Andersons (ANDE) to Report Q3 Earnings: Here's What to Expect

The Andersons ANDE is scheduled to report third-quarter 2023 results after the closing bell on Nov 7.

Q3 Estimates

The Zacks Consensus Estimate for ANDE’s third-quarter revenues is pegged at $160 million, suggesting a 3.7% year-over-year decline. The consensus mark for third-quarter earnings is pegged at 9 cents per share, which suggests an 80% improvement from the year-ago quarter's actual. The consensus estimate for earnings for the to-be-reported quarter has moved up 13% over the past 30 days.

Q2 Results

In the last reported quarter, Andersons reported a year-over-year decline in both revenues and earnings. While earnings beat the Zacks Consensus Estimate, revenues missed the same.

Andersons’s earnings have outpaced the consensus estimate in two of the trailing four quarters while coming in line in the other two quarters, the average surprise being 10.4%.

The Andersons, Inc. Price and EPS Surprise

The Andersons, Inc. price-eps-surprise | The Andersons, Inc. Quote

Factors to Note

The company’s Trade segment is expected to have benefited from the strong momentum in its merchandising businesses. Also, recent investments in food and pet food ingredients are likely to have contributed to the segment’s results in the third quarter.

The Renewables segment’s results are expected to reflect strong ethanol crush margins in the quarter. Improved efficiency at its production facilities with improved ethanol and corn oil yield and lower costs are expected to have contributed to earnings. The merchandising businesses, including renewable diesel feedstocks, continue to deliver solid earnings on higher volumes and strong co-product values.

The Nutrient & Industrial segment’s results in the third quarter are likely to reflect higher demand for fertilizer and specialty liquid products backed by improving farm income.

What our Zacks Model Indicates

Our proven model does not conclusively predict an earnings beat for Andersons this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Anderson is 0.00%.

Zacks Rank: ANDE currently carries a Zacks Rank of 2.

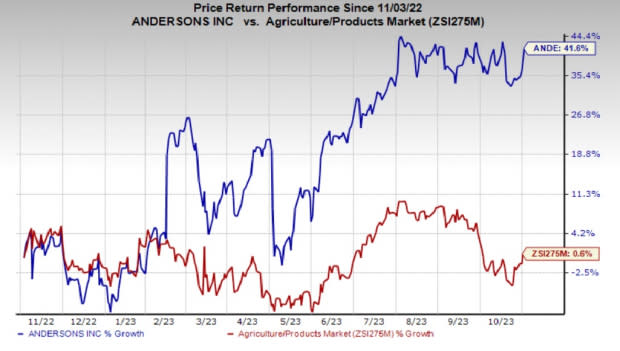

Price Performance

Andersons’ shares have gained 41.6% in the past year compared with the industry’s 0.6% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some stocks with the right combination of elements to post an earnings beat in their upcoming releases.

LegalZoom.com LZ, slated to release earnings on Nov 7, has an Earnings ESP of +17.65% and a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for Legal Zoom’s earnings for the third quarter is pegged at 9 cents per share. LZ has an average trailing four-quarter earnings surprise of 10.4%.

Kinross Gold Corporation KGC, scheduled to release third-quarter earnings on Nov 8, has an Earnings ESP of +2.96% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Kinross Gold’s earnings for the third quarter is pegged at 10 cents per share. The company has an average trailing four-quarter earnings surprise of 31.7%.

Innospec IOSP, scheduled to release earnings on Nov 7, currently has an Earnings ESP of +1.73% and a Zacks Rank of 3.

The Zacks Consensus Estimate for IOSP’s earnings for the third quarter is pegged at $1.45 per share. The company has an average trailing four-quarter earnings surprise of 7.2%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

LegalZoom.com, Inc. (LZ) : Free Stock Analysis Report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report