Andreas Halvorsen Exits Salesforce, Trims Alibaba Position

- By Tiziano Frateschi

Viking Global Investors' Andreas Halvorsen (Trades, Portfolio) sold shares of the following stocks during the first quarter.

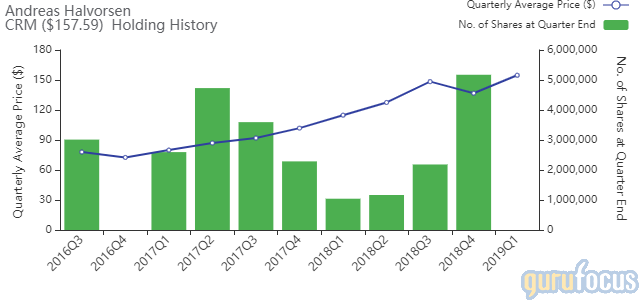

The investor sold out of Salesforce.com Inc. (CRM). The trade had an impact of -4.03% on the portfolio.

The pure-play software-as-a-service company has a market cap of $121.79 billion and an enterprise value of $120.62 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 8.50% and return on assets of 4.33% are outperforming 50% of companies in the Software - Application industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 1.37 is below the industry median of 5.23.

The largest guru shareholder of the company is Frank Sands (Trades, Portfolio) with 0.97% of outstanding shares, followed by Spiros Segalas (Trades, Portfolio) with 0.93% and Ken Fisher (Trades, Portfolio) with 0.69%.

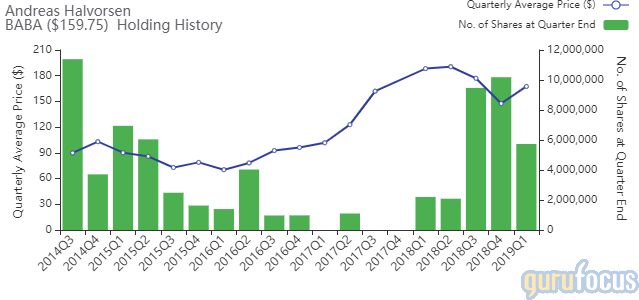

The guru curbed his Alibaba Group Holding Ltd. (BABA) stake by 43.67%. The portfolio was impacted by -3.47%.

The Chinese e-commerce company has a market cap of $420.33 billion and an enterprise value of $428.42 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 20.15% and return on assets of 10.22% are outperforming 82% of companies in the Specialty Retail industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 1.51 is above the industry median of 0.99.

The company's largest guru shareholder is PRIMECAP Management (Trades, Portfolio) with 0.59% of outstanding shares, followed by Sands with 0.55% and Fisher with 0.45%.

Halvorsen trimmed 53.04% off his Amazon.com Inc. (AMZN) position, impacting the portfolio by -3.01%.

The e-commerce giant has a market cap of $914.52 billion and an enterprise value of $934.09 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 30.39% and return on assets of 8.06% are outperforming 64% of companies in the Specialty Retail industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 0.65 is below the industry median of 0.99.

Fisher is the company's largest guru shareholder with 0.34% of outstanding shares, followed by Sands with 0.27% and Segalas with 0.14%.

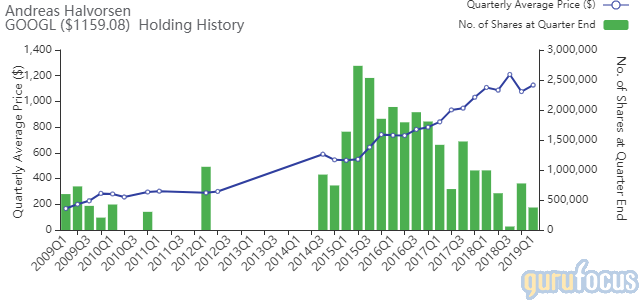

The Alphabet Inc. (GOOG) holding was reduced by 51.72%. The portfolio was impacted by -2.39%.

The tech company has a market cap of $799.79 billion and an enterprise value of $690.37 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 16.39% and return on assets of 12.52% are outperforming 56% of companies in the Internet Content and Information industry. Its financial strength is rated 9 out of 10. The cash-debt ratio of 27.91 is above the industry median of 7.46.

The company's largest guru shareholder is PRIMECAP Management with 0.32% of outstanding shares, followed by Fisher with 0.29%, Sands with 0.16% and Ruane Cunniff (Trades, Portfolio) with 0.12%.

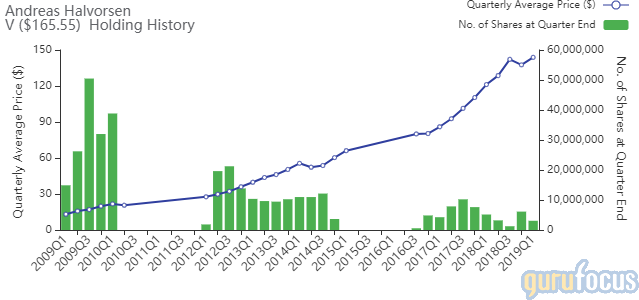

Halvorsen trimmed 49.85% off his Visa Inc. (NYSE:V) stake. The trade had an impact of -2.29% on the portfolio.

The company, which provides electronic payment transaction services, has a market cap of $369.17 billion and an enterprise value of $379.74 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of -31.92% and return on assets of 15.99% are outperforming 85% of companies in the Credit Services industry. Its financial strength was rated 7 out of 10. The cash-debt ratio of 0.69 is below the industry median of 8.34.

Fisher is the largest guru shareholder of the company with 0.85% of outstanding shares, followed by Sands with 0.73% and Warren Buffett (Trades, Portfolio) with 0.48%.

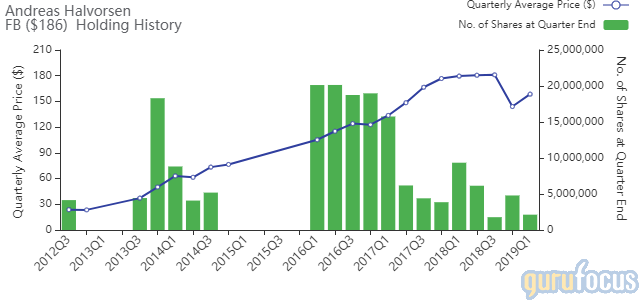

The Facebook Inc. (FB) stake was reduced by 51.61%. The portfolio was impacted by -1.99%.

The social media company has a market cap of $527.57 billion and an enterprise value of $482.32 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 23.96% and return on assets of 20.43% are outperforming 84% of companies in the Internet Content and Information industry. Its financial strength is rated 9 out of 10 with no debt.

The largest guru shareholder of the company is Chase Coleman (Trades, Portfolio) with 0.31% of outstanding shares, followed by Segalas with 0.21%, Chris Davis ( Trades , Portfolio ) with 0.19% and Steve Mandel (Trades, Portfolio) with 0.17%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Dodge & Cox Buys FedEx and Fox

Chris Davis Trims General Electric, Microsoft Positions

First Pacific Advisors Buys Univar, Wells Fargo

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.