong Buy), provides online auctions and a wide range of remarketing services to process and sell salvage and clean title vehicles. Analysts have taken their earnings expectations modestly higher and have been in full agreement.

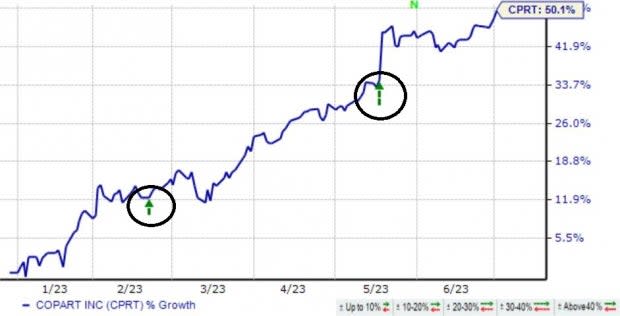

Image Source: Zacks Investment Research

The company posted strong results in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 15% and delivering a modest revenue beat. Shares got a boost post-earnings thanks to the results, just as they did in the previous quarter.

Image Source: Zacks Investment Research

Bottom Line

As of late, the Zacks Autos sector has seen near-term optimism from analysts, helping land it into the #3 spot of all 16 Zacks sectors.

And for those looking to tap into the improved outlooks, all three stocks above – Copart CPRT, Genuine Parts GPC, and Gentex GNTX – could be solid watchlist considerations.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Genuine Parts Company (GPC) : Free Stock Analysis Report

Copart, Inc. (CPRT) : Free Stock Analysis Report

Gentex Corporation (GNTX) : Free Stock Analysis Report