Analyzing SLR Investment Corp's Dividend Performance and Sustainability

A Comprehensive Look at SLR Investment Corp's Dividend History, Yield, Growth, and Future Prospects

SLR Investment Corp (NASDAQ:SLRC) recently announced a dividend of $0.14 per share, payable on 2023-09-28, with the ex-dividend date set for 2023-09-19. This announcement has sparked interest among investors in the company's dividend history, yield, and growth rates. Leveraging data from GuruFocus, we delve into SLR Investment Corp's dividend performance and assess its sustainability.

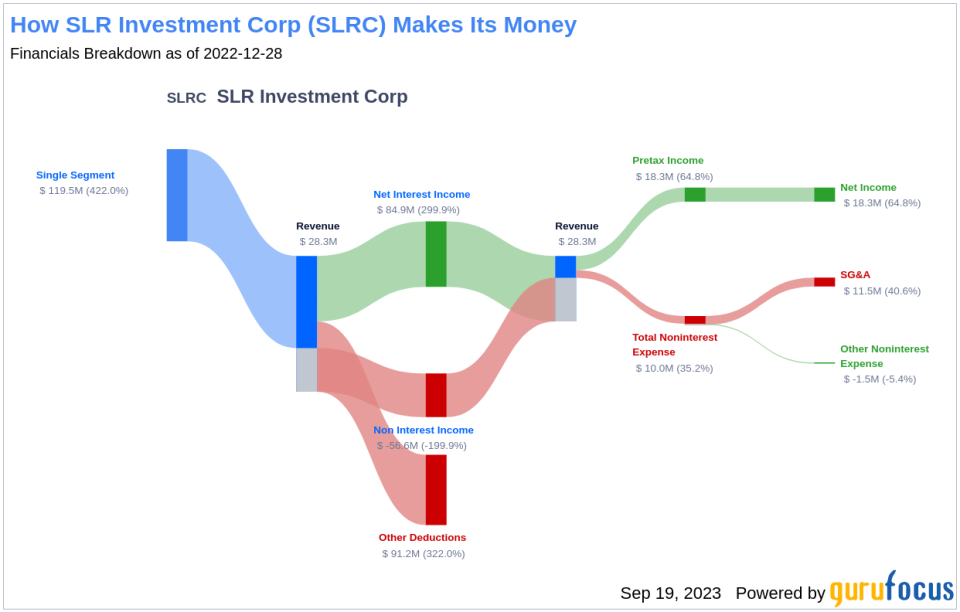

What Does SLR Investment Corp Do?

Warning! GuruFocus has detected 6 Warning Signs with SLRC. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

SLR Investment Corp is a closed-end investment company that offers bespoke debt financing solutions to U.S. middle market businesses and intermediaries. These solutions cater to various needs such as working capital, acquisition, refinancing, and growth capital requirements.

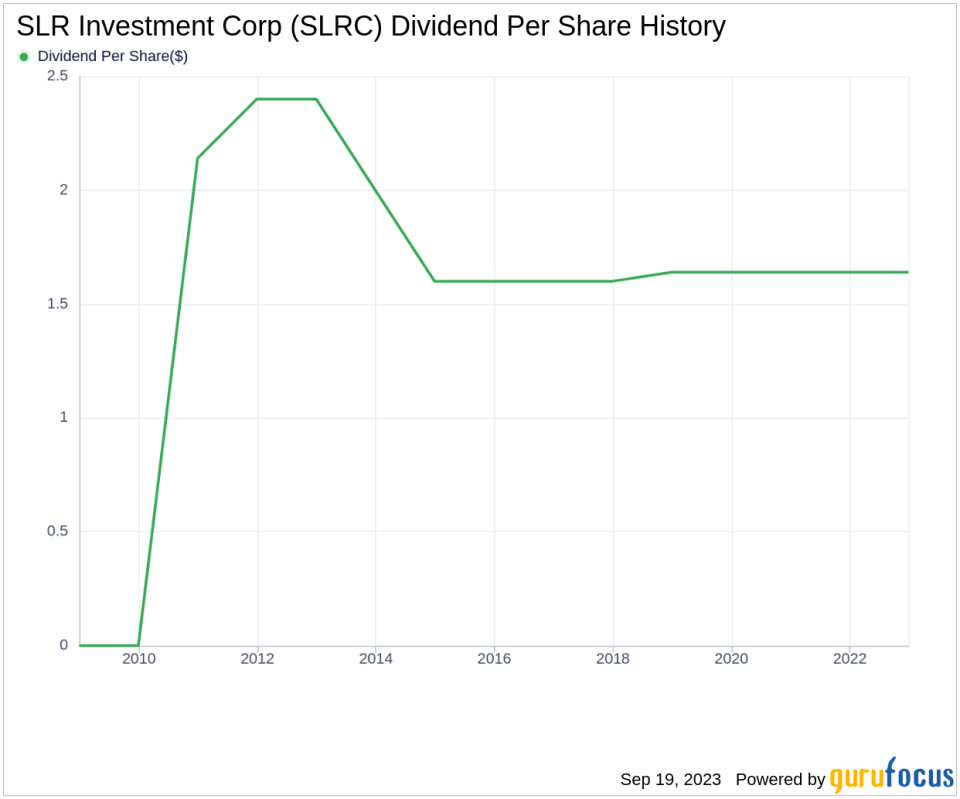

A Glimpse at SLR Investment Corp's Dividend History

Since 2010, SLR Investment Corp has consistently distributed dividends to its shareholders on a monthly basis. The chart below provides a historical view of the company's annual Dividends Per Share.

Breaking Down SLR Investment Corp's Dividend Yield and Growth

As of today, SLR Investment Corp boasts a 12-month trailing dividend yield and a 12-month forward dividend yield of 10.54%, implying an expectation of consistent dividend payments over the next 12 months.

Over a five-year horizon, the yield growth rate increased to 0.40% per year. However, over the past decade, SLR Investment Corp's annual dividends per share growth rate was -2.30%. Based on these figures, the 5-year yield on cost of SLR Investment Corp stock is approximately 10.76% as of today.

The Sustainability Question: Payout Ratio and Profitability

The sustainability of SLR Investment Corp's dividend is best evaluated through its dividend payout ratio. As of 2023-06-30, the company's dividend payout ratio is 1.48, which may suggest potential challenges in sustaining the dividend.

Furthermore, SLR Investment Corp's profitability rank of 4 out of 10 as of 2023-06-30 indicates moderate earnings capability relative to its peers, which could also impact the sustainability of its dividends. However, the company has consistently reported positive net income over the past decade, reflecting a solid profitability profile.

Growth Metrics: The Future Outlook

SLR Investment Corp's growth rank of 4 out of 10 suggests modest growth prospects, which could impact the sustainability of its dividends. The company's revenue per share and 3-year revenue growth rate of -29.60% per year on average, underperforms approximately 83.04% of global competitors. Additionally, the 3-year EPS growth rate of -35.90% per year on average, and the 5-year EBITDA growth rate of -23.60%, both underperform a significant proportion of global competitors.

Next Steps

In conclusion, while SLR Investment Corp has a commendable history of consistent dividend payments, its current payout ratio, profitability rank, and growth metrics suggest potential challenges in sustaining its dividends in the long run. Investors should carefully consider these factors before making investment decisions. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article first appeared on GuruFocus.